Featured News Headlines

Are Short Squeezes Coming? Crypto Funding Rates Signal Oversold Market

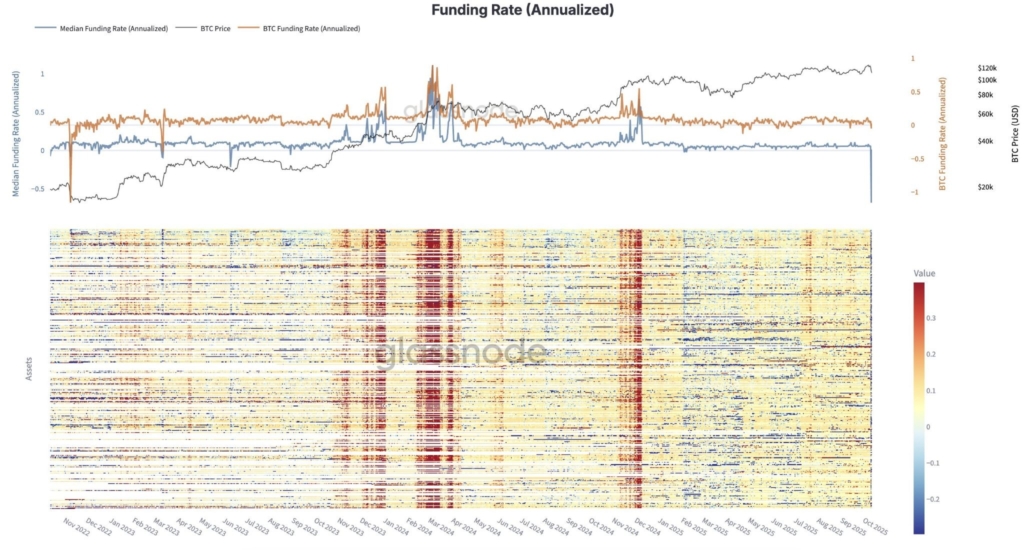

Crypto Funding Rates Crash – In a dramatic weekend shake-up, funding rates across crypto derivatives markets plunged to their lowest levels since the 2022 bear market, as short sellers dominated and over-leveraged longs were wiped out in what some analysts are calling a “crypto Black Friday.”

Funding Rates Crash as Shorts Stack Up

According to on-chain analytics firm Glassnode, the sharp decline in funding rates marks “one of the most severe leverage resets in crypto history.” The firm emphasized that this flush signals just how thoroughly speculative excess has been cleared from the system.

Funding rates, which are recurring payments between traders of perpetual futures contracts, help keep those contracts aligned with spot prices. When these rates turn extremely low or negative, it suggests the market is overloaded with short positions, with traders betting on further price drops.

Oversold Market May Trigger a Short Squeeze

While heavy shorting typically signals bearish sentiment, such extremes can flip the script. The market may now be oversold, setting the stage for a potential short squeeze — where rising prices force short sellers to close positions, pushing prices even higher.

This dynamic appears to be playing out. Data from CoinGlass shows a shift in sentiment, with 54% of traders now bullish or very bullish, and long positions making up 60% of accounts. Funding rates across Bitcoin (BTC) and Ethereum (ETH) perpetual swaps remain slightly negative, suggesting shorts still linger.

Crypto Black Friday: $1 Trillion Wipeout

The weekend also saw what may be the largest liquidation in crypto history, with nearly $1 trillion in market cap evaporating in hours. Triggered by a cascade following U.S. President Donald Trump’s announcement of new tariffs on China, the drop liquidated 1.6 million leveraged long traders.

Bitcoin alone printed its first-ever $20,000 red candlestick, shedding $380 billion in market cap before rebounding sharply in a V-shaped recovery, according to the Kobeissi Letter.

As spot markets begin to recover — with BTC up 5% and ETH regaining 12% — this massive leverage flush may be setting the stage for the next big move.

Comments are closed.