Coinbase: Crypto Bull Market Has Room to Run Despite Market Uncertainty

Coinbase Report – A fresh report from Coinbase Institutional reveals growing confidence among institutional players in Bitcoin’s long-term potential. According to the “Navigating Uncertainty” research report, 67% of institutional investors surveyed expressed a positive outlook for BTC over the next three to six months, signaling continued optimism even amid cautious market sentiment.

“Most respondents are bullish on Bitcoin,” wrote David Duong, head of research at Coinbase Institutional.

The survey, which included 124 institutional respondents, also uncovered a “meaningful divergence” in perceptions of the current market cycle. While 45% of institutions believe we’re in the late stages of a bull run, only 27% of retail investors share that view.

Crypto Treasuries Buy the Dip as Long-Term Conviction Holds

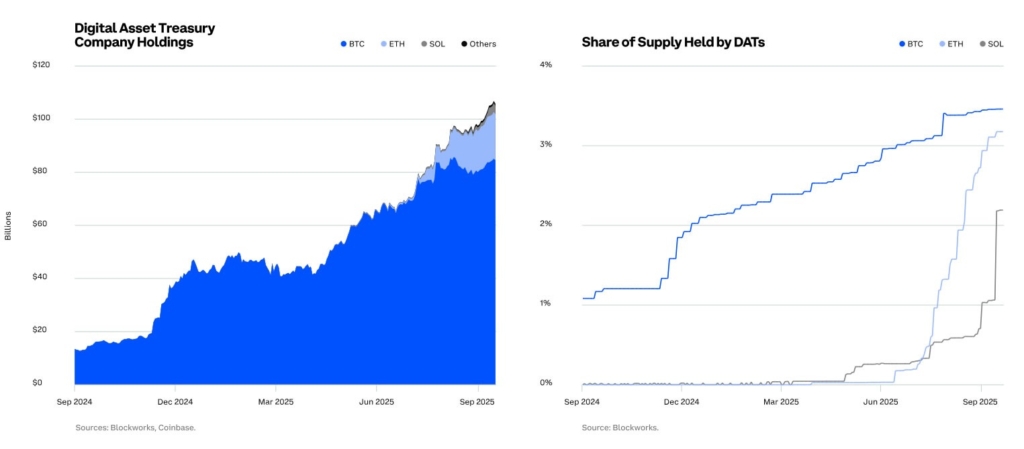

Institutional appetite extends beyond sentiment. Duong highlighted the significant impact of crypto treasury firms on supply-demand dynamics, stating, “It’s hard to overstate the impact that digital asset treasury companies have had on markets this year.”

Among them is BitMine, chaired by Tom Lee, which has acquired over 379,000 ETH—valued at nearly $1.5 billion—since Ethereum dipped below the $4,000 mark.

Meanwhile, Michael Saylor’s Strategy may also be preparing to expand its holdings after sharing a chart revealing $69 billion in Bitcoin reserves.

Despite equity market pullbacks, crypto reserves at major firms remain untouched, indicating a firm long-term belief in digital assets.

Macro Tailwinds and Fed Cuts Could Fuel Further Growth

Duong stated that the crypto bull market “has room to run,” although recent events, such as those on October 10, have prompted a more cautious stance.

Coinbase pointed to resilient liquidity, a strong macro backdrop, and potential Federal Reserve rate cuts as factors that could drive growth in Q4. Additional support could come from monetary stimulus in China and sidelined money-market funds re-entering the space.

While Bitcoin’s current setup looks particularly favorable, Coinbase noted a more cautious approach toward altcoin positioning.

Over the weekend, Bitcoin topped $109,000, while Ether briefly reclaimed $4,000, though sentiment remains cautious and recovery efforts limited.