Featured News Headlines

BTC Price Nears $120,000 — Can Bitcoin Break Resistance?

BTC Price – Bitcoin (BTC) is preparing to close July 2025 with strength as the price hovers around $118,645, eyeing a potential break above the crucial $120,000 mark. After a sharp rebound earlier in the month, market participants are increasingly optimistic about a push to new all-time highs (ATHs), though analysts warn of possible downside to $113,000.

The rally comes at a pivotal time, with macroeconomic events and a historic US-EU trade deal influencing risk assets. Despite the excitement, one technical factor—stablecoin liquidity—suggests that Bitcoin bulls may face resistance in reentering price discovery.

Bulls Rally, But Momentum Slows Near $120K

A late-week surge brought BTC/USD within striking distance of $120,000, but momentum failed to carry it further. Still, Bitcoin is holding firm above $119,000, a level many traders view as critical support.

“If Bitcoin can tighten up and hold over $117,000, then I think we are good for new ATHs very soon,” trader Crypto Tony posted on X.

Rekt Capital, another prominent analyst, highlighted a bull flag pattern following a weekly close at $119,450. Turning the $119,200 zone into support could fuel another leg upward, he said. But until then, Bitcoin needs to avoid wicking above resistance, which could trap bulls and keep the price in a range.

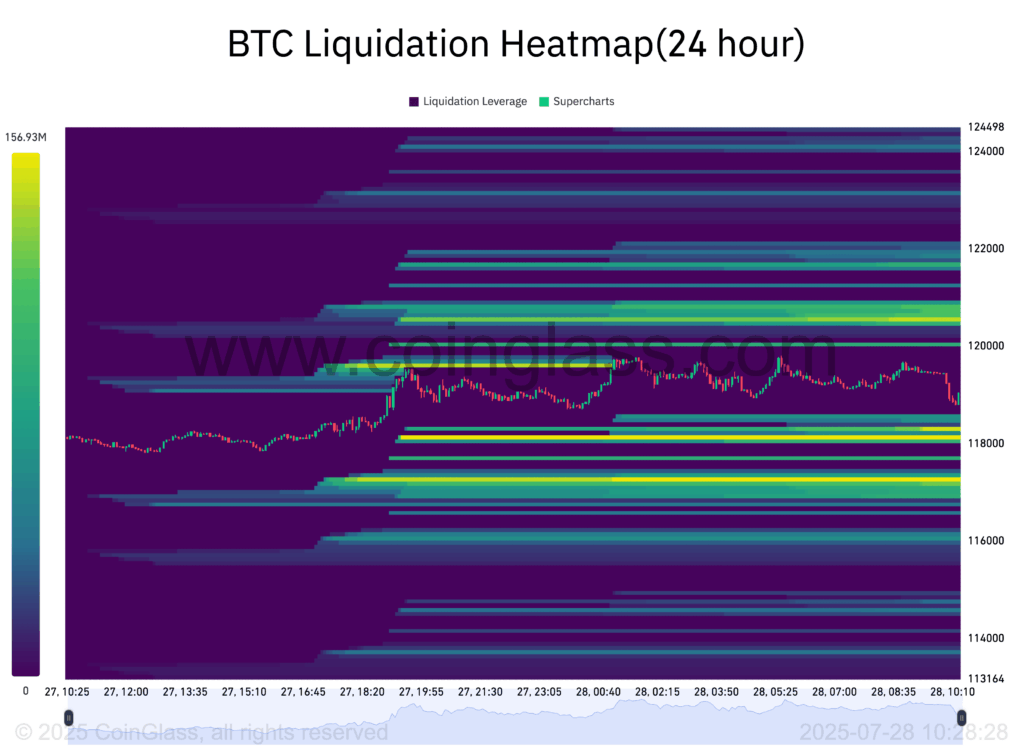

Order book data shows liquidity zones between $116,800 and $118,300, while CoinGlass reports a balanced long/short ratio—58.7% longs vs. 41.3% shorts—indicating neutral sentiment and a lack of strong conviction from either side.

FOMC Week Puts Fed Chair Powell in Spotlight

July may have been quiet on the macroeconomic front, but this week changes everything. The Federal Reserve’s interest rate decision, along with Q2 GDP and the PCE inflation index, all land within days—marking what traders call “the most data-packed week of the year.”

President Donald Trump continues to pressure Fed Chair Jerome Powell to cut rates, but Powell remains hawkish as inflation data remains mixed. Most analysts expect no rate change in July, but markets are hunting for clues about September’s meeting.

According to the CME FedWatch Tool, the chance of a rate cut this week is slim, but sentiment could shift quickly depending on Powell’s tone.

Trade Deals Spark Optimism Across Risk Assets

Markets received a surprise boost after the US sealed a trade deal with the EU and Japan, delaying tariffs on China for 90 days. The news sent S&P 500 futures to record highs, opening above 6,400 for the first time.

Both President Trump and European Commission President Ursula Von Der Leyen hailed the deal as the “biggest trade agreement ever.” The deal, covering economies representing 44% of global GDP, injected optimism across equities and crypto.

Mosaic Asset highlighted the rally in both stocks and M2 money supply, stating: “Easing trade tensions and liquidity tailwinds are sending the S&P 500 to fresh record highs while volatility falls to yearly lows.”

Stablecoin Liquidity: The Hidden Brake on BTC

While Bitcoin’s price action appears healthy, on-chain data suggests a critical limiting factor: stablecoin liquidity. According to CryptoQuant, the Stablecoin Supply Ratio (SSR) has been rising in tandem with BTC/USD—signaling weak liquidity inflows.

“A rise in this indicator indicates that stablecoins are few compared to the volume of Bitcoin. In other words, liquidity is weak… and buying momentum may weaken in the future,” analyst Arab Chain explained.

SSR last peaked in November 2024, and although it hasn’t hit that level again, the trend suggests that the market may be entering a temporary saturation phase. Without a fresh influx of stablecoins, Bitcoin could struggle to maintain upward momentum.

Will August Deliver?

Bitcoin’s 11.3% gain in July is impressive, but only slightly above its 12-year average of 7.85%. In comparison, July 2022 delivered nearly 17% despite being a bear market year.

August, historically, offers less upside, with average returns of just 1.75%. Analysts like Aksel Kibar stress the importance of holding early-month gains to keep bullish momentum alive. Kibar targets $141,300 but warns: “It’s important not to give back those gains during the pullback.”

Bitcoin may be flirting with $120,000, but underlying liquidity dynamics and macro pressures suggest that caution remains warranted. With the Fed decision, GDP, inflation data, and geopolitical news all converging, BTC’s next move could be explosive—up or down.

Comments are closed.