Featured News Headlines

BNB Deflation Accelerates as Token Burn Hits 1.44 Million

BNB Chain has completed a significant token burn, removing 1.44 million BNB—valued at over $1.65 billion—from circulation. The burn program, which started in 2017 and occurs quarterly, has now eliminated a total of 64.26 million BNB.

Currently, 137.7 million BNB tokens remain in circulation. At the ongoing deflation rate of roughly 4 million BNB per year, the total supply could fall below 100 million within the next decade.

Deflation and Network Activity

Growing partnerships, such as integrating countries like Kyrgyzstan on-chain, are driving network activity. Increased transactions generate higher fees, which in turn fuel the burn program. Binance founder CZ has linked BNB’s momentum to “building and community efforts,” including institutional demand from treasury companies.

A comparison can also be drawn with Hyperliquid [HYPE], which has maintained a strong position through both product quality and an aggressive buyback program. Similarly, BNB’s deflationary mechanics could reinforce scarcity over time.

BNB Price Trends and Technical Insights

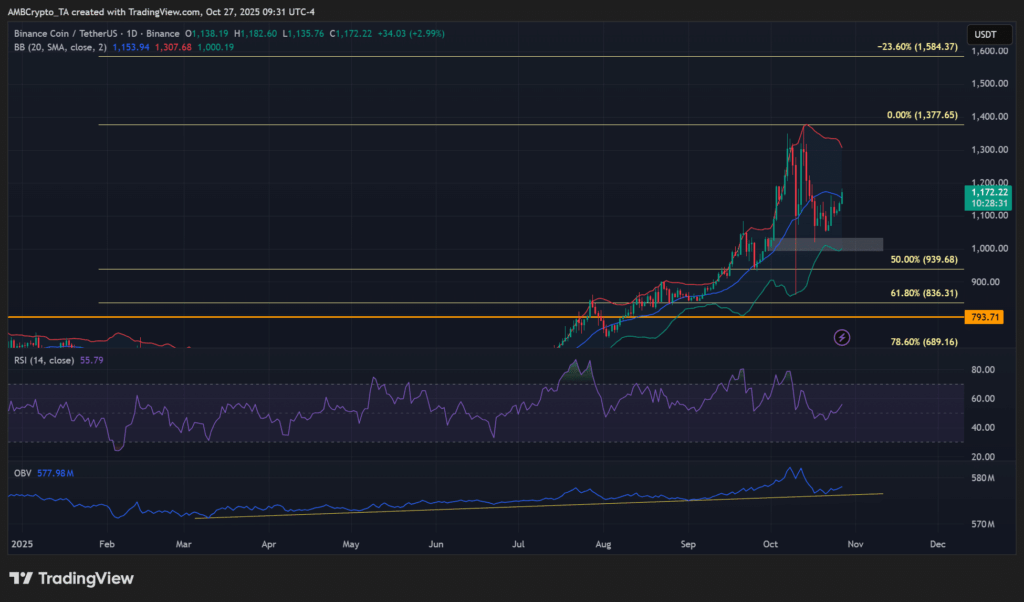

BNB has remained above the $1,000 psychological level, despite a rejection near $1,400. Analysts note that if the previous high is surpassed, $1,500 could emerge as a potential target. Technical indicators such as the daily RSI have stayed above average, and On-Balance Volume (OBV) has not broken key trendline support in 2025.

“Taken together, the technical indicators leaned bullish,” the analysis stated.

On-chain data also supports this outlook. According to Arkham data, overall exchange outflows in October were negative, suggesting that BNB holders moved more tokens to self-custody rather than selling. At the time of writing, average exchange outflows reached 179k BNB, signaling higher holder retention.

Long-Term Supply Dynamics

With the burn program removing around 4 million BNB per year, coupled with rising network activity and stable on-chain metrics, the deflationary trend appears sustainable. Analysts suggest this could continue to reduce circulating supply, potentially accelerating over the next few years.

While this provides context for long-term dynamics, short-term market movements could still be influenced by macroeconomic conditions or unexpected updates affecting the broader crypto market.

Comments are closed.