Featured News Headlines

DAT Firms Lose Market Premium Amid Crypto Liquidations

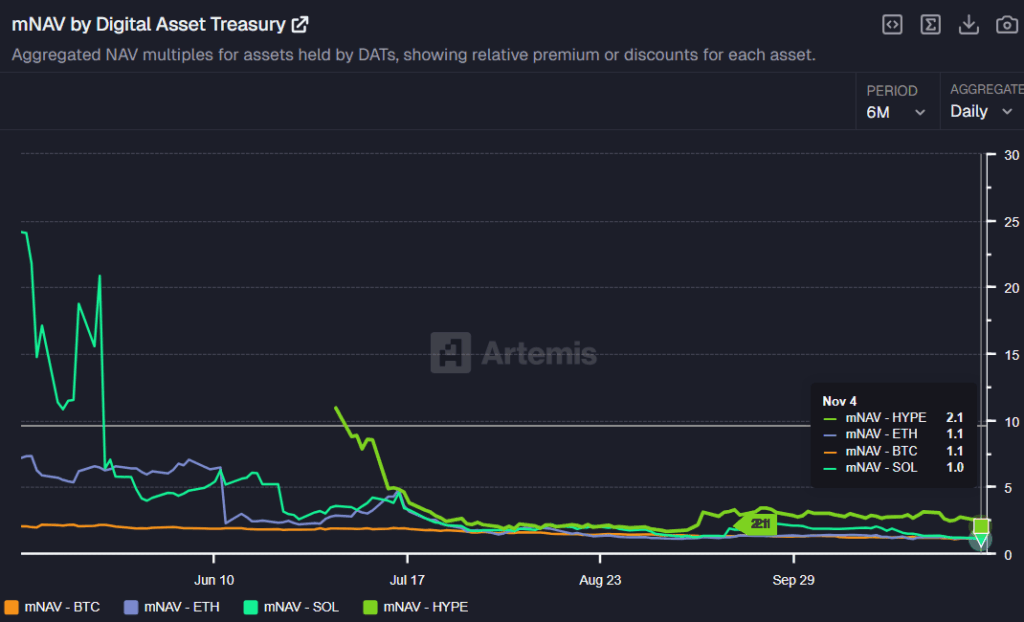

Data released Wednesday by on-chain analytics platform Artemis shows that the market premium for Digital Asset Treasury (DAT) firms has nearly vanished. According to Artemis’s “mNAV by Digital Asset Treasury” metric, the Market Net Asset Value (mNAV) ratio for these crypto-holding companies—once exceeding 25—has now fallen close to 1.0, indicating that the market is no longer assigning a significant premium to these entities.

Market Premiums Vanish

The mNAV ratio, which divides a firm’s market capitalization by the net asset value (NAV) of its digital holdings, serves as a crucial valuation indicator. A value above 1 implies that investors see additional value or growth potential beyond the company’s crypto assets. In contrast, a ratio below 1 suggests the stock is undervalued, reflecting weak investor confidence.

Between May and June, DAT firms maintained an average mNAV between 1.9 and 2.0, even for conservative assets like Bitcoin (BTC). However, as of this week, BTC and ETH DATs stand at 1.1, while SOL DATs have dropped to 1.0. Even high-risk HYPE DATs have fallen from double-digit levels to 2.1.

Liquidations and Loss of Confidence

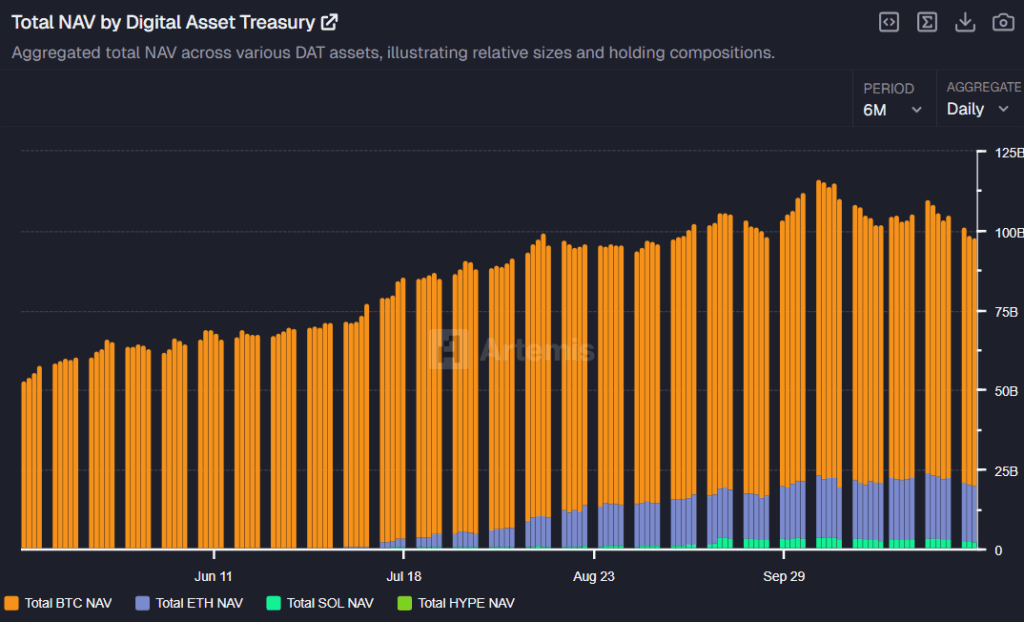

This decline has coincided with significant liquidation events. The total amount of BTC held by DAT firms has dropped from a record $92.6 billion (October 6) to $78.1 billion, while ETH holdings declined from $20.6 billion (October 27)to $17.6 billion.

Expert Commentary

Omid Malekan, Adjunct Professor at Columbia Business School, attributed recent crypto price weakness to this trend:

“DATs turned out to be a mass extraction and exit event – a reason for prices to go down,” Malekan said.

He criticized the costly business models of shell, PIPE, and SPAC-based DATs, calling them “an inefficient way to gain crypto exposure.”

Matt Hougan, CIO of Bitwise Invest, echoed this sentiment:

“If all a DAT does is hold coins, you’re better off owning an ETF,” he said, emphasizing that innovation—not accumulation—will define which DATs survive.

Comments are closed.