Featured News Headlines

Crypto Market Rally Faces Risks: Leverage Peaks and OG Whales Cashing Out

Crypto Market Hits $4.2 Trillion – As the crypto market surged past a staggering $4.2 trillion in October, the euphoria has been tempered by growing concerns among analysts who warn of mounting risks lurking beneath the surface. From record-breaking leverage levels to profit-taking by large holders, the market appears poised on fragile ground that could soon unravel.

Record Leverage Sparks Concern Over Market Stability

One of the most glaring warning signs is the unprecedented leverage in the market. Data from Coinglass reveals that total open interest in derivatives contracts has soared to an all-time high of $233.5 billion, even as spot trading volumes decline. This suggests traders are increasingly relying on margin and derivatives to amplify short-term gains instead of making outright investments.

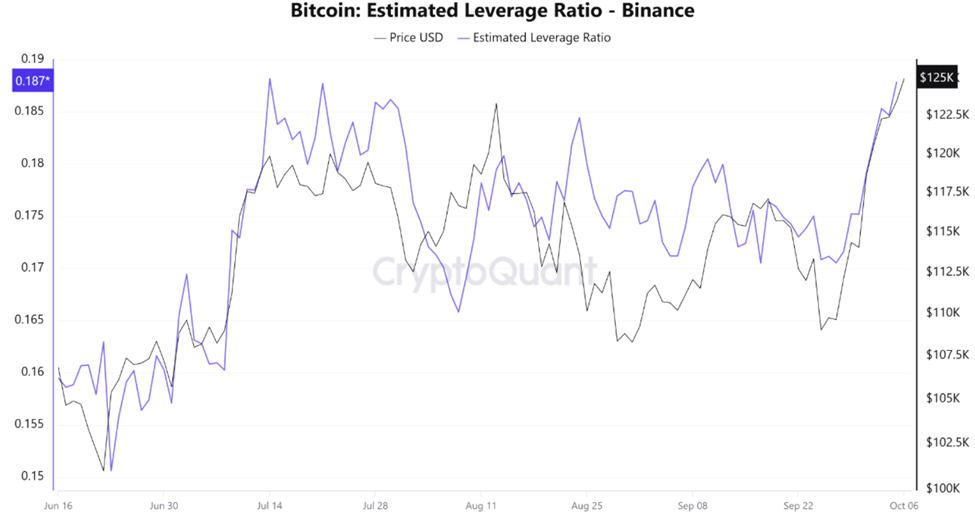

According to CryptoQuant, Binance’s Estimated Leverage Ratio (ELR) has climbed to 0.187, the highest since July. CryptoQuant analyst Arab Chain points out that this rise signals a growing risk appetite as Bitcoin nears new all-time highs. However, history cautions that when leverage surpasses the 0.18–0.20 range, pullbacks often follow due to cascading liquidations triggered by sudden price dips.

Interestingly, this risky behavior is largely driven by retail investors chasing quick profits, while institutions appear to be dialing back leverage to safeguard capital. This divergence underscores a market that’s increasingly speculative and potentially vulnerable.

Greedy Sentiment Hits Warning Levels

The Fear and Greed Index has also surged, now resting at 70, which firmly places the market in the “greedy” territory. While this optimism fuels rallies, it often marks points of exhaustion where overconfidence prevails among traders.

Historically, readings above 70 to 80 have preceded market cool-downs, signaling that sentiment might be overheating and due for a correction.

OG Whales Cashing Out Amid Rally

Adding to the unease, on-chain data reveals that long-term holders — often called “OG whales” — are taking advantage of the rally to realize profits. Analyst Maartunn from CryptoQuant reported that these whales booked over $800 million in profits in just the first three days of October. Moreover, around 15,000 BTC worth approximately $1.88 billion moved onto exchanges, indicating a potential increase in sell pressure.

In a striking example, Lookonchain highlighted that a dormant whale moved 100 BTC (valued at $12.5 million) after 12 years of inactivity—an unusual event during a market peak. This wallet originally received 691 BTC back when Bitcoin was just $132, now worth an eye-watering $86 million.

Such movements from old wallets during a rally have historically foreshadowed corrections as seasoned investors lock in gains.

Dollar’s Resurgence Could Stifle Crypto Rally

While crypto prices soared roughly 12% above their 2024 highs, the US Dollar Index (DXY) dipped nearly the same amount — but it is now showing signs of rebound. Analysts including Axel Adler and The Great Martis caution that the dollar could strengthen amid Europe’s economic struggles and ongoing fiscal uncertainties in the US.

A stronger dollar generally exerts downward pressure on risk assets like cryptocurrencies. Adler notes, “The dollar index rose above 98 as investors assessed the economic implications of the ongoing government shutdown.”

Meanwhile, Daan Crypto Trades warns that crypto’s recent rally may have been partially fueled by a weakening dollar, meaning a renewed dollar surge could quickly sap crypto’s momentum.

The “1999 Moment”: Is Crypto Facing a Dot-Com Bubble Repeat?

Billionaire investor Paul Tudor Jones has drawn parallels between today’s crypto market and the late-1990s dot-com bubble, dubbing the current state a potential “1999 moment.” While he finds Bitcoin attractive, Jones cautions that the market might be flirting with a speculative peak.

With Bitcoin flirting around $126,000 and sentiment running at fever pitch, the question is no longer about crypto’s strength, but whether it’s too strong. When greed, excessive leverage, and whale profit-taking converge, history tells us a shakeout often follows before the next major upswing.