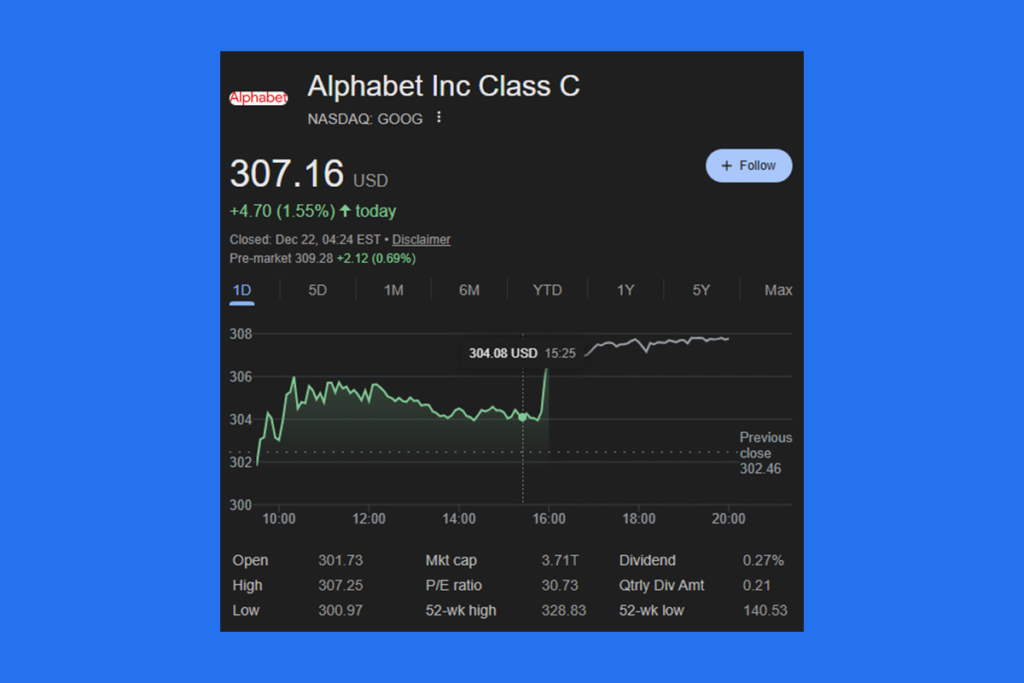

Alphabet Reaches New High as Cloud and AI Demand Accelerate

Alphabet shares surpassed $300, marking a new achievement for the parent company of Google. Its dominant position in international equity markets is strengthened by this. Restored investor confidence is reflected in the move, which was fueled by strong results, strong demand for advertising, and steady expansion in cloud and AI-related industries. The technical interpretation of the breakout above a psychological barrier level is that it also indicates growing bullish momentum.

Alphabet Earnings Stay Strong Despite Macro Headwinds

Despite a mixed macroenvironment, Alphabet’s main advertising business continues to provide strong cash flows. Google Cloud is displaying increasing profitability and consistent client growth, while search and YouTube revenues continue to be strong. Cost-cutting measures have also been important. Over the previous year, efficiency-focused reorganization has increased operating leverage. The long-term profitability forecast for investors is strengthened by the mix of margin improvement and revenue stability.

$300 Breakout Strengthens Alphabet’s Bullish Trend

The $300 level served as a significant resistance zone in terms of market structure. Strong buying interest and better confidence among institutional investors are shown by the clean break above it. Instead of speculative spikes, volume trends show accumulation. The stock might convert previous resistance into support if it can stay above this level. In that case, Alphabet is positioned as a key large-cap tech asset in a risk-on market, and the trend remains positive.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.