Crypto ETP Inflows Surge Again: $716M Marks Second Week of Gains

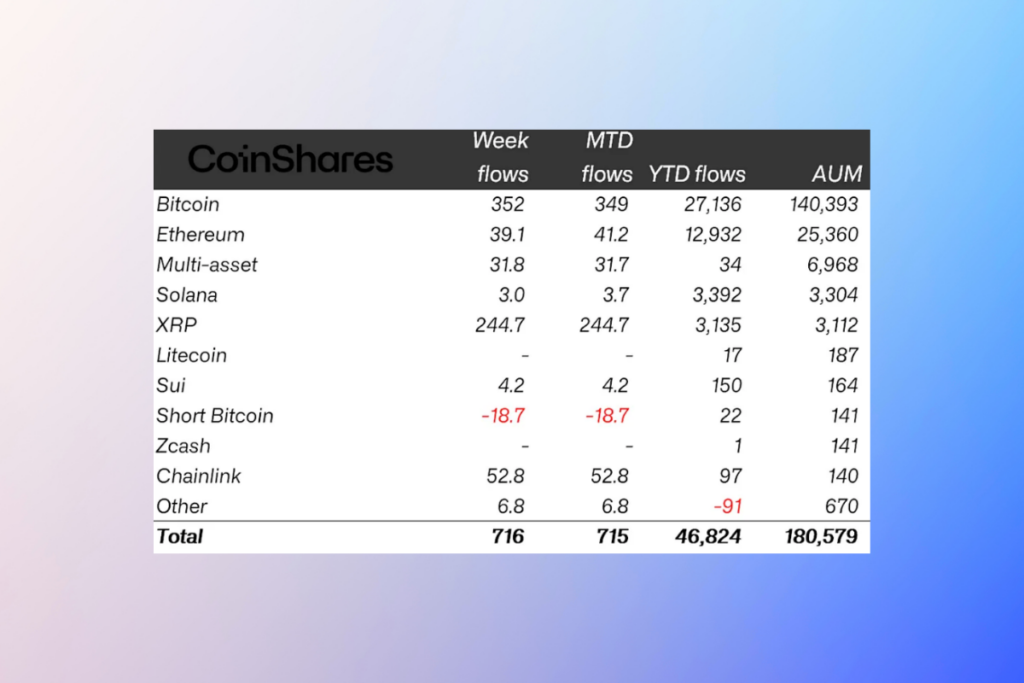

Last week, cryptocurrency investment products maintained their upward trend. After they made large gains, they were profitable for two weeks in a row. CoinShares stated on Monday that inflows into cryptocurrency exchange-traded products (ETPs) totaled $716 million. This complements the robust $1 billion profits from the previous week.

Daily data highlighted minor outflows on Thursday and Friday in what we believe was a response to macroeconomic data in the US alluding to ongoing inflationary pressures,

CoinShares’ head of research, James Butterfill

Crypto Market Recovers: AUM Hits $180B After Heavy Outflows

AUM, or total assets under management, surpassed $180 billion as a result of the additional inflows. Following four weeks of outflows totaling $5.5 billion, there has been an 8% recovery from the November lows. Butterfill pointed out that AUM was still far below its peak of $264 billion.

Last week, Bitcoin attracted $352 million in inflows, leading crypto ETP gains. With $244 million in revenue, XRP funds came in second. A record inflow of $52.8 million, or 54% of its AUM, made Chainlink stand out. $39 million was modestly inflowed into ether funds. At the same time, short Bitcoin ETPs saw outflows of almost $19 million. This may be a sign that negative sentiment is declining.

Global Crypto Inflows Climb Despite Heavy Outflows in Sweden

ProShares had the largest inflows of $210 million among issuers. BlackRock, the biggest issuer by AUM, on the other hand, experienced outflows of $105 million. Last week, there were withdrawals from Cathie Wood’s ARK and Grayscale Investments as well, totaling $78 million and $7 million, respectively. Geographically, inflows were noted in nearly every part of the planet. Canada came in first with $80.7 million, Germany with $97 million, and the United States with $483 million. Last week, outflows from Sweden totaled $5.6 million. As a result, its year-to-date outflows reached $836 million, the biggest amount in the world.

For more up-to-date crypto news, you can follow Crypto Data Space.