Crypto Derivatives Boom: Binance’s July Futures Volume Tops Bybit and OKX Combined

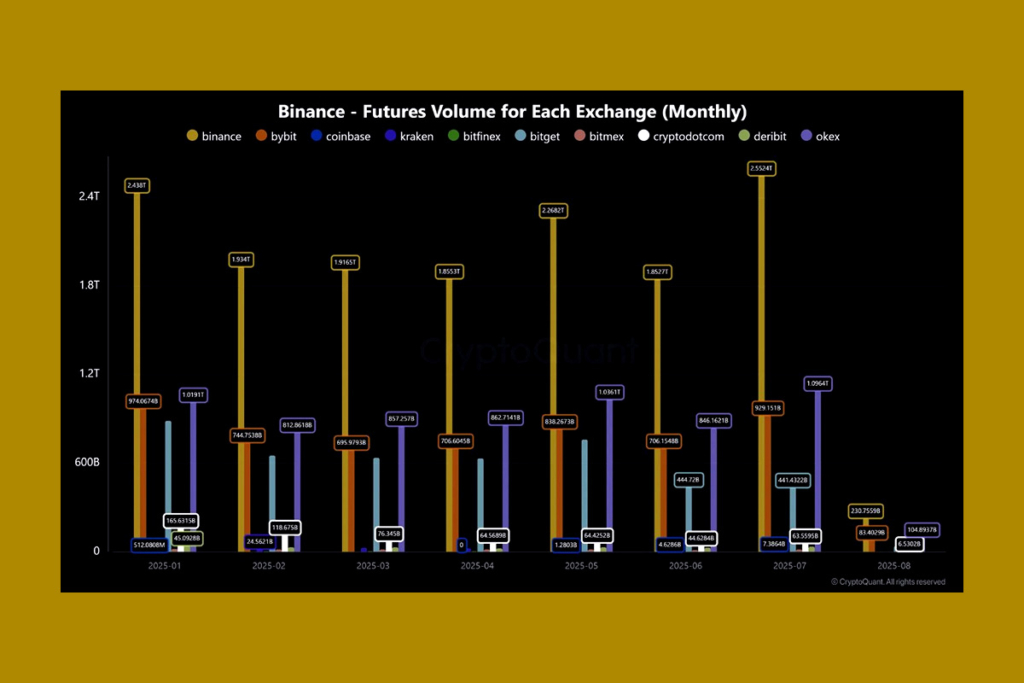

In July, trade volumes for cryptocurrency derivatives on the Binance platform reached their highest level in six months. This suggests a rise in trading activity and possibly more volatility in the wake of recent market swings. Analyst J.A. Maartun of CryptoQuant said on Tuesday that the volume of trade in Binance futures reached $2.55 trillion in July, the biggest since January.

The jump in volume followed a month of sharp price moves in both Bitcoin and altcoins,

Maartun

With $929 billion and $1.09 trillion in volume, Bybit and OKX, two other providers of cryptocurrency derivatives, also saw robust activity. However, Binance was by far the biggest, accounting for more than half of all major exchanges’ total volume, according to the researcher.

The increase in trading suggests more users are active again, possibly due to the recent price breakout,

Maartun

Binance Dominates Crypto Derivatives Market With Unmatched Liquidity

With 568 pairs available, Binance leads the market for cryptocurrency derivatives with the most assets and the highest liquidity. According to CoinGecko, it reached a four-month daily high of $134 billion on July 18 and is currently trading at $82 billion per day. More derivative traders and institutions are actively involved in the market when the volume of futures trading rises. This circumstance is frequently linked to notable price fluctuations or times of market turbulence. Because more traders are voicing their opinions on future prices when volume is higher, futures markets are also essential for price discovery.

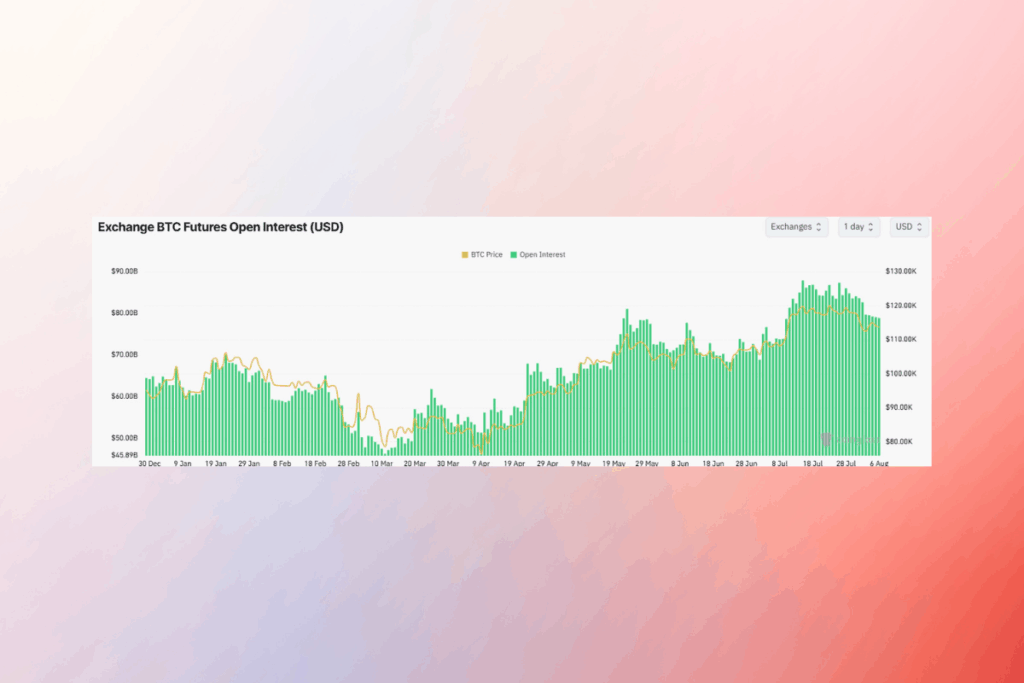

Bitcoin Futures Open Interest Holds Strong at $79B Despite July Pullback

The whole amount of open contracts that have not yet been resolved, or the total Bitcoin futures OI, is still high at about $79 billion. Nevertheless, CoinGlass reports that it has dropped from its peak of $88 billion in mid-July. Sharp declines in spot markets may result from a leverage flushout that frequently follows an excessively high OI.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.