BNB Price- Massive Profit-Taking Fails to Shake Binance Coin’s Uptrend

BNB Price– On July 28th, Binance Coin (BNB) recorded a staggering $772 million in realized profits at the $823 level, marking the largest single-day profit-taking surge since the election. Nearly 1 million BNB tokens changed hands as investors cashed in gains, yet the price pullback has been surprisingly shallow.

Buyers Hold the Line Despite Profit-Taking

Despite this significant sell-off, BNB has only dipped 4% this week and remains a modest 8% below its July all-time high. This minimal retreat highlights strong buyer conviction, stepping in aggressively whenever the price dips.

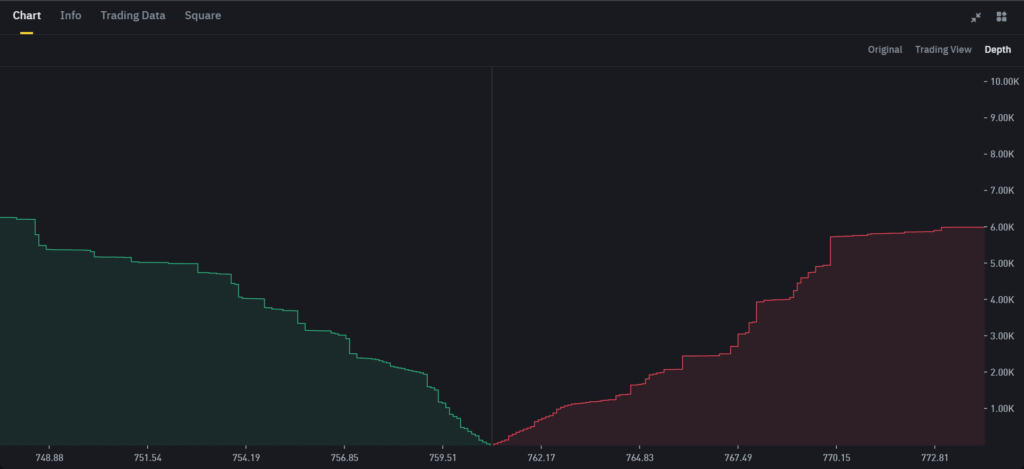

The BNB Depth Chart backs this up with a solid demand wall between $748 and $759, showing concentrated buy-side liquidity. In contrast, the ask-side remains thin, indicating limited immediate selling pressure. This bid-ask imbalance favors bulls, suggesting that $760 could soon act as a base for a push back toward the $800 supply zone.

On-Chain Momentum and Institutional Interest Surge

Even more compelling is the on-chain data. Total Value Locked (TVL) in BNB surged by nearly $800 million in July, surpassing $7 billion for the first time since 2022. With over 99% of supply still profitable and low realized gains around $20 million at $755, holders are showing strong conviction and reluctance to sell.

Institutional interest is heating up too. U.S.-listed CEA Industries (NASDAQ: VAPE) recently closed a $500 million private placement to adopt BNB as its core treasury asset, with $750 million more planned via warrants. This $1.2 billion treasury play catapulted VAPE’s stock by 548% in a single day on July 28th, signaling growing blue-chip buzz around BNB.

Comments are closed.