BitMine’s ETH Buying Frenzy: What Happens Next?

The biggest corporate Ethereum holder, BitMine Immersion Technologies, upped its ETH purchases in December. This action shows how confident the business is in the asset. Despite a challenging climate for Ethereum, buying has resumed. Increased exchange inflows and continuous ETF withdrawals indicate market-wide short-term pressure.

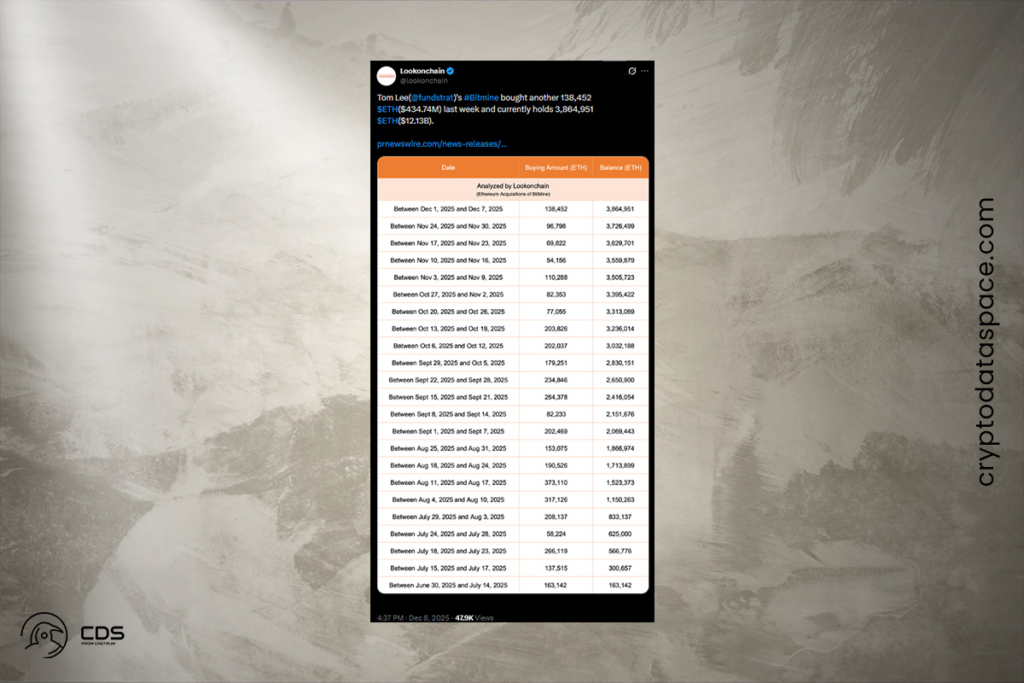

BitMine purchased 138,452 ETH last week, a 156% rise over the preceding four weeks, according to a recent statement. It now has 3.86 million ETH in total holdings. This makes up more than 3.2% of the total amount of Ethereum in circulation. Additionally, it moves BitMine two-thirds of the way closer to its objective of controlling 5% of the supply of ETH.

Massive ETH Accumulation: BitMine Signals a Bullish Turning Point

Since using ETH as a reserve asset, BitMine has made big purchases. BitMine collected 2.83 million ETH from June 30 to October 5. Since October 5, it’s added 1.03 million ETH. Even more impressive is BitMine’s sustained accumulation given Ethereum‘s fourth-quarter decline. Since early October, ETH has lost 24.8%, indicating continuing negative pressure.

December somewhat reversed that tendency. The price is up almost 4% since the month began. Additionally, BitMine has bought more ETH. According to BitMine Chairman Tom Lee, the company’s increased buying shows its faith in ETH. Several catalysts support his prediction of asset gains in the coming months.

The Fusaka upgrade activated last week. Ethereum’s scalability, security, and network efficiency have improved significantly. BitMine also notes macroeconomics. This is supported by the Fed concluding quantitative tightening and perhaps cutting rates tomorrow. After weeks of volatility, these developments confirm the company’s conviction that market conditions may improve for ETH.

We are now more than 8 weeks past the October 10th liquidation shock event, a sufficient length of time to allow crypto to again trade on forward fundamentals,

Lee

Massive ETH Inflows Trigger Sell-Off Fears: Is Ethereum at Risk?

On-chain data indicates caution in spite of this. Ethereum exchange netflow to Binance has increased, according to CryptoOnchain. On December 5, 2025, 162,084 ETH were received by the exchange. Since May 2023, this was the largest ETH influx to the exchange in a single day. Since investors usually move tokens to platforms before liquidation, large deposits on exchanges frequently indicate upcoming sell pressure.

Additionally, Ethereum exchange-traded funds are indicating a decline in demand. November 2025 saw a record $1.4 billion in net withdrawals from the ETFs, the highest monthly withdrawal ever. In December, the pattern persisted. In the first week of the month, an extra $65.59 million left ETH-focused ETFs, according to SoSoValue.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.