Crypto Market- Fed Rate Decision Could Change Crypto’s Fate

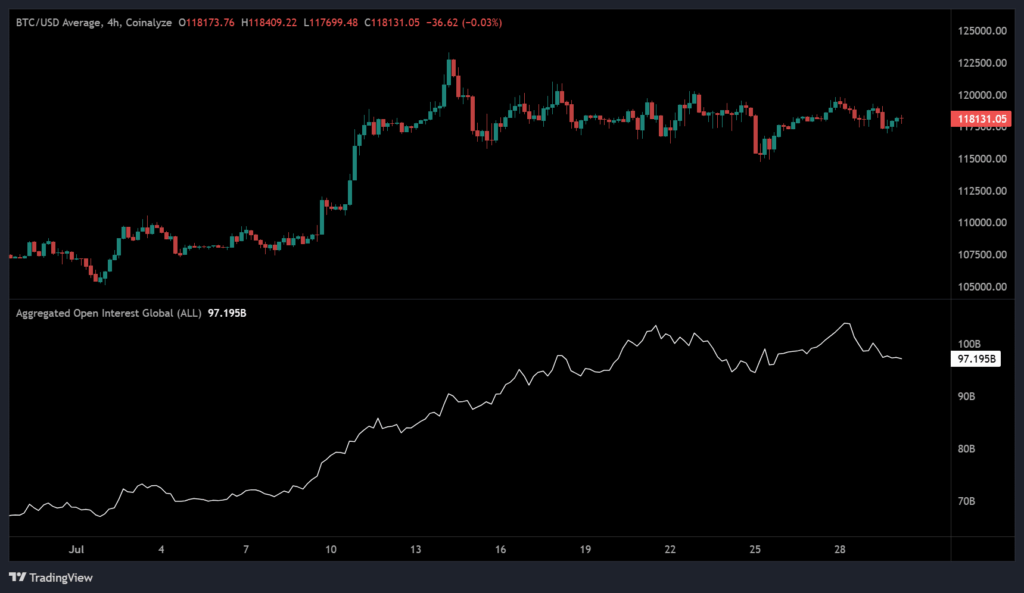

Crypto Market– Just hours before the U.S. Federal Open Market Committee (FOMC) announces its rate decision, the crypto market is showing signs of cautious de-risking—especially among altcoins. Bitcoin (BTC) briefly dipped to $116,950 on July 29 but bounced back above $118,000 as traders held their breath.

Meanwhile, altcoins are struggling to find a clear direction, reflecting uncertainty ahead of what could be a pivotal Fed announcement.

Altcoins Bear the Brunt: Who’s Selling the Most?

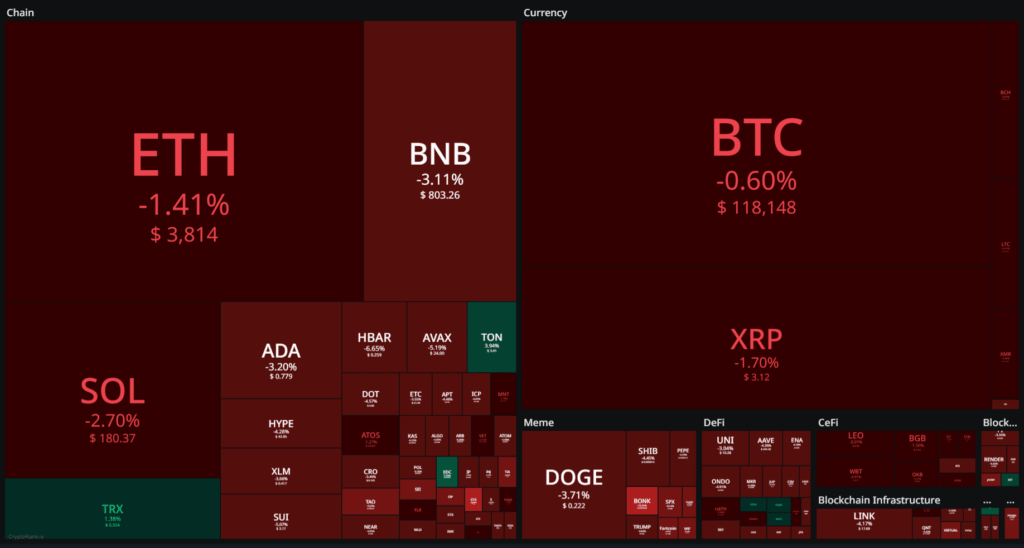

In the last 24 hours, altcoins took a hit. Bonk (BONK) led the decline with a sharp 10% drop, while meme coins Pepe (PEPE) and Dogecoin (DOGE) fell 4% and 3%, respectively. Top layer 1 tokens like Binance Coin (BNB), Cardano (ADA), and Solana (SOL) also dipped between 2-3%.

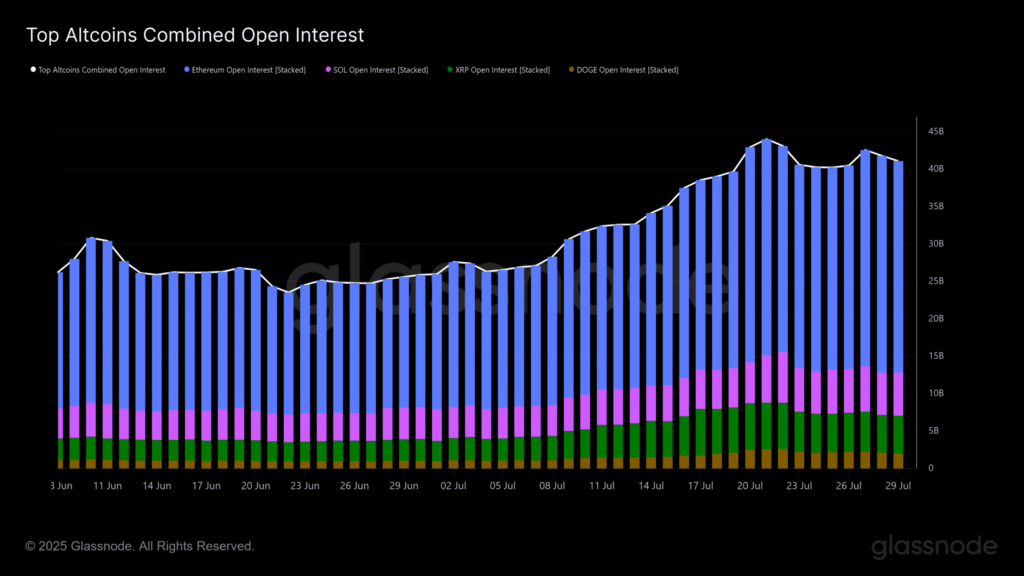

This sell-off wiped nearly $50 billion from the altcoin market cap, sliding it from $1.57 trillion down to $1.52 trillion. Open Interest (OI) on exchanges dropped from $101 billion to $97 billion, signaling traders are moving to the sidelines, bracing for Fed-driven volatility.

What’s Next? Will Altcoins Bounce Back?

Crypto strategist Matt Mena from 21Shares offers a cautiously optimistic view. He predicts the Fed will hold rates steady this July but flags a possible 25 basis points rate cut in September. If that happens, it could ignite a fresh Bitcoin rally — potentially dragging altcoins back into the green.

Keep an eye on upcoming inflation data (PCE) on July 31, which could be the next major catalyst shaping crypto’s near-term direction.

Comments are closed.