Aster Token Drops Despite Buyback and CZ Support

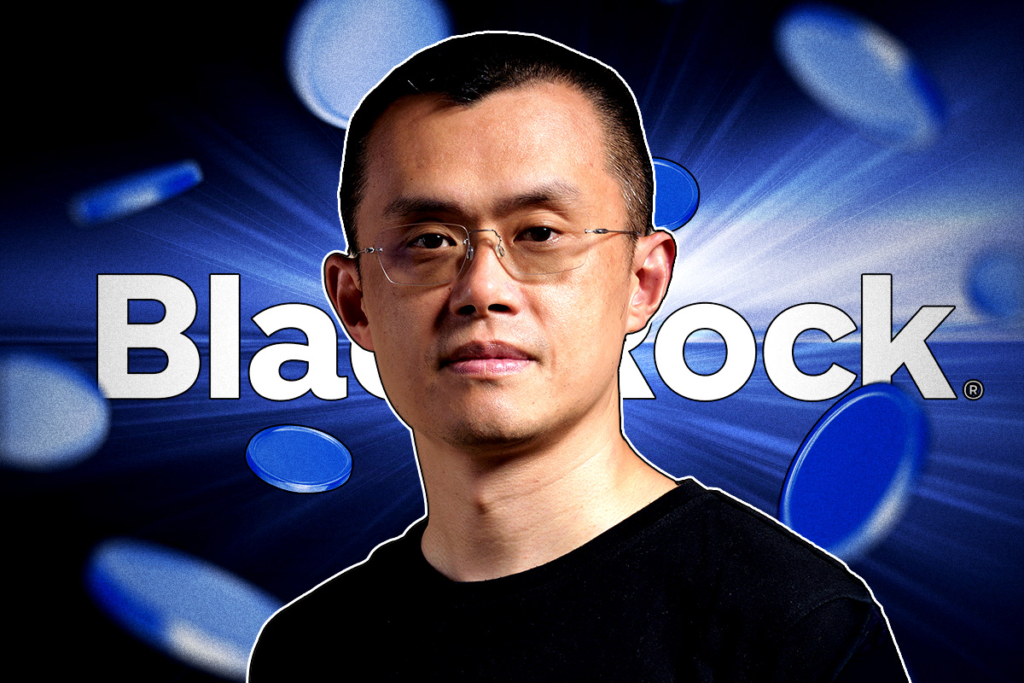

The long-standing link between Aster and CZ continues to attract attention, largely due to CZ’s personal investment and his public endorsement of the decentralized derivatives exchange. His previous comments have triggered strong market reactions, fueling speculation during periods of heightened volatility.

Viral Claim About a BlackRock “Aster ETF” Proven False

A controversy erupted after a post on X (formerly Twitter) claimed that BlackRock had filed for a staked ASTER ETF with the U.S. Securities and Exchange Commission. The post included what appeared to be an official S-1 registration form dated December 5, 2024, referring to an “iShares Staked Aster Trust ETF” and listing BlackRock’s legitimate contact details.

The image rapidly spread, prompting rumors about institutional interest in ASTER. However, no such filing exists in the SEC’s public database. The document was a convincing forgery modeled after real SEC submissions, making it difficult to identify as fake at first glance.

A closer inspection showed that the description was copied from BlackRock’s iShares Staked Ethereum Trust ETF, an authentic filing submitted on December 5. BlackRock has repeatedly emphasized that its crypto ETF strategy currently focuses only on Bitcoin and Ethereum.

CZ quickly addressed the situation, warning his followers about circulating misinformation.

“Fake. Even big KOLs gets fooled once in a while. Aster doesn’t need these fake photoshopped pics to grow,” he wrote.

His connection to Aster is well-documented. In September, he publicly voiced support for the platform, and YZi Labs (formerly Binance Labs) holds a minority stake in the DEX. In November, CZ disclosed that he had purchased approximately $2 million worth of Aster tokens, leading to a 30% intraday surge in ASTER’s price.

Aster’s Buyback Effort Fails to Lift Token Price

Despite announcing an accelerated Stage 4 token buyback on December 8, ASTER has struggled to gain momentum. The team stated it would increase daily buybacks to around $4 million, up from roughly $3 million.

Aster explained:

“This acceleration allows us to bring the accumulated Stage 4 fees since Nov 10 on-chain more quickly, providing more support during volatile conditions.”

However, the news has not reversed the token’s downturn. ASTER slipped nearly 4% over the past 24 hours, trading around $0.93, while daily volume dropped by 41.80%, signaling weakening market participation.

Comments are closed.