iShares Bitcoin Trust ETF Sees $25B Inflows Despite Market Drop

BlackRock has identified its spot Bitcoin exchange-traded fund as one of its three most significant investment themes for 2025, placing it alongside Treasury bills and major U.S. technology stocks. The move highlights the growing institutional relevance of Bitcoin-related products, even amid ongoing market volatility.

The world’s largest asset manager specifically pointed to its iShares Bitcoin Trust ETF (IBIT), ranking it alongside an ETF tracking Treasury bills and another tied to the so-called “Magnificent 7” tech companies—Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla.

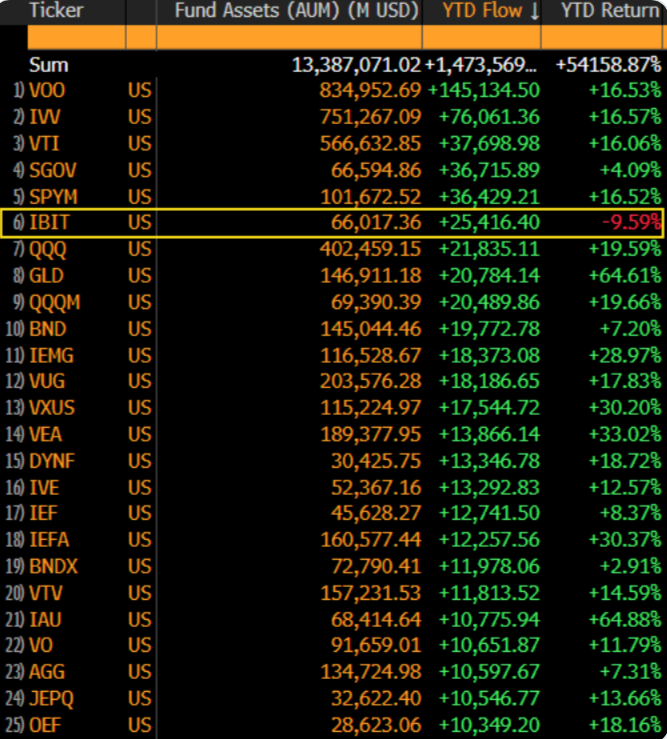

Despite delivering a negative return so far this year, IBIT has attracted more than $25 billion in net inflows in 2025, making it the sixth-largest ETF by inflows across the entire market. This places it behind only broad-based index funds, underscoring sustained demand despite weaker price performance.

Institutional Confidence Despite Bitcoin’s Pullback

Nate Geraci, president of NovaDius Wealth Management, commented on BlackRock’s decision, stating that the inclusion of IBIT signals the firm is not deterred by Bitcoin’s recent downturn. He noted that BlackRock appears unfazed by Bitcoin’s roughly 30% decline from its October peak.

Bloomberg ETF analyst Eric Balchunas echoed this perspective, saying, “If the ETF can do $25 billion in a bad year, imagine the flow potential in a good year.”

According to Farside Investors data, the $25 billion added in 2025 follows approximately $37 billion in inflows during 2024, bringing IBIT’s total inflows since launch to $62.5 billion.

Expansion Into Yield and Ethereum Products

BlackRock has also continued expanding its digital asset offerings. In September, the firm filed to register a Bitcoin Premium Income ETF, designed to generate yield by selling covered call options on Bitcoin futures.

Meanwhile, its iShares Ethereum Trust ETF (ETHA) has also surpassed expectations, drawing over $9.1 billion in inflows this year, with total inflows nearing $12.7 billion. In November, BlackRock filed to launch an iShares Staked Ethereum ETF, following regulatory shifts that allow greater flexibility under a more crypto-friendly U.S. Securities and Exchange Commission.

Notably, BlackRock has so far refrained from joining the recent wave of altcoin ETF launches involving assets such as Litecoin, Solana, and XRP, maintaining a more measured approach to product expansion.

Comments are closed.