Featured News Headlines

Cathie Wood’s ARK Invest has made a dramatic reversal in its investment strategy, purchasing 262,463 shares of Jack Dorsey’s financial services company Block for $19.2 million after an extended period of aggressive selling.

ARK Ends Block Selling Streak with Major Purchase

The Monday acquisition marks ARK’s first Block purchase in months, signaling a potential shift in the investment firm’s approach to the fintech company. With Block shares closing at $73, the purchase comes as the stock experiences renewed momentum, surging 8% over the past 30 days.

This buying spree represents a stark contrast to ARK’s recent behavior, having dumped 279,047 Block shares worth approximately $22 million just last week. The investment giant’s selling streak extended throughout 2024 and early 2025, with no recorded purchases during this period.

$193 Million Block Position Across ARK Funds

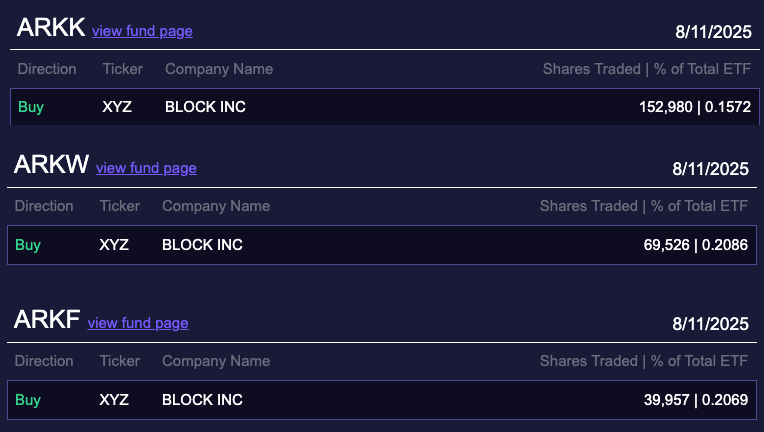

The latest acquisition involved transactions across three ARK funds: the flagship ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). ARKK alone purchased 152,980 shares and now holds approximately 1.34 million Block shares valued at $97.7 million.

Combined with ARKF holdings, ARK Invest now controls 2.6 million Block shares worth a total of $193 million, representing a significant position in Dorsey’s payment platform company.

Block’s Mixed Performance Despite Strong Earnings

ARK’s renewed interest comes after Block reported impressive Q2 results with $2.54 billion in profit and 14% year-over-year gross profit growth. The company’s Cash App drove much of this success, generating $1.5 billion in gross profit while Bitcoin accounts reached 8 million users.

However, Block shares paradoxically declined 7% following the earnings release and remain 21% below January highs despite the recent rebound. The company plans to launch Bitcoin banking tools for small and medium enterprises by late 2025, potentially driving future growth.

ARK’s strategic reversal suggests growing confidence in Block’s fintech innovation potential, particularly given the company’s strong fundamentals and expanding cryptocurrency services.

Comments are closed.