Featured News Headlines

Chainlink Whales Unfazed by 11% Drop, Accumulation Reaches 7-Month High

Chainlink (LINK) has experienced a notable pullback after reaching its recent peak, but institutional investors remain bullish on the altcoin’s prospects. The cryptocurrency, which hit an intraday high of $24.74 on August 13, has since retreated to $22.29, marking an 11% decline that has caught the attention of market participants.

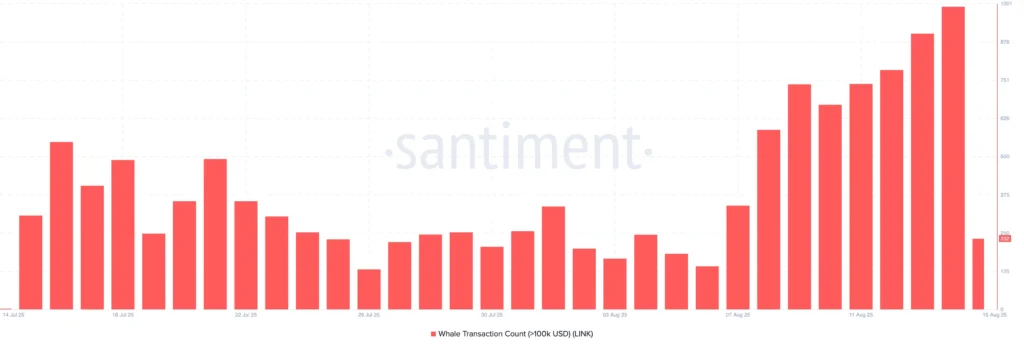

Whale Activity Surges to Seven-Month High

Despite the recent price weakness, large holders are viewing the current levels as an attractive entry point. On-chain data reveals that LINK whale transactions exceeding $100,000 reached a remarkable 992 transactions on Thursday, representing the highest level in seven months.

This surge in high-value transfers coincided with LINK’s price climbing to $24.31, falling just 2% short of the previous day’s closing price before encountering resistance. The whale accumulation pattern suggests that sophisticated investors remain confident in Chainlink’s long-term fundamentals.

Retail Interest Builds Momentum

The institutional appetite for LINK has been complemented by growing retail participation. Daily active addresses trading the token have shown significant growth, with Santiment data indicating a 55% increase since the beginning of August when measured using a seven-day moving average.

As of today, 232 whale transactions worth more than $100,000 have already been recorded, demonstrating sustained interest from deep-pocketed investors despite broader market consolidation pressures.

Technical Outlook Hinges on Critical Support

The current price action has brought LINK to a crucial juncture. Technical analysis suggests that maintaining support at $22.21 could pave the way for a rally toward $25.55. However, a breakdown below this key level could see the altcoin test lower support at $19.51.

The combination of increased whale activity and rising network engagement creates an interesting dynamic for LINK’s near-term price trajectory, with market participants closely monitoring these key technical levels.

Comments are closed.