BTC Nears Final Resistance: Could a New ATH Be Imminent?

As it nears a pivotal point on its trajectory toward a possible new all-time high (ATH), Bitcoin is once again grabbing attention. The leading cryptocurrency is crossing a last resistance level that may determine its next significant rise, thanks to strong market momentum and increased institutional interest. It has now moved out of the phase when it was trapped between MAs and resistance and reached a confirmed breakout. The bias is currently heavily bullish due to liquidity sweeps and structural changes. The market structure currently favors continuation into $120K–$124K, where the next major supply block and sell-side liquidity cluster await, even though short-term pullbacks are still probable.

Bitcoin Breakout Alert: Critical $118K Level Signals Bull Run

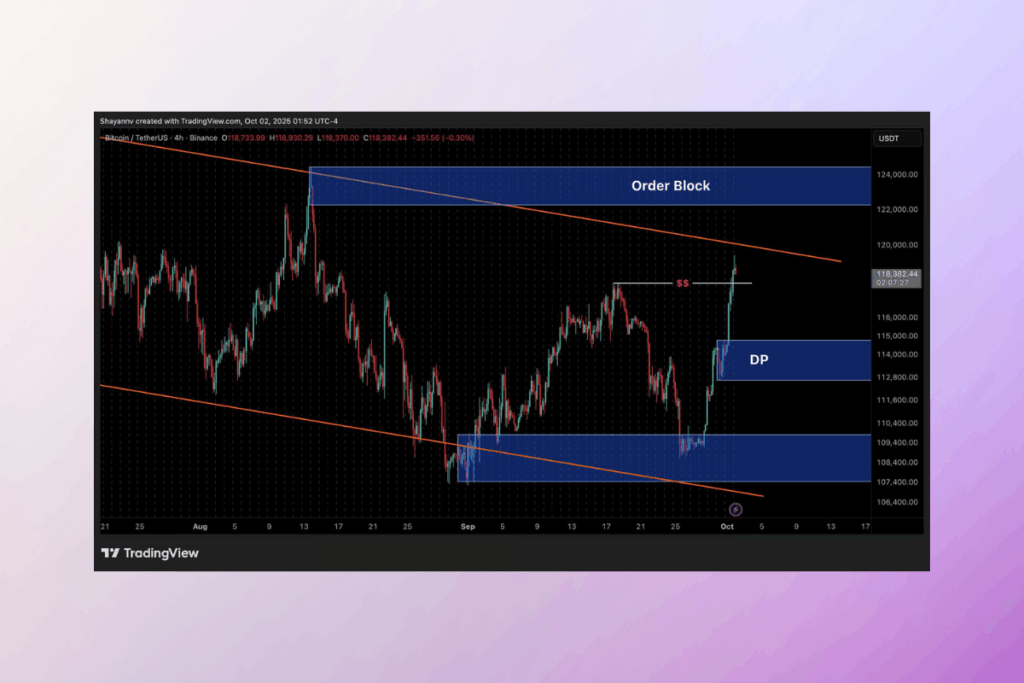

Bitcoin has regained the 100-day MA ($114K) on the daily timeframe and pushed through the middle of its consolidation range, into the $118K zone just below the larger $120K–$124K supply block. This region is a critical level since it aligns with a major order block from a previous distribution. The rise undermines the larger corrective structure by confirming a bullish breakout from the most recent major swing high.

The breakout is best shown in the 4-hour framework. Following a consolidation above $114K, Bitcoin overcame descending resistance, pushing into the $118K liquidity pool and sweeping buy-side liquidity above $116K. In the event of a pullback, the $114K–$115K demand block is crucial. Another surge into the $120K–$124K supply cluster would be possible if bids remained strong here. However, failing to defend it might cause the price to drop back toward $110,000.

$118K Resistance Holds the Fate of Bitcoin’s Next Major Move

The technical picture is further supported by the liquidation heatmap, which shows the intense liquidity clusters that are active at the moment. A sizable percentage of short bets had to leave the market as Bitcoin increased from its $109,000 demand base to its current level. The unexpected increase was brought on by this. A very high concentration of liquidity is now visible on the heatmap, slightly above the $118K–$120K range. The price is currently encountering resistance precisely at this point.

A concentration of short positions at that level is shown in this cluster. Bitcoin’s likelihood of getting swept increases significantly if it maintains its momentum above $118K. A lengthy rise might be sparked by the forced liquidations brought on by such a move. The asset would be forced further into the $120K–$124K supply zone as a result.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.