Featured News Headlines

AI and CBDCs Challenge the Dollar’s Global Dominance as Digital Finance Accelerates

CBDCs and AI Disrupt the Dollar Era – The U.S. dollar’s dominance has long underpinned global finance, but a new wave of digital transformation—from central bank digital currencies (CBDCs) to AI-powered financial systems—is testing that supremacy for the first time in decades.

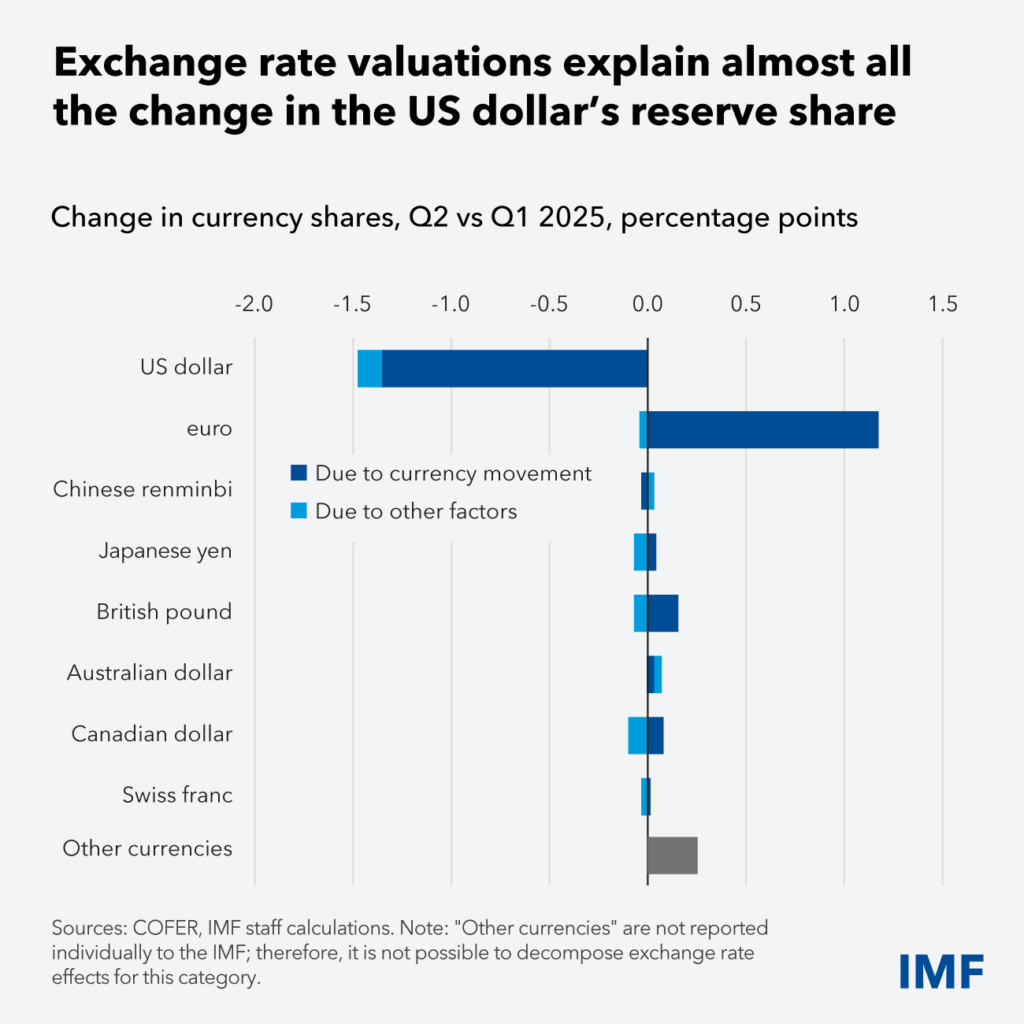

According to IMF COFER data, the dollar’s share of global foreign exchange reserves dropped to 56.32% in early 2025, its lowest point since the euro’s launch. At the same time, 94% of central banks are experimenting with CBDCs, signaling an accelerating shift toward digital state money.

Economist Dr. Alicia García-Herrero of Natixis notes that the dollar remains the anchor of global reserves but faces gradual erosion. “If the USD’s share falls below 55% by 2027 and CBDC settlements exceed $1 billion annually, that will mark a structural turning point,” she says.

Stablecoins Reinforce—and Challenge—the Dollar

Despite the shift, stablecoins still act as digital extensions of dollar liquidity. Roughly 99% of all stablecoins—including USDT and USDC—are pegged to the U.S. dollar. García-Herrero warns, however, that a yuan-backed token gaining 10–15% of market share could ignite geopolitical tension, with true fragmentation emerging once non-dollar tokens reach 20% of global settlements.

On-chain settlement has already exceeded $35 trillion annually, more than twice Visa’s throughput. Yet in high-inflation economies like Argentina and Turkey, stablecoins provide financial stability by serving as informal dollar rails.

Tokenization and the Rise of Digital Assets

The tokenization of real-world assets is moving from theory to practice. Franklin Templeton reports over $5.5 billion in tokenized treasuries, and García-Herrero forecasts that 5% of new sovereign debt could be issued on-chain by 2028, led by Asia and Europe.

Meanwhile, China’s e-CNY continues to expand rapidly, processing 7 trillion yuan in transactions by mid-2025—showing how state-led digital finance can scale under centralized control.

A Diffusing but Durable Dollar Order

Across CBDCs, AI finance, and blockchain innovation, García-Herrero’s data-driven outlook suggests evolution, not revolution. The dollar’s reach is diffusing, not disappearing, as global finance becomes more programmable, data-driven, and decentralized.

Ultimately, the future of money may hinge less on disruption than on governance—on how transparency, trust, and digital control reshape global liquidity in the AI age.

Comments are closed.