Featured News Headlines

Chainlink Poised for Breakout as Selling Pressure Drops

Chainlink (LINK) could be approaching a significant price shift, with on-chain data pointing to reduced selling pressure and historically low exchange reserves.

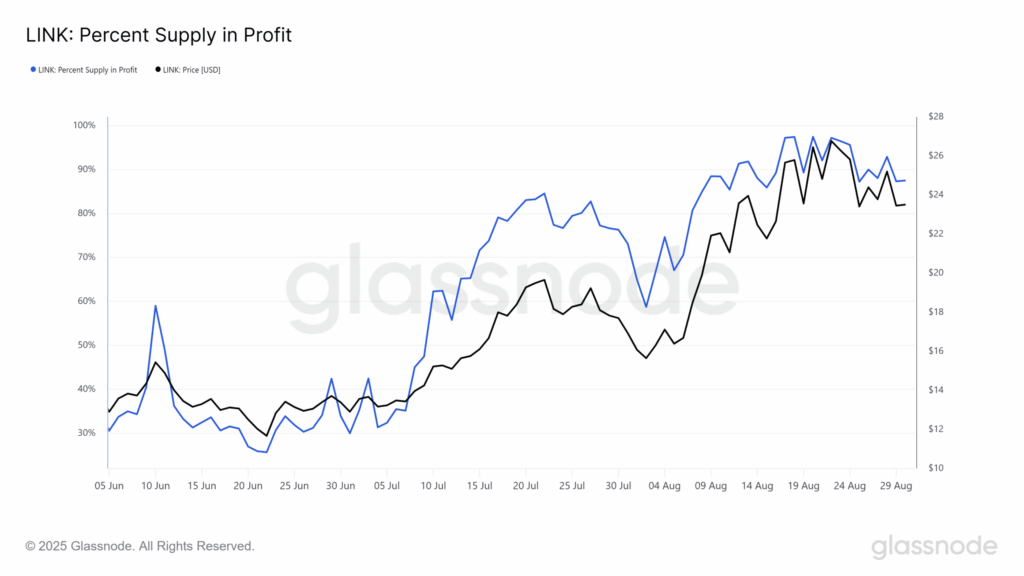

87.5% of LINK Supply in Profit

According to Glassnode, 87.5% of LINK’s circulating supply is currently in profit—a level not seen since earlier bull runs. This surge in profitability has tracked closely with LINK’s rally from below $15 in early July to over $25 in recent weeks.

With most holders now sitting on gains, the incentive to sell at current prices is lower. If new demand enters the market, the lack of willing sellers could act as a catalyst for further upward movement.

“This kind of setup often precedes strong upside momentum,” noted analysts at Glassnode.

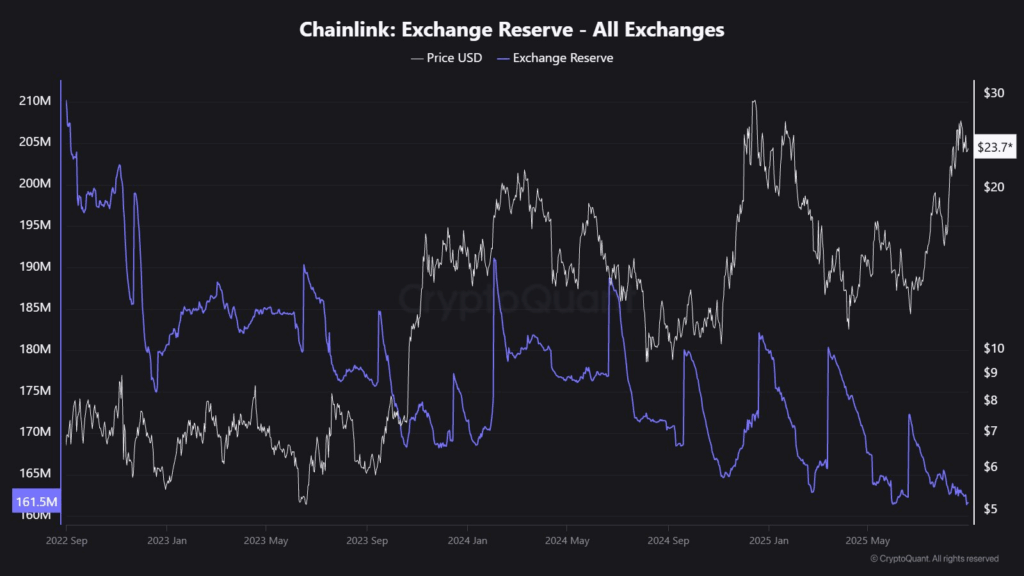

Exchange Reserves Hit Multi-Year Lows

Data from CryptoQuant shows that LINK exchange reserves have dropped to 161.5 million tokens, marking a multi-year low. The steady decline in reserves since mid-2023 suggests that fewer tokens are available for immediate sale on exchanges.

Historically, shrinking exchange balances have preceded major price rallies, as reduced liquidity amplifies price movements when demand returns.

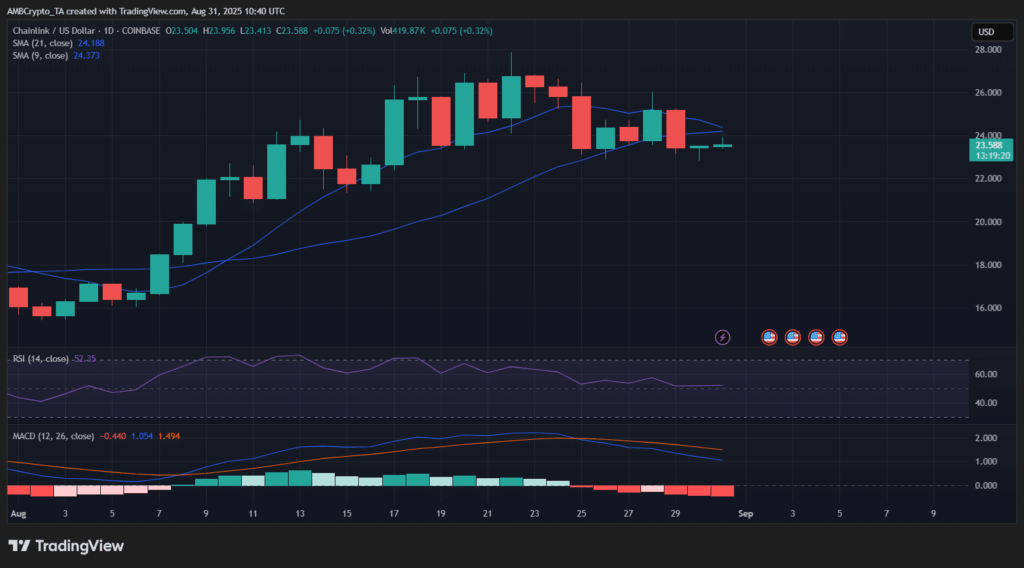

Price Consolidation Amid Cooling Momentum

At the time of writing, LINK trades at $23.58, consolidating after an early-August rally. The token recently slipped below both its 9-day and 21-day simple moving averages (SMA), signaling short-term weakness. The RSI stands at 52.35, indicating a neutral trend, while the MACD has crossed into bearish territory.

Despite the cooling momentum, LINK remains structurally strong above the $23 level. If buying pressure increases, the current low-liquidity environment could accelerate any upside breakout.

Comments are closed.