Chainlink Price Rebounds Strongly – Bullish Signals Build

Recent on-chain data reveals that three newly created wallets collectively withdrew over 825,000 LINK tokens—worth approximately $15 million—from Binance. According to analysts, “This transfer pattern suggests that large investors are moving holdings off exchanges in anticipation of higher valuations.” Historically, such withdrawals have been associated with accumulation phases, often preceding significant market rallies.

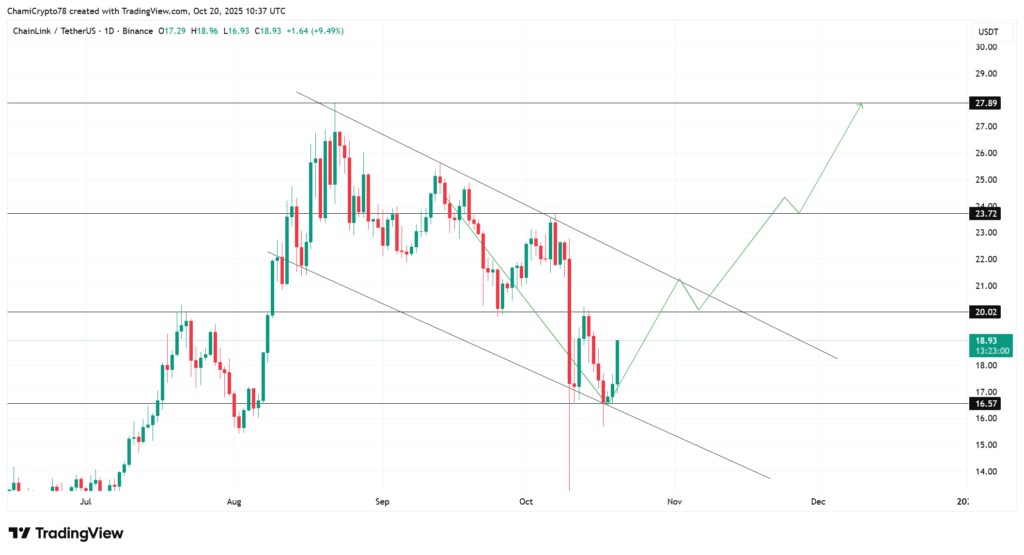

Price Action Eyes Key $20 Breakout

Chainlink recently rebounded from the $16.5 support level, forming a potential bullish reversal within a descending channel. Price now approaches the $20.02 resistance—a critical level. A successful breakout above this point could pave the way toward $23.72 and possibly $27.89, as noted by market watchers. “The strength of recent daily candles indicates that bullish momentum is gradually overpowering sell pressure,” one analyst observed. However, a failure to clear $20 could extend LINK’s consolidation phase.

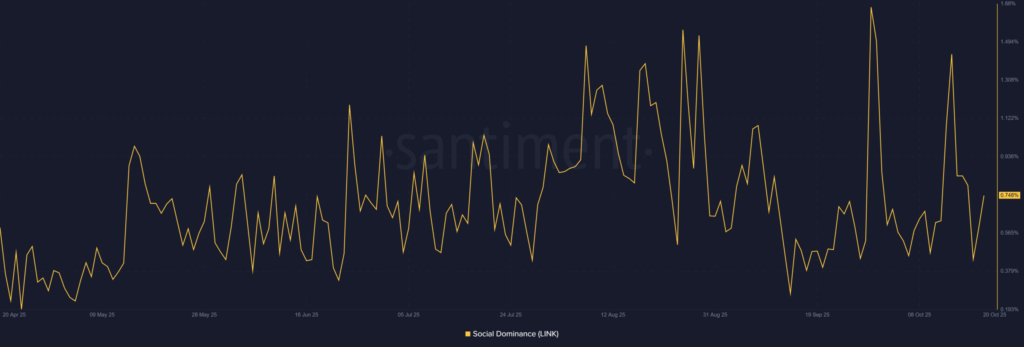

Data from Santiment shows LINK’s social dominance has increased to 0.74%, signaling renewed community interest. Experts note that “this gradual climb suggests a healthy resurgence in community interest rather than short-lived hype.” This trend coincides with increased on-chain activity, adding structural strength to the recent price recovery.

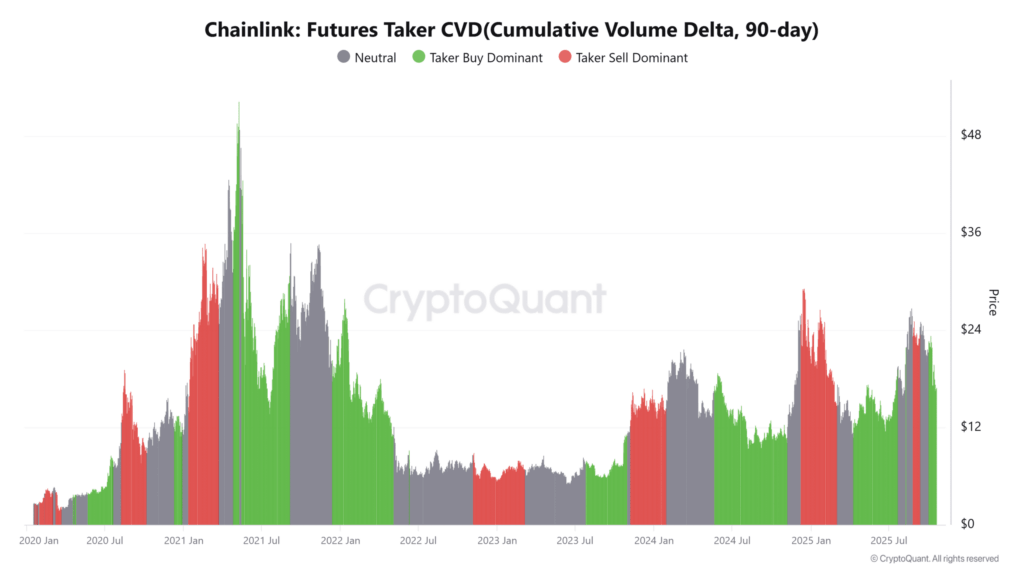

On the futures front, 90-day CVD data highlights a clear taker buy dominance, supporting the narrative of traders positioning for upside. Additionally, rising Open Interest suggests capital is flowing back into the LINK market, reinforcing confidence among both retail and institutional players.

Comments are closed.