Featured News Headlines

BTCS Stock Surges on First-Ever Ethereum Dividend Announcement Worth $0.40

BTCS Inc. has made financial history by becoming the first publicly traded company to issue a dividend in Ethereum (ETH), announcing a groundbreaking $0.40 per share payout structure designed to combat predatory short-selling while rewarding loyal shareholders.

Revolutionary “Bividend” Structure Unveiled

The innovative payment system consists of two components: a $0.05 per share ETH dividend dubbed the “Bividend” scheduled for September 26, and a substantial $0.35 per share “Loyalty Payment” in ETH for shareholders who maintain their positions until January 26, 2026. Notably, the loyalty payment excludes officers, directors, and employees from eligibility.

“These payments are designed to reward our long-term shareholders and empower them to take control of their investment by reducing the ability of their shares to be lent to predatory short-sellers,” the company stated Monday.

Market Response and Strategic Positioning

Investors responded enthusiastically to the announcement, driving BTCS shares up 10.4% to $4.87 on Monday. This surge helped the company recover ground after tumbling from its 2025 high of $6.57 reached on July 18. The Nasdaq-listed firm now maintains a market capitalization of $233 million.

Competing in the ETH Treasury Race

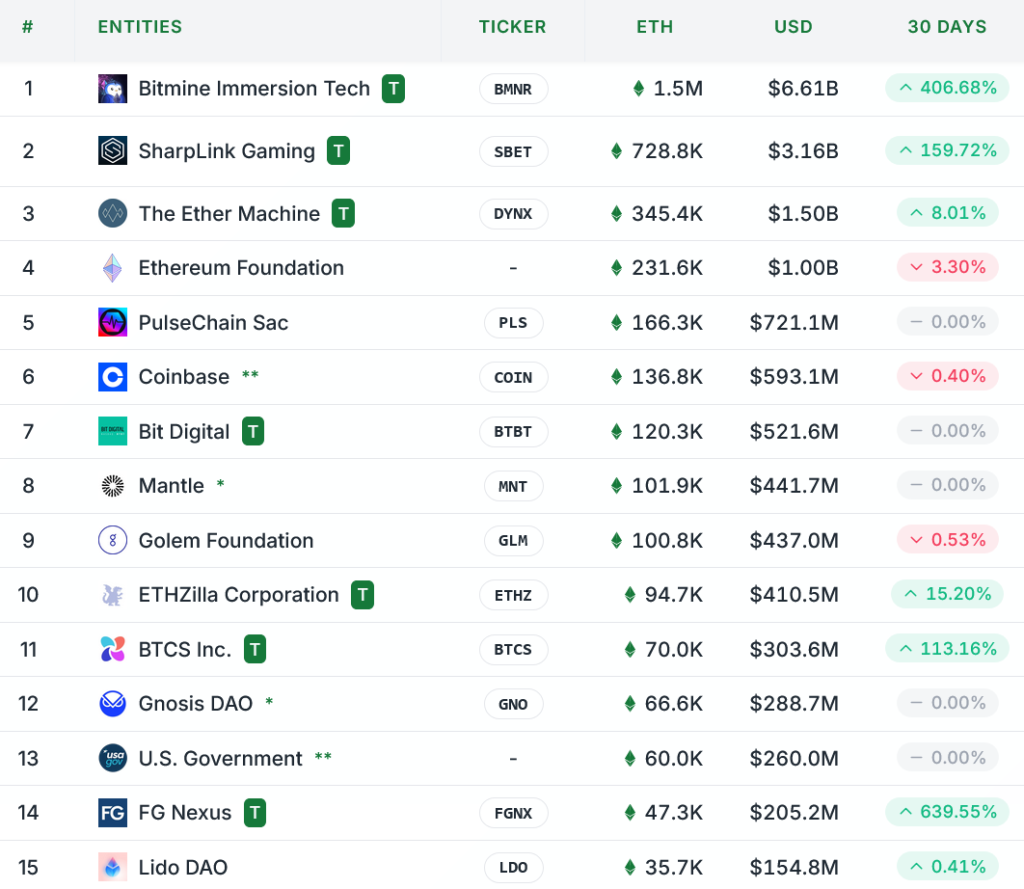

The former Bitcoin mining company faces stiff competition in the Ethereum treasury space, with 69 entities currently vying for dominance. BTCS ranks 11th with 70,000 ETH worth over $303 million, trailing leaders Bitmine Immersion Tech (1.5 million ETH) and SharpLink Gaming (728,800 ETH).

The company has been leveraging decentralized finance protocols like Aave and staking mechanisms since 2022, funding recent aggressive ETH accumulation through at-the-market equity offerings and convertible notes. This strategic pivot coincides with Ethereum’s remarkable rally from $1,465 to $4,775 over the past four months, largely driven by treasury company adoption.

Comments are closed.