Featured News Headlines

Bitwise Seeks SEC Nod for HYPE-Based Crypto ETF

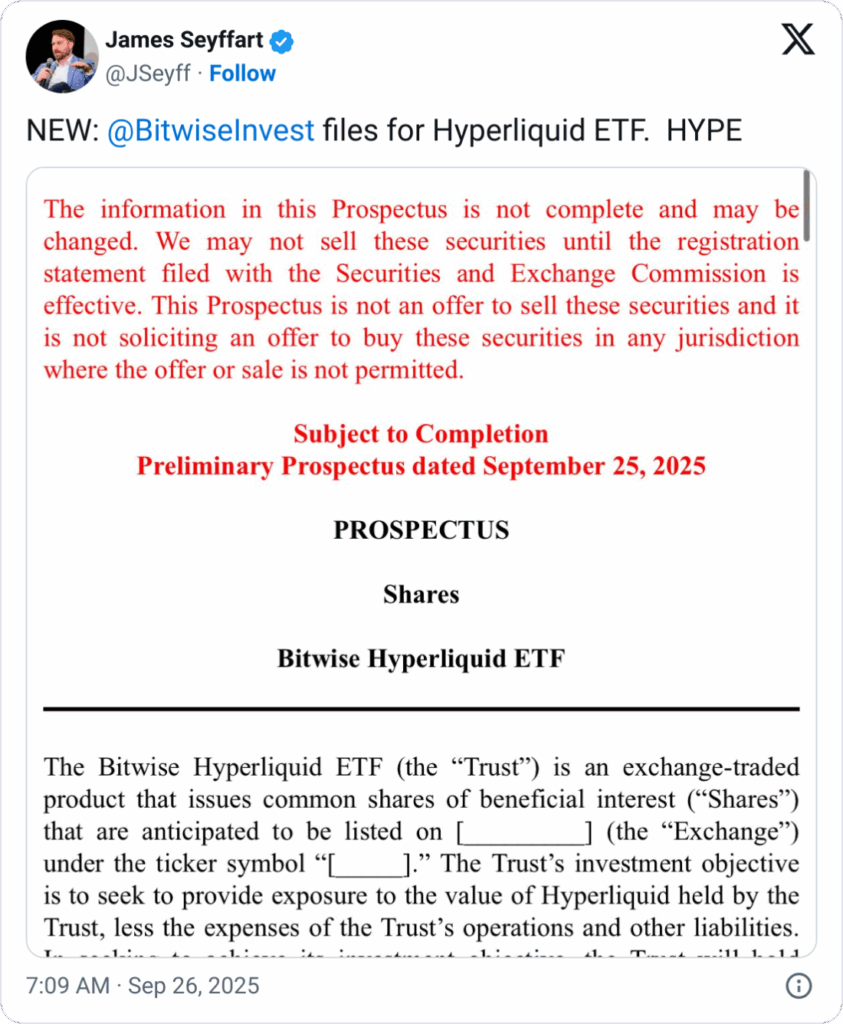

Asset manager Bitwise has filed paperwork to launch an exchange-traded fund (ETF) centered on Hyperliquid (HYPE), a token linked to the blockchain and perpetual futures protocol Hyperliquid. According to the regulatory filing submitted Thursday, the Bitwise Hyperliquid ETF would directly hold HYPE tokens, which provide fee discounts on Hyperliquid’s decentralized exchange (DEX) and are used for transaction fees on its blockchain.

ETF Details and Market Context

The filing did not specify the exchange on which the ETF would trade, its ticker symbol, or the management fees to be charged. Bitwise’s move comes amid intensifying competition in the perpetual futures DEX sector. Earlier this month, rival platform Aster launched its own token, which has quickly surged past Hyperliquid in both trading volume and open interest.

In-Kind Creation and Redemption Features

Bitwise plans for the ETF to offer in-kind creation and redemption, meaning investors could exchange ETF shares directly for HYPE tokens instead of cash. This mechanism, allowed by the Securities and Exchange Commission (SEC) since July, is touted as a more efficient and cost-effective way to manage crypto ETF shares, similar to popular Bitcoin and Ethereum ETFs launched last year.

Regulatory Process Ahead

The filing, a Form S-1 under the Securities Act of 1933, is the initial step in registering the ETF with the SEC. The fund will also require a Form 19b-4 to begin the formal approval process, which can take up to 240 days. Recent SEC guidelines aim to expedite crypto ETF approvals if the underlying assets have been traded on a Commodity Futures Trading Commission (CFTC)-regulated exchange for at least six months. However, Bitwise noted that “there are currently no Hyperliquid futures contracts registered with the CFTC.”

Aster’s Rising Market Influence

Meanwhile, Aster, native to the BNB Chain, has rapidly increased its market presence. Its 24-hour trading volume recently exceeded $35.8 billion—more than triple Hyperliquid’s $10 billion in the same timeframe—while open interest surged from under $143 million to $1.15 billion in just days, according to CoinGlass and DefiLlama data.

Comments are closed.