Berkshire’s Record Cash Signals Market Caution

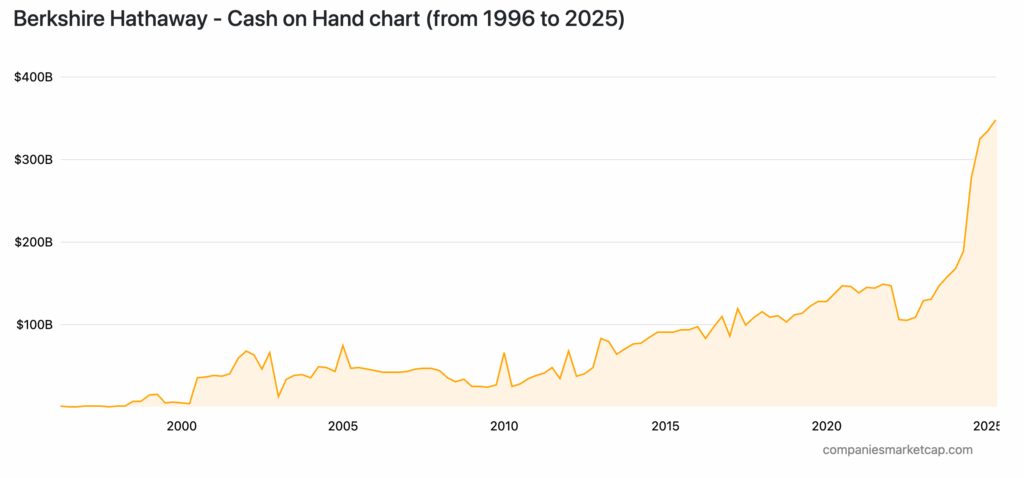

Warren Buffett’s Berkshire Hathaway has increased its cash and Treasury bill holdings to a record $350 billion by mid-2025 — the highest in the company’s history and the largest cash reserve among U.S. public companies. This accounts for over 50% of shareholder equity and nearly 30% of total assets, based on Q1 2025 filings.

Historically, Buffett has ramped up liquidity ahead of major market corrections. In 2000 and again in 2005, Berkshire raised cash significantly before downturns, later using the reserves to buy discounted assets post-crisis.

Nasdaq Bubble Adds Crypto Risk

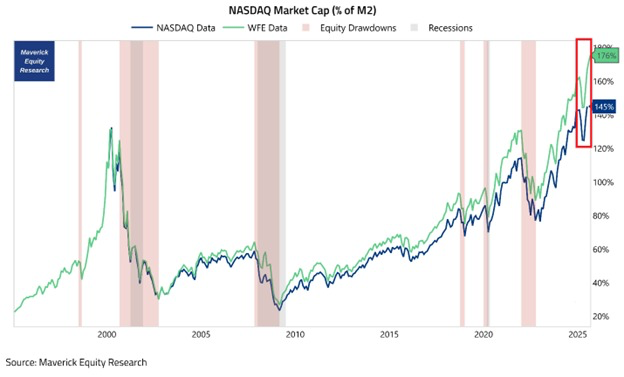

Buffett’s cautious positioning appears timely, as equity valuations continue to soar. The Nasdaq has reached 176% of U.S. M2 money supply, far above the Dot-Com peak of 131%, per Maverick Equity Research data. Relative to GDP, Nasdaq now equals 129%, nearly double its 2000 ratio.

This matters for Bitcoin, which has shown a 0.73 correlation with the Nasdaq over the past 52 weeks. As the top cryptocurrency recently touched an all-time high of $124,500 before correcting to $108,813, the risk of further downside grows if tech stocks retreat.

M2 Growth May Still Support Crypto

Despite these warning signs, the expanding U.S. M2 money supply may offer Bitcoin support. M2 rose 4.8% YoY by July 2025 — the fastest pace since early 2022 — after months of stagnation. With over 20 global central banks cutting rates in 2025, expectations are rising that the Federal Reserve may follow, potentially driving M2 growth toward 10–12% annually, according to economist Daniel Lacalle.

If that happens, Bitcoin — often seen as a hedge against currency debasement — could still benefit despite broader market risks.

“Buffett raises cash when others are greedy,” but whether that signals a Bitcoin top remains to be seen.

[…] miners’ daily revenue against the annual average, has returned to the discount zone following Bitcoin’s recent drop to around […]