BTC- Exchange Data Suggests Growing Selling Interest in Bitcoin

BTC– Recent data from CryptoQuant highlights a significant increase in Bitcoin (BTC) moving onto centralized exchanges. On July 15 alone, over 80,810 BTC—valued at more than $9.4 billion—were transferred to trading platforms, marking the largest single-day inflow in days. Such spikes in exchange inflows often signal rising sell pressure, as holders prepare to liquidate positions amid weakening price momentum.

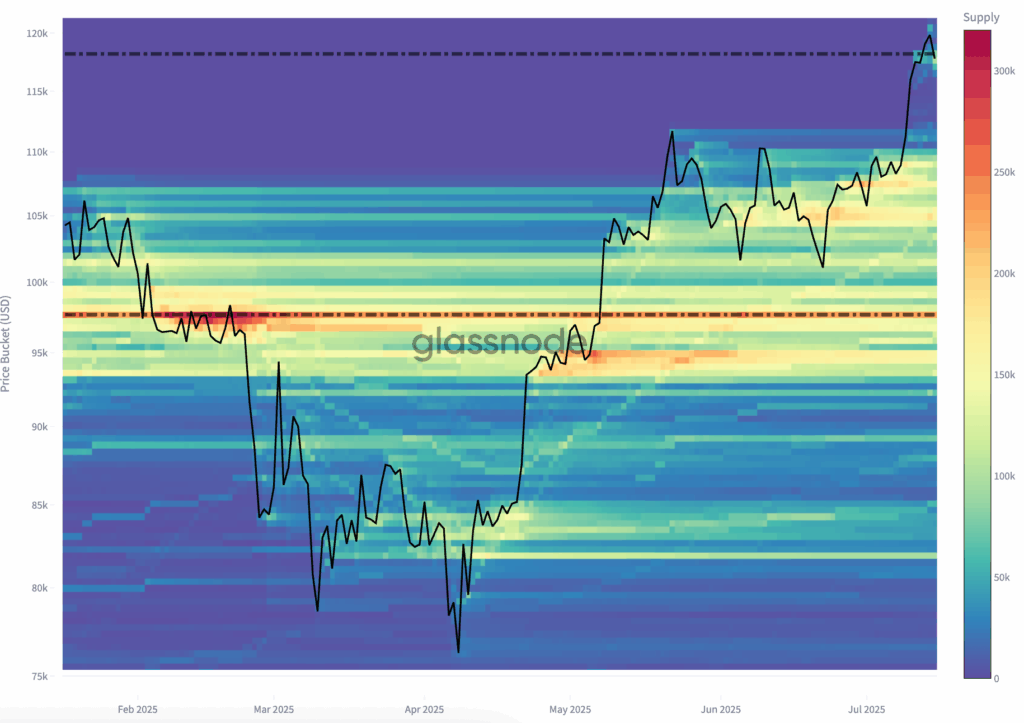

Support Found in Historical Accumulation Zones

Despite the bearish signs, certain price levels may provide support. Glassnode’s heatmap reveals strong accumulation zones where buyers previously entered the market in large volumes. Notably, the ranges between $93,000–$97,000 and $101,000–$109,000 stand out as areas with heavy wallet activity, creating natural “accumulation clusters.” Among these, the $107,000–$109,000 band is particularly crucial, having served as a consolidation zone before Bitcoin’s recent breakout. If the price declines further, this area could attract dip-buyers seeking to stabilize the market.

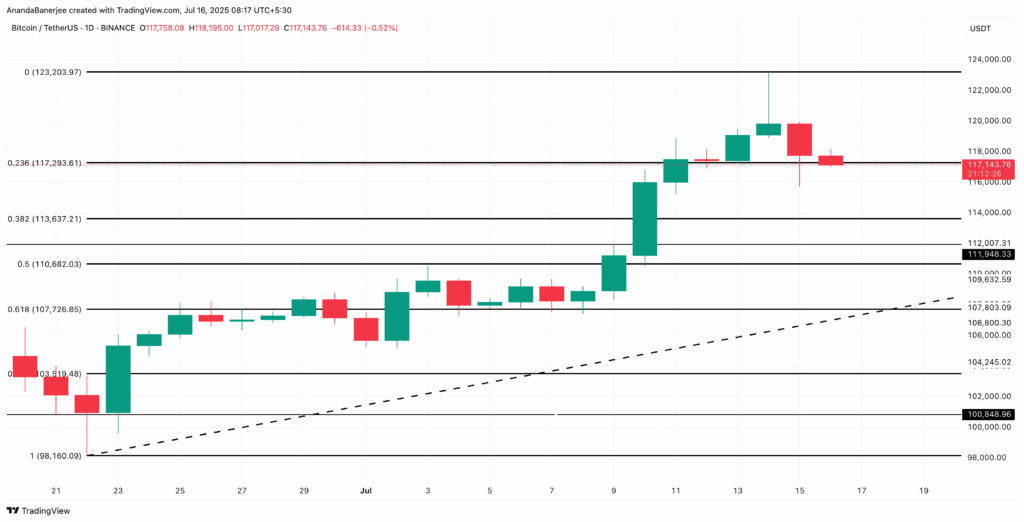

Weakening Price Structure and Fibonacci Levels

Bitcoin is currently trading near $117,143, down from its all-time high of $123,203. This nearly 5% retreat pushed BTC below the 0.236 Fibonacci retracement level at $117,293—its first major support post-peak. Fibonacci retracement levels, measured from the June swing low around $98,160 to the peak, help identify potential pullback targets. The next critical level is the 0.618 retracement at $107,726, known as the “golden pocket” where prices often find strong support during corrections.

This $107,726 level closely aligns with the key accumulation cluster, reinforcing its importance. If the price drops to this level, it would imply an additional 8% decline, a plausible scenario given current exchange inflows and weakening technical structure.

This bearish outlook would be negated if Bitcoin reclaims the $117,293 level with reduced exchange inflows. A sustained recovery above this resistance could reignite bullish momentum and bring the $123,203 all-time high back into focus.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.