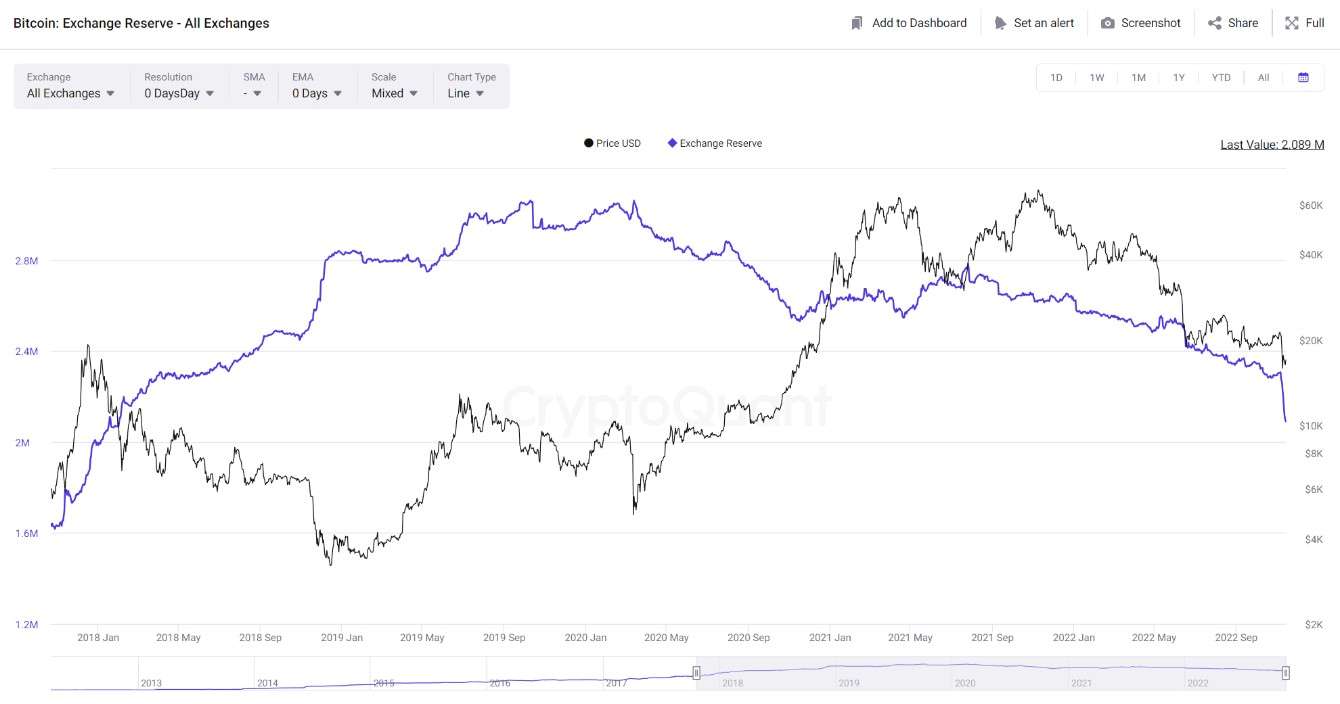

After FTX bankruptcy, one of the largest known centralized exchanges, declared bankruptcy, its balance sheet in the cryptocurrency market was very heavy. As we all know, FTX was the 2nd largest centralized cryptocurrency exchange. With the collapse of such a large centralized exchange, trust in centralized exchanges has decreased significantly, and as a result, billions of dollars of Bitcoin, Ether and stablecoin have been withdrawn from exchanges. When we look at the data of the on-chain analysis company CryptoQuant, we see that the money withdrawn from the exchanges since the start of the FTX Bankruptcy collapse is over $ 8 billion in total.

FTX Bankruptcy

After Binance CEO Changpeng Zhao’s statements about FTX bankruptcy, a total of $3.7 billion worth of Bitcoin, $2.5 billion worth of Ether, and nearly $2 billion stablecoins were withdrawn from centralized exchanges. With the decrease in trust in centralized exchanges, we can say that cryptocurrency investors have started to turn to decentralized exchanges. We also see that the reserves of the central crypto exchanges are at their lowest levels since November 2018.

The data that we can show as another example of the decrease in trust in centralized exchanges occurred after the FTX stopped withdrawals in recent weeks and asked Binance for help to eliminate the liquidity deficit. After this incident, 80000 Bitcoins were withdrawn from the exchanges within 24 hours. The influx of users withdrawing their money on the FTX exchange led to a liquidity problem for FTX.

Friday, November 11, FTX failed to keep up with these requests, stopped withdrawals, and then filed for bankruptcy. As a result of these negative events in the crypto money market, it is thought that Gate and CryptoCom exchanges may also face similar liquidity problems. According to the analysis of CryptoQuant CEO Ki Young Ji, after 320000 ETH transfer transactions, which we can call strange, which CryptoCom has done, and the previous faulty sending transactions, the stablecoin reserves of the CryptoCom exchange have decreased by 90% in the last 7 months.

Leave a comment