BTC and ETH Options Expire: Will Volatility Explode This Weekend?

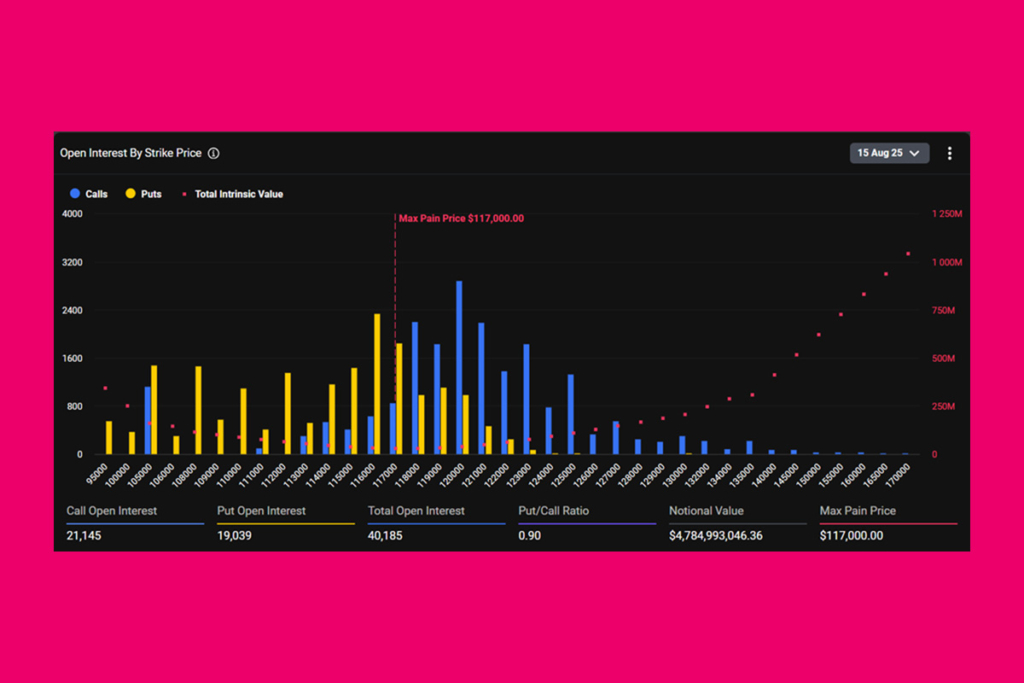

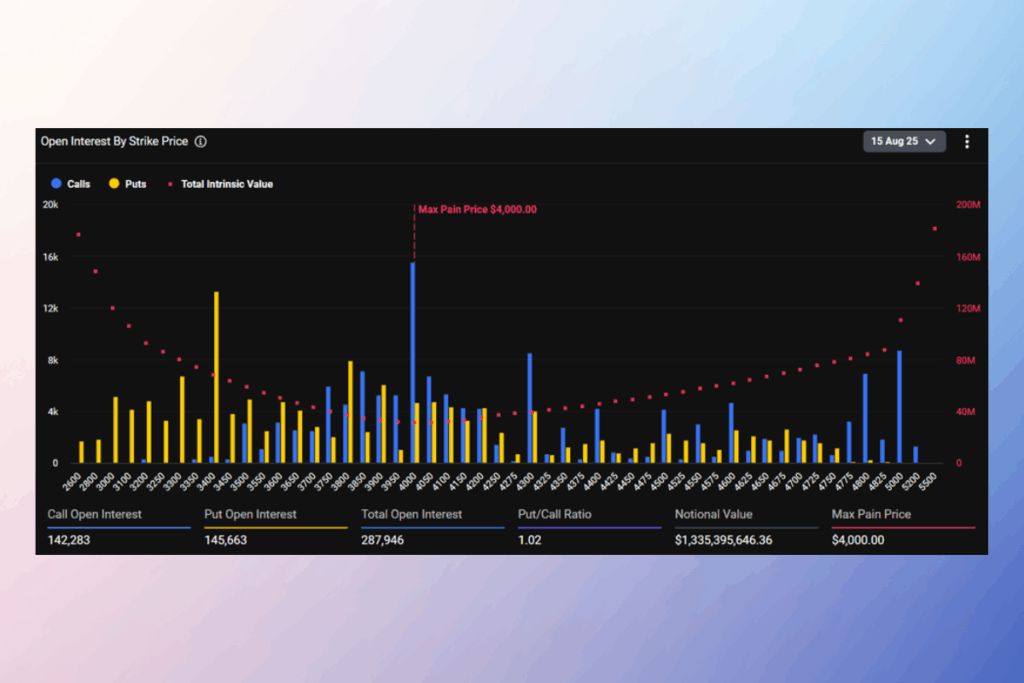

The expiration of more than $6 billion worth of Bitcoin (BTC) and Ethereum (ETH) options is a significant test for the crypto derivatives market today. Options that expire today pave the way for traders to strategically realign themselves and possibly experience increased volatility over the weekend. Deribit data indicates that $117,000 is Bitcoin’s maximum pain level, or the strike price at which the majority of options lose value.

For the Bitcoin options that expire today, the put-call ratio (PCR) is 0.90. Despite the price trading over its maximum pain level, this indicates a bullish stance since there are somewhat more calls (purchase orders) than puts (sale orders). Ethereum’s price is currently $4,629, but its maximum pain is $4,000, which is far less than that. Today’s expiring Ethereum options have a PCR of 1.02. With a modest inclination toward puts (sale options), it shows a balanced market. According to this PCR, investors might be waiting for a correction given the present price of ETH.

Ethereum Nears ATH as Inflation Data Sends Ripples Through Crypto Markets

There are a few more options expiring today than there were last week, when contracts worth around $5 billion expired. Greeks.live reports that this Friday’s expiration options coincide with a market that is still processing a surprise correction brought on by macro data. Still, the outlook is still skewed toward a long-term bull market.

According to Greeks.live analysts, the market underwent an unexpected correction as the price of Bitcoin reached a new all-time high and the price of Ethereum approached its all-time high. Mostly, this was brought on by an incredibly high PPI (Producer Price Index) reading. In fact, PPI inflation is at its highest level since March 2022, and Core CPI inflation has returned to above +3%. In particular, PPI inflation peaked at 3.7% as opposed to 2.9% predicted and 2.6% the month before. Greek.live’s experts noted no significant shifts in the options market in spite of this.

Crypto Market Split: Bullish Euphoria vs. Local Peak Warnings

The Deribit options market had a significant trade volume of $10.9 billion. For the first time in a single day, it surpassed the $10 billion milestone.

The high trading enthusiasm shows that the market is not worried about the follow-up market, and the bull market is likely to continue,

Greeks.live

Nevertheless, opinions in the market are still divided. Some traders cite inexorable upward momentum and limitless bid conditions. Others caution of a possible local peak in the vicinity of $4,700 for Ethereum and $122,000 for Bitcoin levels. The market structure is exceptional since peak open interest coincides with the highest spot prices ever.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.