Featured News Headlines

- 1 Crypto Treasury Companies Drive Massive $7.8 Billion Crypto Purchases This Week

- 2 Ether Takes Center Stage in Corporate Crypto Purchases

- 3 Altcoins Also Shine as Tron and Binance Tokens Attract Big Bets

- 4 Bitcoin Treasury Buys Continue Strong, Fueled by Strategy and New Entrants

- 5 Risks and Market Dynamics of the Corporate Crypto Treasury Trend

Crypto Treasury Companies Drive Massive $7.8 Billion Crypto Purchases This Week

Crypto Treasury – This week has seen an unprecedented surge in corporate crypto treasury activity, with firms announcing plans to buy more than $7.8 billion worth of cryptocurrencies — one of the largest institutional crypto accumulations in recent memory. The spotlight remains firmly on Ether (ETH), which continues to be the preferred target for these savvy treasury managers.

Ether Takes Center Stage in Corporate Crypto Purchases

According to an analysis of 16 company disclosures since Monday, at least five public companies have committed to acquiring over $3 billion in ETH, a volume nearly 45 times the amount of ETH issued in the past week.

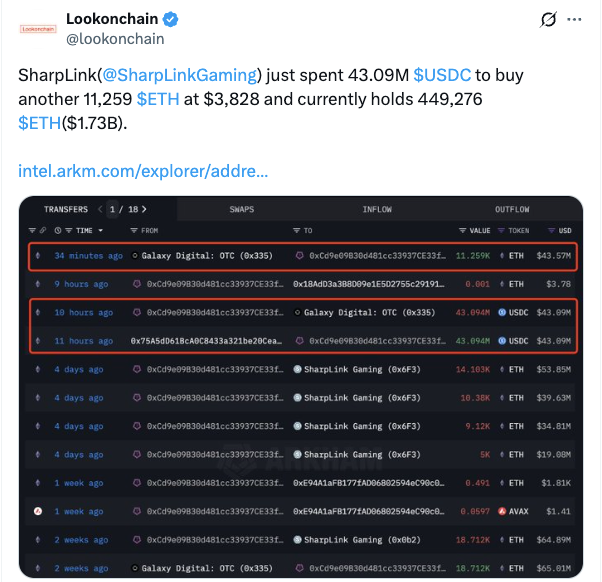

Notable players include Bitcoin miner BTCS Inc., which filed plans to raise up to $2 billion in shares to fund future ETH purchases. Meanwhile, Joe Lubin’s Sharplink Gaming, already one of the largest Ethereum treasury holders, boosted its stash by buying $338 million worth of ETH across two deals. Another prominent buyer, The Ether Machine, added 15,000 ETH (around $57 million) to its portfolio.

In addition, two new corporate entities emerged this week focused solely on Ether: biotech company 180 Life Sciences Corp rebranded as ETHZilla Corporation following a $425 million deal, and merchant banker Fundamental Global transformed into FG Nexus with a $200 million commitment.

Altcoins Also Shine as Tron and Binance Tokens Attract Big Bets

Crypto treasury firms aren’t just betting on Ethereum and Bitcoin. The week’s biggest altcoin-buying announcement came from Tron Inc., which aims to raise $1 billion to purchase Tron (TRX) tokens following its takeover by Justin Sun’s blockchain firm.

Other companies revealed plans to buy tokens like Solana (SOL), Sui (SUI), and Binance Coin (BNB). A standout new player is CEA Industries, a Canadian vape company that pivoted to buying BNB after an investment from 10X Capital and YZi Labs. This firm, closely linked to Binance co-founder Changpeng Zhao, plans to raise between $500 million and $1.25 billion to acquire BNB tokens.

Bitcoin Treasury Buys Continue Strong, Fueled by Strategy and New Entrants

While Ethereum steals the show, Bitcoin remains a heavyweight in treasury buys. Seven companies have proposed or completed acquisitions totaling about $2.7 billion in BTC.

MicroStrategy, now known simply as Strategy, remains a major buyer, having raised $2.5 billion and purchased over 21,000 BTC. The UK’s The Smarter Web Company acquired 225 BTC for roughly $26.5 million, and Metaplanet added 780 BTC at a cost of $92 million.

Meanwhile, a new Bitcoin-focused treasury emerged this week with energy firm ZOOZ Power Ltd., planning an $180 million purchase.

Risks and Market Dynamics of the Corporate Crypto Treasury Trend

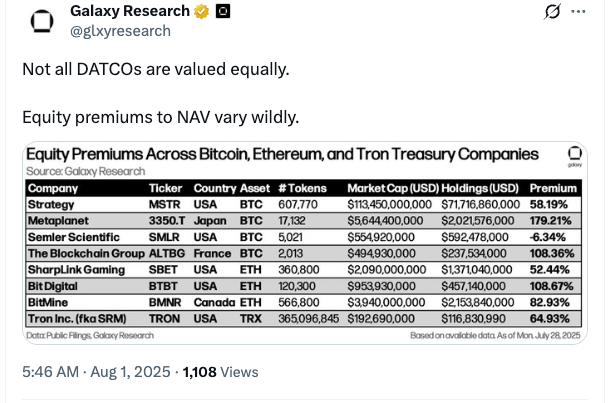

Despite massive inflows, analysts caution that the model carries risks. According to Galaxy Research analyst Will Owens, crypto treasury companies collectively hold more than $100 billion in digital assets, with about $93 billion in Bitcoin alone.

Owens warns that the business model depends heavily on maintaining an “equity premium” over net asset value (NAV). If investor sentiment shifts, or liquidity dries up, the entire treasury company sector could face structural challenges.

Comments are closed.