CFTC Eliminates 2020 Crypto Rules: Is the U.S. Finally Catching Up?

The U.S. Commodity Futures Trading Commission’s Vice Chair, Caroline Pham, eliminated the antiquated guidelines on the delivery of cryptocurrencies. This ruling was praised for providing greater freedom for trades.

Eliminating outdated and overly complex guidance that penalizes the crypto industry and stifles innovation is exactly what the Administration has set out to do this year,

Pham

The March 2020 finalization of the guidelines first addressed the timing of the actual delivery of cryptocurrency in commodities transactions. But given the changes over the previous five years, the CFTC said in a notice that it was forced to reevaluate this advice.

Crypto Exchanges Gain Flexibility Under New CFTC Guidance

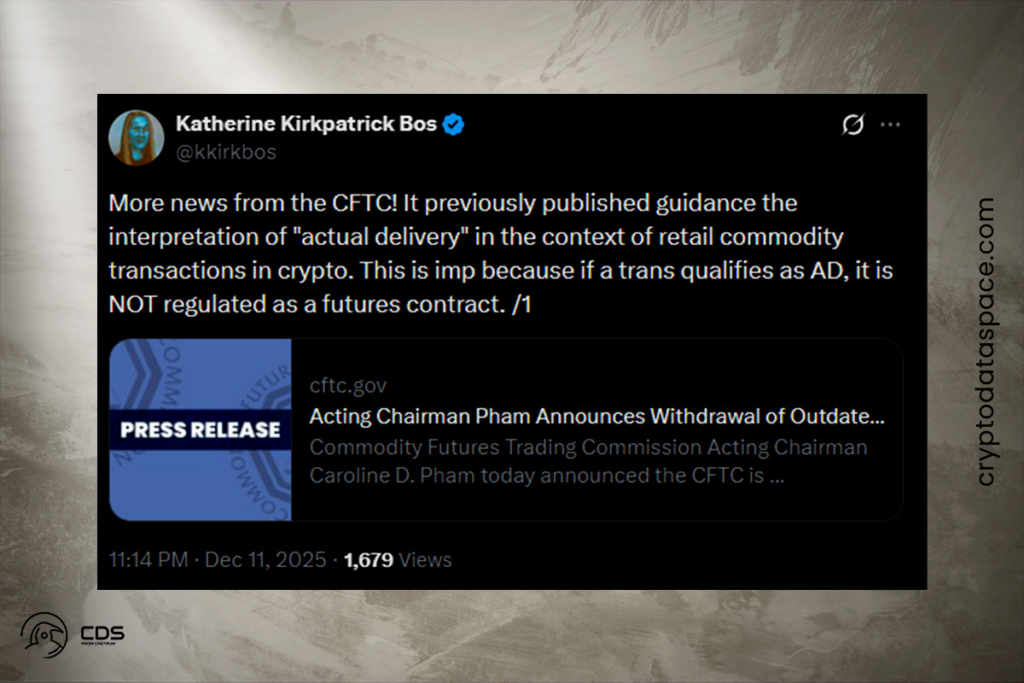

According to Pham, the chairman’s cryptocurrency working group’s recommendations led to the withdrawal of the advisory. The working group suggested that the CFTC release guidelines regarding the potential classification of cryptocurrency as commodities. Additionally, it recommended extending the agency’s earlier guidelines for the tangible delivery of virtual assets. Katherine Kirkpatrick Bos, general counsel at StarkWare, praised the action, stating that the advice was making it more difficult for exchanges to provide leverage or margin. These limitations are in effect unless the delivery actually takes place within 28 days, she added.

This offers way more flexibility for exchanges. But PSA — this isn’t law! Just guidance. All of this can be changed again should leadership change.

Bos

Experts Say CFTC’s Move Marks Clearer Crypto Jurisdiction

The CFTC can provide guidelines on how it interprets laws and enforces rules. It’s not as binding as formal regulation. In an X post on Thursday, Aifinyo AG head of Bitcoin strategy Garry Krugljakow speculated that it’s a huge sign of what’s to come.

This move signals two things: cleaner jurisdiction for the CFTC and a regulatory path designed for scale, not hesitation. Actual delivery made sense in 2020. It doesn’t in a world of real custody, collateralization, and Bitcoin-backed credit,

Krugljakow

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.