Bold BitMine Move: What It Means for ETH Bulls

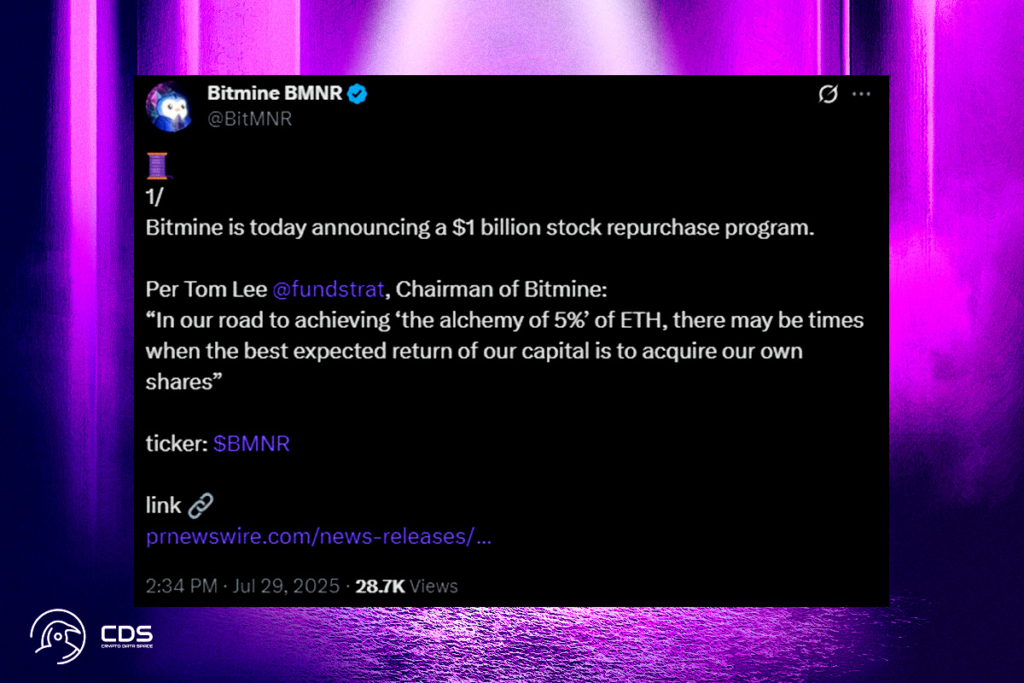

The board of directors of BitMine Immersion Technologies, a Bitcoin miner that is now an Ethereum treasury firm, approved a stock buyback scheme on Tuesday. Up to $1 billion worth of outstanding common shares may be repurchased under the scheme. BitMine reported that its total cash and crypto NAV per share is $22.76 and that it now has 121,739,533 fully diluted common shares outstanding.

BitMine Begins Aggressive Buyback Program

According to a statement from BitMine, the company can occasionally repurchase shares through market or negotiated transactions under the open-ended buyback program. Its overarching objective to purchase and stake 5% of Ethereum’s token supply is in line with this action.

In our road to achieving ‘the alchemy of 5%’ of ETH, there may be times when the best expected return of our capital is to acquire our own shares,

BitMine Chair and Fundstrat co-founder Tom Lee

BitMine Joins ETH Elite with Massive 625,000 ETH Treasury

BitMine has switched its main focus to Ethereum, even though it still mines Bitcoin and offers mining services. This action places the business with others like Bit Digital, BTCS, and SharpLink as a top publicly traded Ethereum accumulation company.

BitMine reported that as of July 28 at 10:45 p.m. ET, it has approximately $401.4 million in unencumbered cash, including 625,000 ETH ($2.4 billion) and 192 BTC ($22.8 million). As previously reported by The Block, the company increased its ether holdings to 566,776 ETH last week.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.