Featured News Headlines

BTC Price- High Open Interest and Onchain Data Signal Volatility for Bitcoin Price

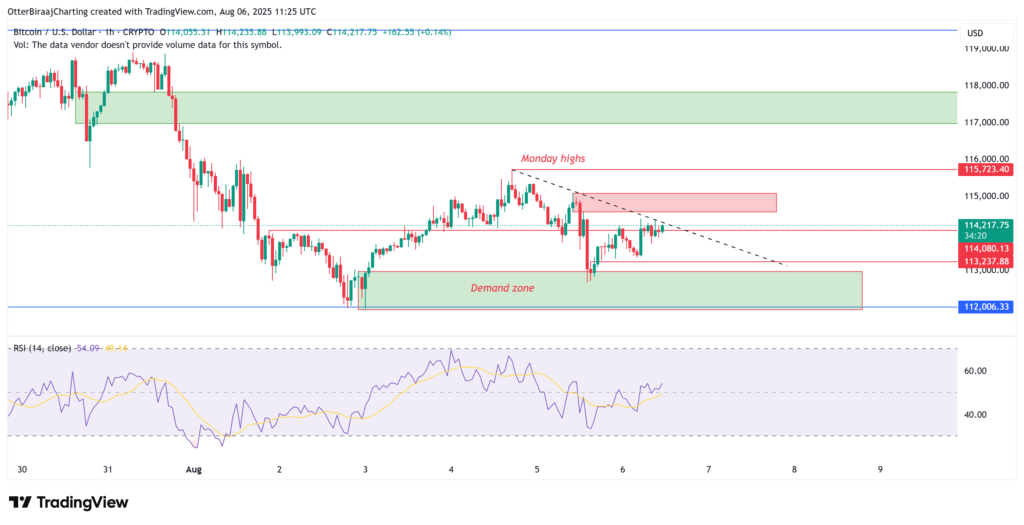

BTC Price– Bitcoin (BTC) is currently trading sideways around $113,853 after briefly bouncing from the critical demand zone between $112,000 and $113,000. The market eyes a potential breakout above the descending resistance trendline, which could spark a rally toward Monday’s high of $115,700. However, traders should remain cautious as hidden risks may be brewing beneath the surface.

The $105,000 Danger Zone: What Onchain Metrics Reveal

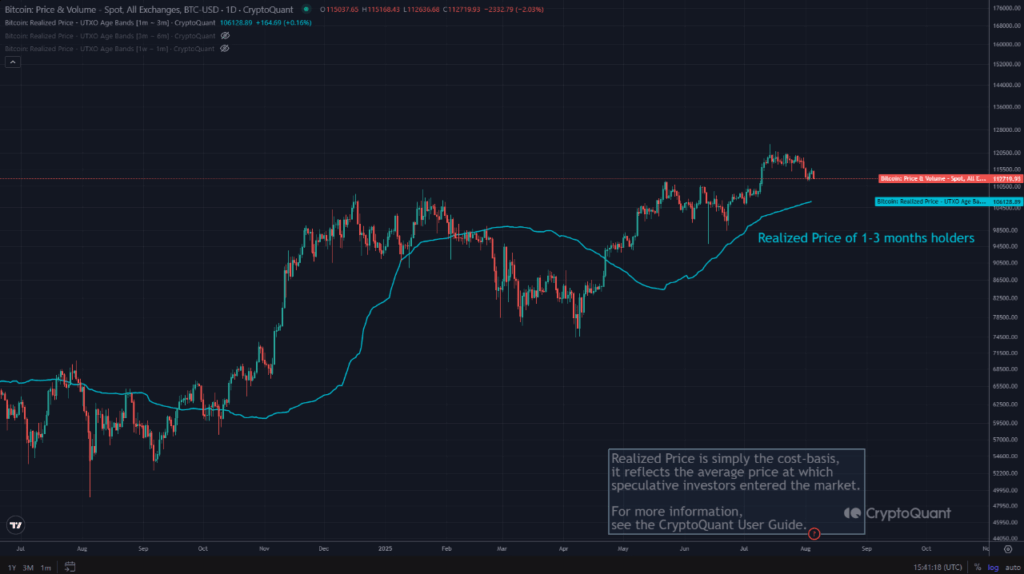

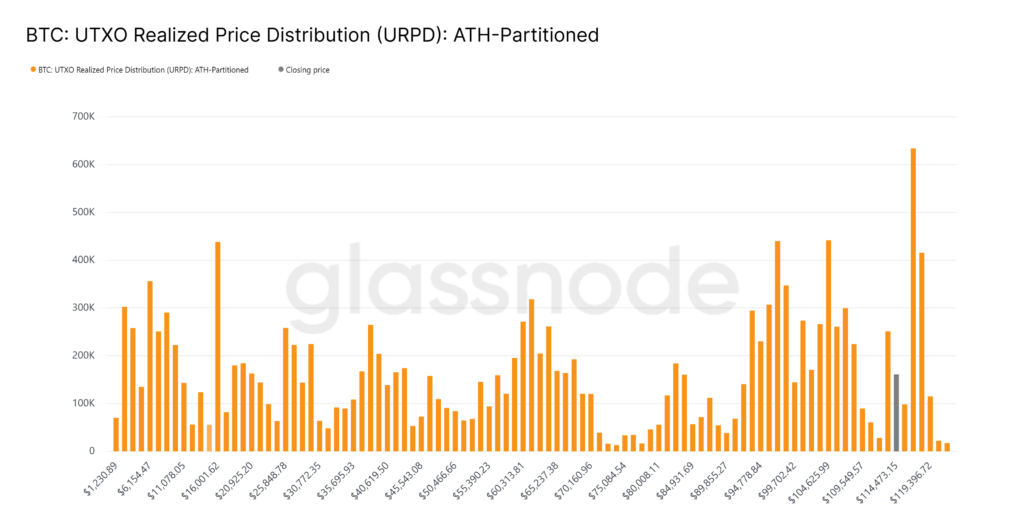

Crypto analyst CryptoMe highlights a crucial support zone near $105,000 that is gaining significance across multiple onchain indicators. Using Unspent Transaction Output (UTXO) and realized price models, several data points converge in this range:

- A major accumulation wall stands at $105,644, indicating heavy onchain activity.

- Mid-term holders’ average realized cost sits near $106,000.

- Short-term holders, those holding BTC less than 155 days, have an average acquisition cost around $105,350.

This cluster suggests $105,000 could be a key battleground. While a retest here might trigger sharp volatility and pressure leveraged traders, the medium to long-term outlook remains bullish.

Elevated Open Interest Adds to Market Fragility

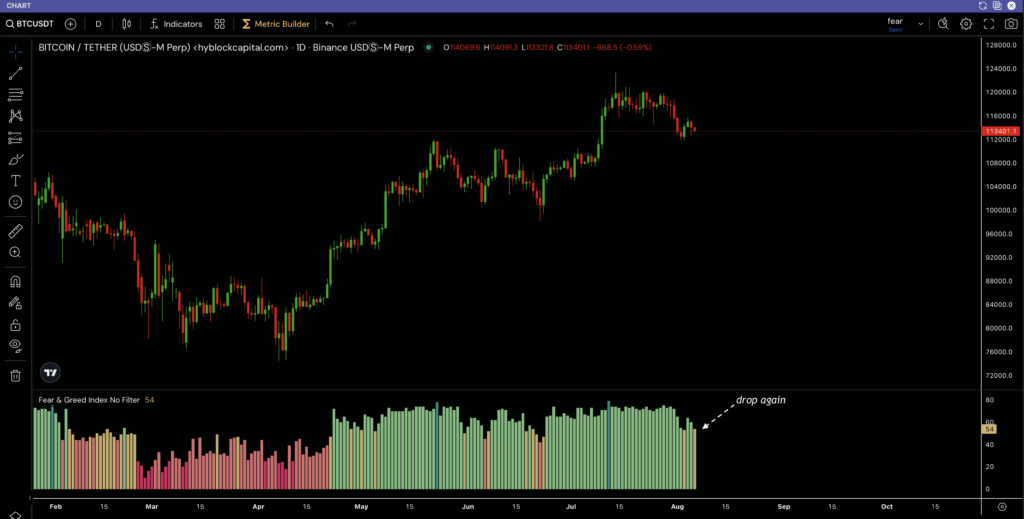

According to Hyblock Capital, Bitcoin’s futures open interest remains high at $79 billion. Such elevated speculation often precedes market corrections, especially after recent sharp price declines from the all-time high of $123,000. When the Fear & Greed Index spikes into “Extreme Greed” amid high open interest, local tops and pullbacks commonly follow.

Structural Risks in the Futures Market

Bitcoin researcher Axel Adler Jr. notes that bearish pressure in futures peaked near -7.5% on July 29, right after BTC’s record high, before easing slightly. Despite this, the market remains vulnerable. Adler warns that any sudden negative catalyst could trigger a cascade of liquidations, accelerating downside momentum quickly.

Comments are closed.