Bitcoin Dips After Record High, But Experts See a Much Bigger Rally Coming

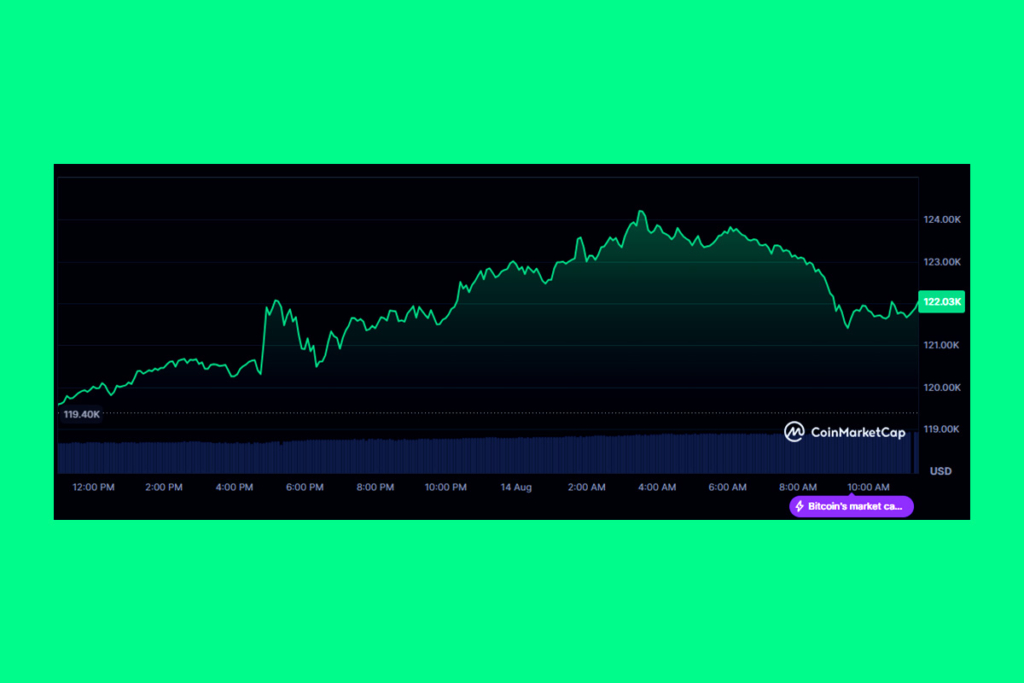

Institutional demand and wagers for a more lenient monetary policy caused Bitcoin to drop 0.8% on Thursday, to slightly around $119,533, after reaching a record $124,457 on Wednesday. The cryptocurrency is up 60% from its April market lows and has increased 31% so far this year.

The main forces behind this year’s token surge have been inflows into spot exchange-traded funds and purchases from publicly traded corporations that have added bitcoin to their balance sheets, following the model of the software firm-turned-bitcoin juggernaut strategy (MSTR). The Trump administration’s support for cryptocurrency is also seen by strategists as a significant motivator.

The administration is pushing crypto. They are pushing bitcoin. Bitcoin is the lead dog in the crypto market. So is it short-term a little frothy? Sure. But longer term, there are some fundamental changes here that I think are bullish for it and we’ll send it much higher in the future.

Tom Essaye, founder of Sevens Report Research

Ethereum Rally Follows Fed Rate Cut Bets and Pro-Crypto Signals

The price spike coincides with US stocks hitting all-time highs due to predictions that the Fed would lower interest rates in September and that Trump’s choice for the next Fed chair will probably support more lenient monetary policy. In the meantime, as Wall Street becomes more optimistic about the second-largest cryptocurrency by market capitalization, Ethereum prices surged to almost all-time highs on Wednesday.

Ether almost missed its 2021 record highs, rising as much as 6% to hover near $4,739 per token. In this context, businesses have begun to include ether in their balance sheets in order to gain exposure to the technological infrastructure that underpins digital assets such as decentralized finance and stablecoins.

Lee: Ethereum Is the Biggest Macro Trade for the Next 15 Years

To increase its cryptocurrency holdings, Bitmine Immersion Technologies (BMNR), an Ethereum treasury firm, said this week that it would sell up to an additional $20 billion worth of stock.

We have stated multiple times we believe Ethereum is the biggest macro trade over the next 10-15 years,

Fundstrat head of research Tom Lee

Lee pointed out that the Ethereum infrastructure is being used to build most Wall Street cryptocurrency projects and stablecoins, which are digital currencies backed by assets like the US dollar. Since last month’s passage of the GENIUS Act legislation, which establishes regulations for the stablecoin sector, Ether has increased by more than 50%.

For more up-to-date crypto news, you can follow Crypto Data Space.