Featured News Headlines

Crypto Market Alert- Ethereum, Solana & BNB’s Volatile Week

Crypto Market Alert– While the crypto market shows signs of recovery, several major altcoins are flashing red on liquidation maps. Let’s break down what’s happening with Ethereum, Solana, and BNB—and why traders are on edge.

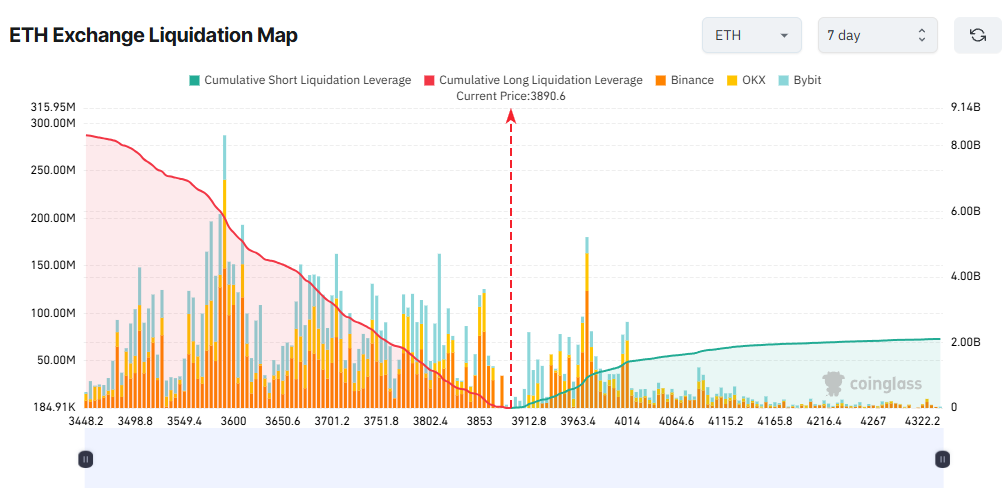

Ethereum (ETH): Bullish Momentum Meets High Risk

Ethereum recently neared the $4,000 mark, driven by major institutional accumulation. SharpLink Gaming alone added over 77,000 ETH to its holdings last week, boosting market confidence. Still, $3,980 remains a critical resistance.

“Breaking $3,980 could trigger a major bull rally,” says crypto analyst Ali Martinez.

But there’s risk on both sides. According to Coinglass, if ETH pushes past $4,000, over $1.2 billion in short liquidationscould hit. Conversely, a drop to $3,500 could lead to a $7.8 billion long liquidation—a massive wipeout.

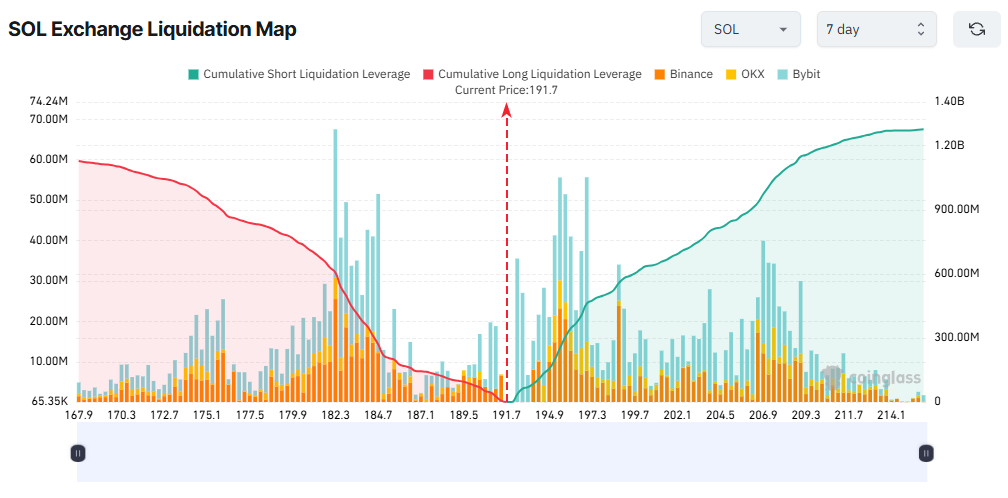

Solana (SOL): Heavy Exposure, Fragile Ground

Solana’s open interest has surged past $11 billion—25% higher than when SOL hit nearly $300 in January. But most of that exposure comes from leveraged derivatives, not spot trading. With SOL trading around $191, the gap between derivatives and real buying pressure is widening.

A move above $200 could liquidate $600M in shorts, while a dip to $181 could wipe out $700M in longs. Volatility is brewing.

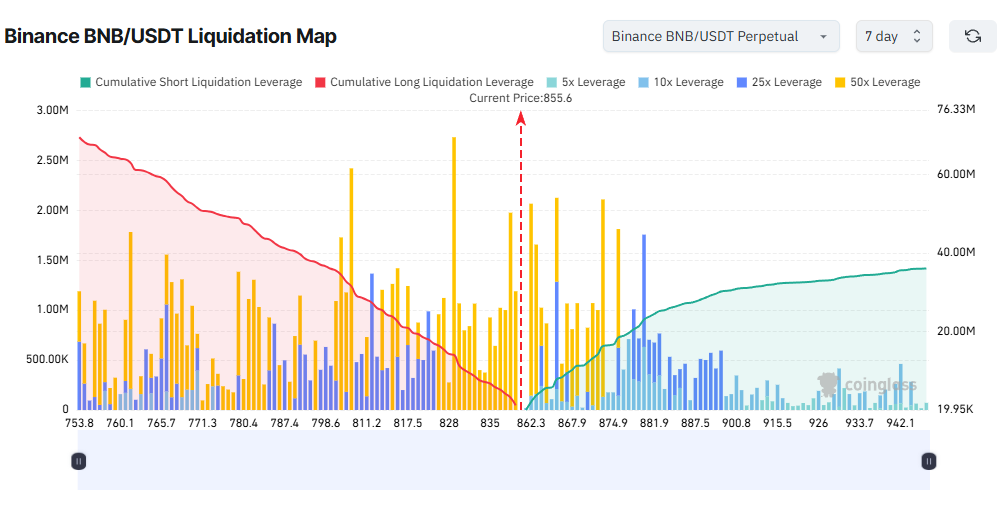

BNB: Riding High—but Highly Leveraged

BNB recently hit a new ATH of $859, thanks to BNB Chain growth and treasury activity. But Binance data reveals extreme leverage—mostly 50x positions clustered between $753–$875.

A break above $875 could liquidate $18.5M in shorts, but falling below $800 risks wiping out $36M in longs.

Analysts remain divided: Is $1,000 next—or will a dip come first?

Comments are closed.