Featured News Headlines

Chainlink’s NVTS Points to Potential Upside Ahead

Chainlink [LINK] has defied broader market volatility, posting a notable 38.6% gain in August. While Bitcoin [BTC] price swings grabbed headlines, LINK bulls quietly pushed forward — and on-chain data suggests there could be more to come.

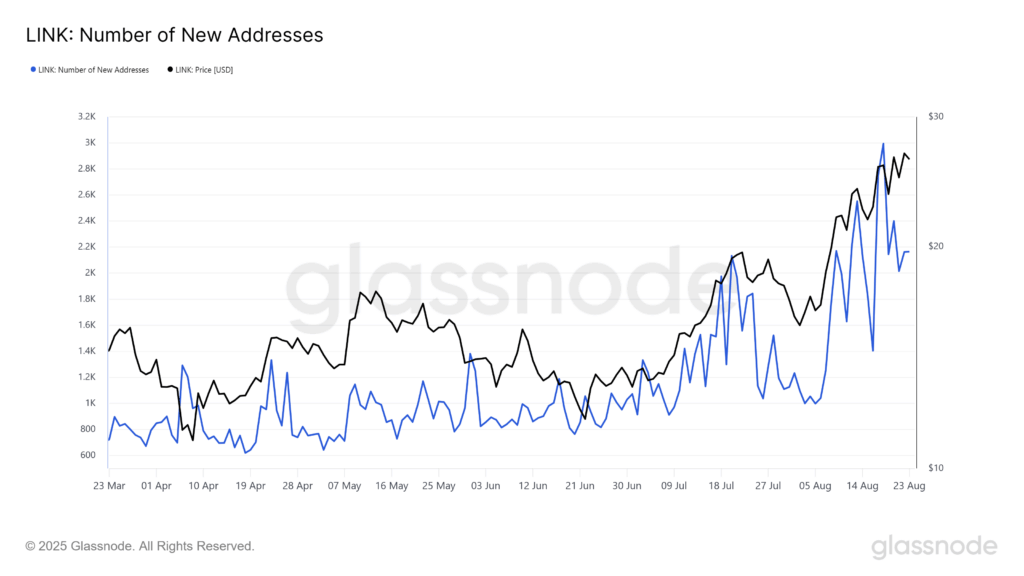

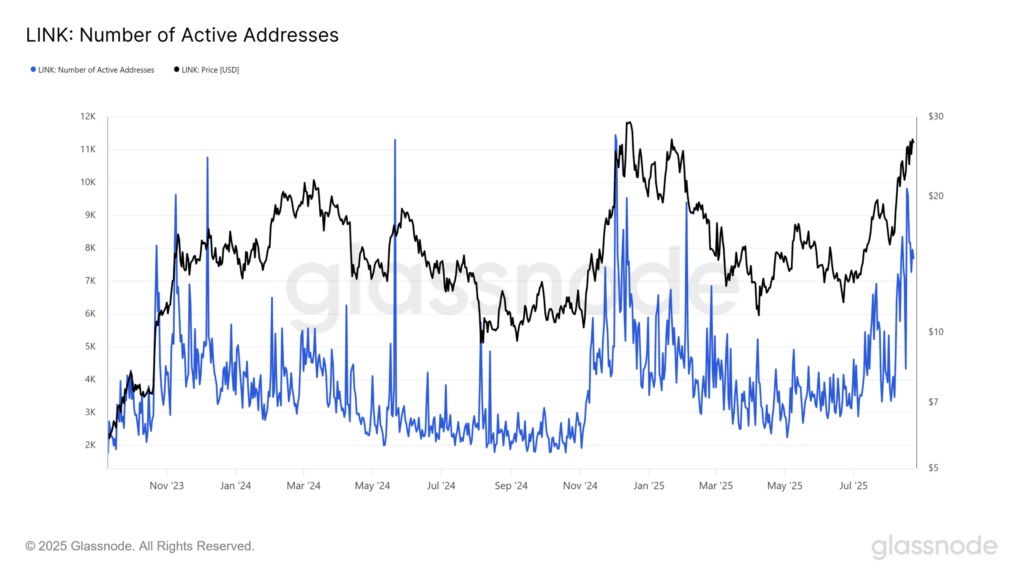

Address Growth Signals Growing Interest

Data from Glassnode shows that new addresses interacting with the Chainlink network have been rising steadily since June. As of press time, the metric reached 2,163, a level last seen in November 2024. Similarly, active addresses are climbing, nearing numbers not recorded since the market peak in late 2021.

This increase in network participation is typically a bullish sign. One analyst noted, “Sustained growth in active users reflects stronger organic interest and long-term holder confidence.”

However, as always in crypto, rising activity can also precede volatility — so caution is warranted.

Network Valuation Backs Bullish Case

Another key metric, the Network Value to Transactions Signal (NVTS), currently aligns with levels seen in early November 2024 — right before LINK surged from $10.56 to $29.26.

A low NVTS often indicates that an asset is undervalued relative to its transaction volume. In LINK’s case, this could point to further upside — especially if Bitcoin or Ethereum extend their rallies and capital rotates into mid-cap tokens.

Technical Setup Supports Short-Term Strength

On the 4-hour chart, LINK is currently trading inside a rising channel, having flipped $24.88 — a key resistance — into support. Indicators like the Awesome Oscillator, A/D line, and moving averages all favor bulls.

If the $24.3–$25 zone continues to act as a demand area, analysts suggest that LINK may target the upper end of the channel in the coming sessions.

Comments are closed.