Spot SUI ETF Progress Signals Growing Interest

Canary Funds has made progress in launching its spot Sui (SUI) exchange-traded fund (ETF) by submitting an updated registration statement (S-1/A) to the U.S. Securities and Exchange Commission (SEC). This latest filing includes administrative changes such as a new company address and the designation of a ticker symbol on the Cboe exchange. Importantly, the core financial terms and structure of the fund remain unchanged.

While these updates are primarily procedural and do not directly increase the likelihood of the ETF’s approval, they signal active coordination between the fund issuer and the exchange. This collaboration is a key step before the SEC proceeds to the next phase of its review process.

SUI Token Recovers Following Sharp Price Decline

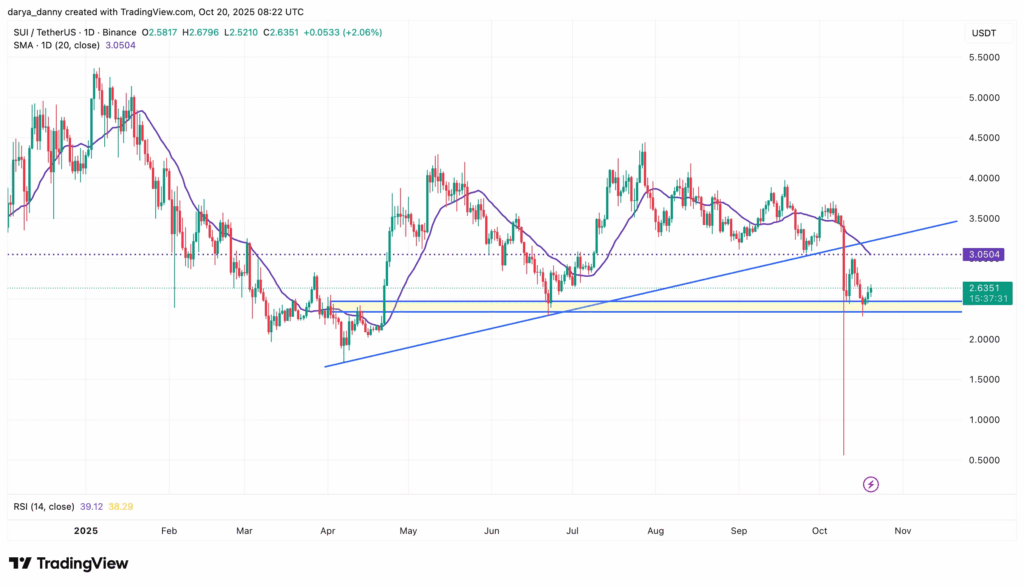

The announcement has brought some optimism to investors after a recent challenging week for the SUI token. On October 10, SUI’s price dropped sharply to $0.55 amid a broader cryptocurrency market selloff driven by escalating global trade tensions. This decline caused SUI to break below a long-term ascending trendline that had supported its upward momentum since April.

Subsequently, the token attempted a rebound, rising back to approximately $3. However, buying pressure was insufficient to overcome the broken trendline, which has since turned into a resistance level. Currently, SUI trades near $2.65, consolidating below this key resistance and the 20-day simple moving average (SMA 20).

SUIG’s Vision to Establish a Crypto Bank and Strengthen the Sui Ecosystem

Beyond the ETF development, momentum in the Sui ecosystem continues to grow. In a recent interview with Crypto Banter, SUIG co-founder Stephen Mackintosh shared the company’s goal to become “the SUI Bank” — a public crypto bank operating on the Sui blockchain.

SUIG has already collaborated with the Sui Foundation and Ethena to launch two native stablecoins, suiUSDe and USDI. These stablecoins aim to connect on-chain liquidity with traditional financial systems. Mackintosh emphasized that “90% of the revenue generated will flow back into the Sui ecosystem — buying tokens, funding development, and strengthening network growth.”

With SUIG’s ambitious plans and Canary Funds’ ETF progress, the SUI token is positioned for potential growth, reflecting increasing activity within the ecosystem.

Comments are closed.