Featured News Headlines

- 1 BlackRock’s Bitcoin ETF Surges with Institutional Demand

- 2 Record Asset Growth Reflects Crypto Integration

- 3 Aladdin Platform Enhances Tokenized Portfolio Management

- 4 Bitcoin ETFs Drive Institutional Demand

- 5 BlackRock’s Growing Crypto Holdings Signal Confidence

- 6 Bridging Traditional and Digital Finance

BlackRock’s Bitcoin ETF Surges with Institutional Demand

BlackRock, the world’s largest asset manager, is increasingly integrating digital assets into its portfolio, signaling a strategic bet on the expanding cryptocurrency market. CEO Larry Fink highlighted the potential of tokenized investment products such as ETFs, suggesting that digitizing these products could attract new crypto investors toward traditional, long-term financial instruments. According to Fink, this shift represents “the next wave of opportunity” for BlackRock.

Record Asset Growth Reflects Crypto Integration

In its latest quarterly report, BlackRock revealed record assets under management of $13.46 trillion, up from $11.48 trillion the previous year. This milestone underscores the rapid convergence of traditional finance with the digital asset ecosystem. Digital exposure within BlackRock’s funds has approximately tripled since 2024, driven by rising institutional interest in regulated crypto channels and tokenization initiatives supported by the company’s proprietary Aladdin technology.

Revenue increased to $6.5 billion, fueled by an 8% rise in organic base fees, while expenses grew to $4.6 billion. Private-market inflows reached $13.2 billion, complemented by $9.7 billion in retail inflows. Strategic acquisitions such as GIP, Preqin, and HPS have enhanced BlackRock’s data and infrastructure capabilities, bolstering its digital asset pipeline.

Aladdin Platform Enhances Tokenized Portfolio Management

BlackRock’s Aladdin system saw a 28% jump in technology revenue, reaching $515 million. This platform is instrumental in managing tokenized portfolios and integrating blockchain analytics, forming a “unified public-private platform” as described by Fink. The system links traditional ETFs, private credit, and digital assets, enabling seamless investment management across these domains.

Bitcoin ETFs Drive Institutional Demand

A key component of BlackRock’s crypto strategy is its iShares Bitcoin Trust (IBIT), which has become the firm’s highest-earning ETF, generating $244.5 million annually from a 0.25% fee. IBIT’s assets have surged to nearly $100 billion in under 15 months — the fastest growth for any ETF in history. This growth mirrors a broader institutional shift, with Bitcoin ETFs across U.S. markets on track to attract $30 billion this quarter.

Other major financial institutions are following suit. JP Morgan announced plans to trade and hold Bitcoin, signaling growing acceptance of digital assets in mainstream finance. Morgan Stanley has also expanded crypto fund access across its wealth management client base, further fueling ETF demand in both retail and institutional channels.

BlackRock’s Growing Crypto Holdings Signal Confidence

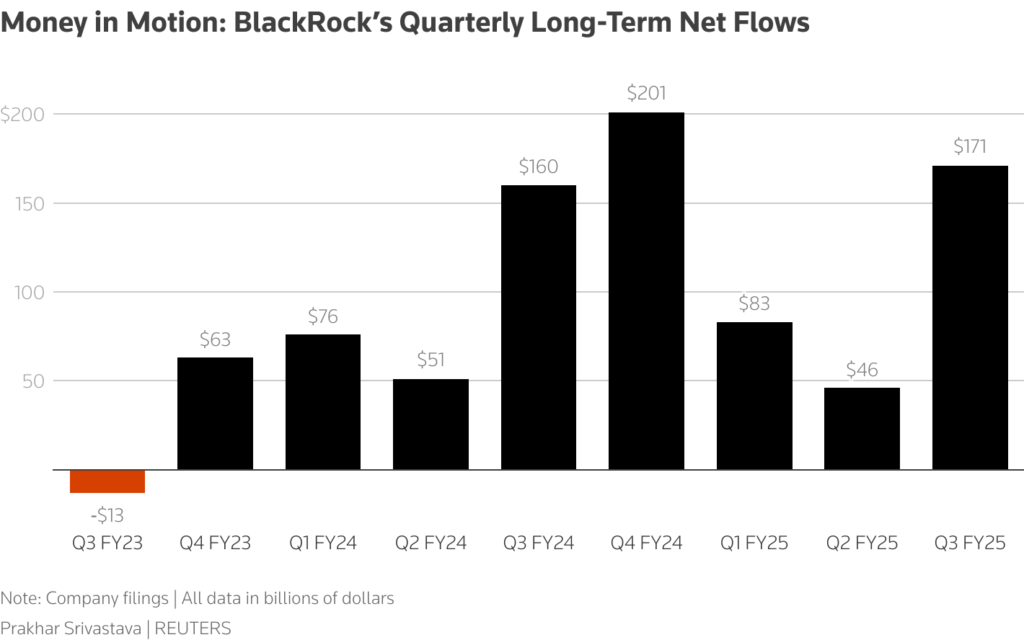

BlackRock has increased its Bitcoin holdings to approximately 805,000 BTC, valued near $100 billion. Industry analysts view this as a strong conviction signal from the asset manager, reflecting its commitment to digital reserves. Market watchers note that BlackRock’s expanding crypto franchise contributed to total inflows of $205 billion in the third quarter.

Bridging Traditional and Digital Finance

The cryptocurrency market, estimated at $4.5 trillion outside conventional banking systems, represents both a challenge and an opportunity for asset managers. With its broad ETF offerings, tokenization projects, and growing institutional credibility, BlackRock is well positioned to lead the next phase of on-chain finance. This evolution could ultimately make digital wallets as integral to investing as traditional custodial accounts are today.

Comments are closed.