Why Do Analysts View Gold’s Momentum as a Sign of Bitcoin’s Growing Influence?

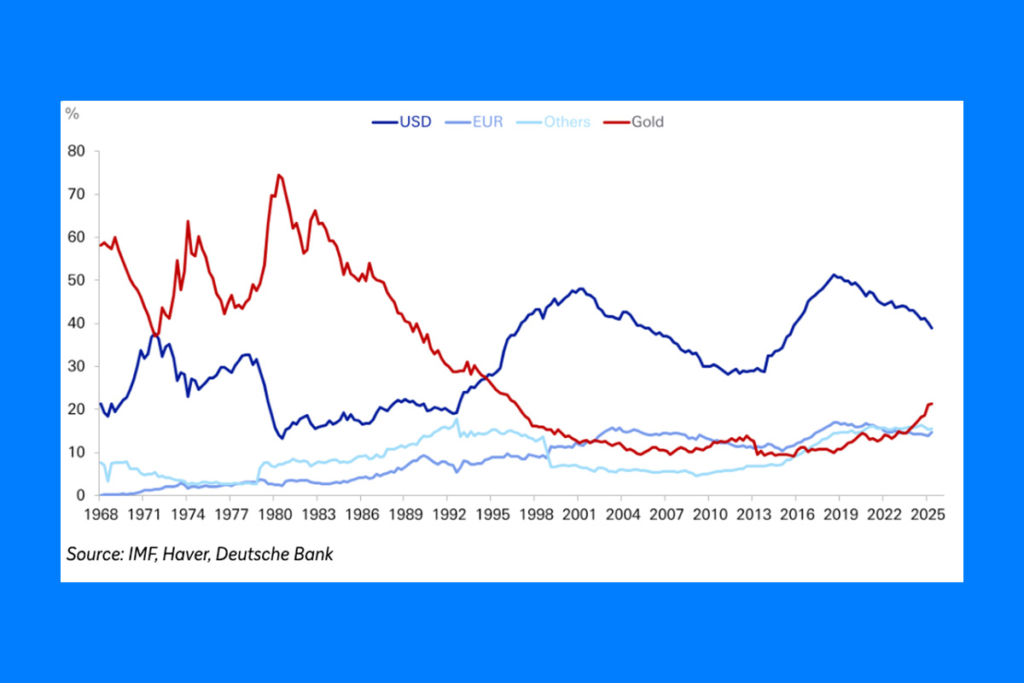

Global central banks have been building up their gold reserves over the last few years, according to the most recent study from Deutsche Bank. For Bitcoin, this pattern may have important ramifications. In the second quarter of this year, gold accounted for 24% of central bank reserves. This is the greatest level since the 1990s, according to strategists at Deutsche Bank.

Gold and Bitcoin are becoming more similar, according to some analysts at Deutsche Bank, with official demand for gold expanding at twice the rate of the 2011–2021 average. They pointed out that the performance of Bitcoin in 2025 broke all previous records. According to analysts at Deutsche Bank, the increased pursuit of gold represents a dramatic change in global banking, reiterating patterns observed over the majority of the 20th century. They also pointed out that there are numerous similarities in the dynamics of Bitcoin’s movement.

Gold Breaks Inflation-Adjusted ATH After 45 Years

Gold has only lately surpassed its inflation-adjusted all-time highs (ATH) from 1980, despite the fact that it has been wildly breaking new highs in terms of fiat money.

It’s only in recent weeks that gold has finally surpassed its real-adjusted all-time highs from around this point 45 years ago,

Deutsche Bank’s strategists

Deutsche Bank pointed to forced institutional gold sell-offs and decades of central bank selling as major factors in the protracted delay in gold‘s inflation-adjusted all-time high. The emergence of the fiat currency period was another aspect cited by the bank.

Gold’s formal role as a reserve asset ended in 1979, when the IMF [International Monetary Fund] prohibited members from pegging exchange rates to gold — eight years after the collapse of Bretton Woods,

Deutsche Bank analysts

Deutsche Bank Strategist Sees Striking Parallels Between Gold and Bitcoin

Marion Laboure, the macro strategist for Deutsche Bank, pointed out several similarities between the assets as gold hit fresh, all-time highs in inflation-adjusted terms. According to her, these parallels might make Bitcoin a desirable asset to have. According to Laboure’s research, “Gold’s reign, Bitcoin’s rise,” the two assets’ performance paths from their birth have been strikingly comparable.

According to the expert, there is another noteworthy similarity between gold and Bitcoin: both have seen periods of underperformance and significant volatility. Furthermore, according to Laboure, Bitcoin and gold both offer significant diversification advantages due to their low correlation with conventional assets.

Volatility, however, has now fallen to historic lows,

Laboure

For more up-to-date crypto news, you can follow Crypto Data Space.

[…] can take positions without the usual pressure tied to Bitcoin’s volatility. This makes Aster an alternative investment vehicle in the crypto space. Macro momentum […]

[…] Bitcoin’s rebound also supported Ether, which reclaimed the $3,000 level—a significant barrier the asset must overcome to attempt a move toward $3,400. […]

[…] purchases occurred during Bitcoin’s November downturn, when the cryptocurrency fell from a peak of $126,000 to a low near $82,000. […]