Bitcoin’s Sharpe Ratio Turns Green: What It Means for Investors

The Sharpe ratio of Bitcoin has reached multiyear lows, according to data from the on-chain analytics platform CryptoQuant. In terms of risk vs reward, Bitcoin is more alluring as a wager than it has been since the middle of 2023. The “green” zone below zero has been reached by the Sharpe ratio, a traditional economic technique for evaluating the investment risk of an asset. It hasn’t done so since June of that year until now.

We are now entering the same zone seen in 2019, 2020, and 2022, periods where the Sharpe Ratio spent time at structurally depressed levels before new multi-month trends emerged. This does not guarantee a bottom, but it does indicate that the quality of future returns is starting to improve, provided the market stabilizes and volatility begins to normalize.

CryptoQuant contributor MorenoDV

Bitcoin Not in Recovery Yet, But Risk vs Reward Looks Better

Before reversing and taking the price with it, Sharpe usually descends further into negative territory. About two months prior to the conclusion of the previous cryptocurrency bear market, in November 2022, it reached its most recent long-term low. Therefore, Moreno proposed that before consumers could exhale with relief, the metric had to start reversing upward.

Bitcoin is not yet signaling trend recovery, but it is signaling that the risk-adjusted landscape is becoming more attractive for forward returns,

Moreno

Bitcoin Heater Turns Green: Could Higher Prices Follow?

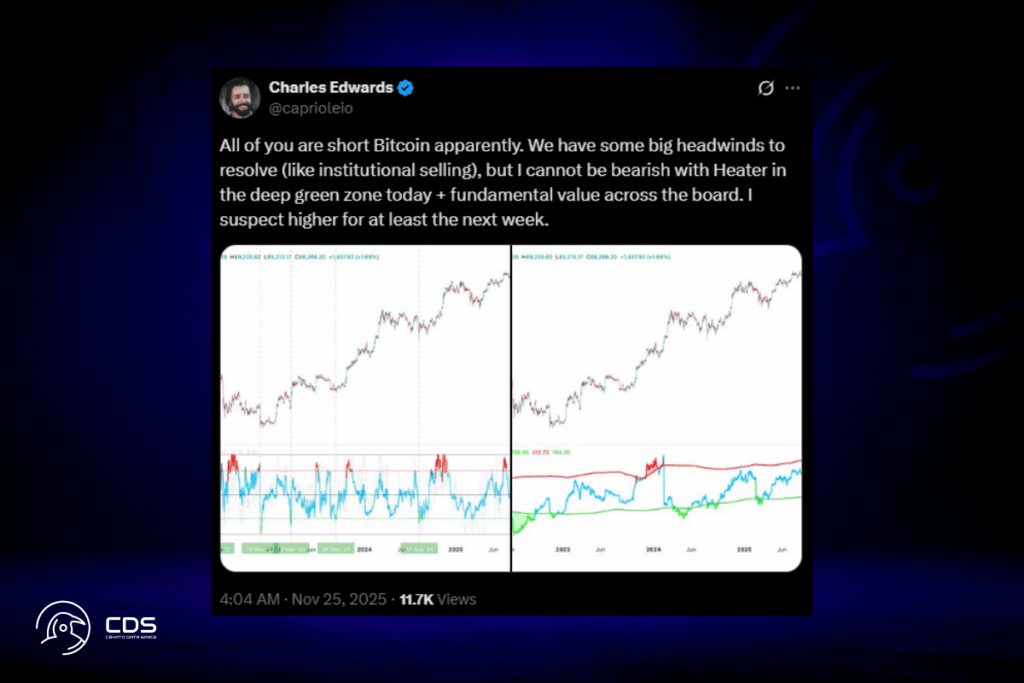

A similar resurgence was also suggested by another popular BTC price indicator. The Bitcoin Heater metric created by quantitative Bitcoin and digital asset fund Capriole Investments also returned to green. The metric calculates the relative heat in the open interest-weighted Bitcoin Perpetuals, Futures, and Options. It is currently at its lowest point since November 2022, at 0.09.

We have some big headwinds to resolve (like institutional selling), but I cannot be bearish with Heater in the deep green zone today + fundamental value across the board. I suspect higher for at least the next week.

the creator, Charles Edwards

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.