Why Some Analysts Say the Bitcoin Halving Cycle No Longer Works

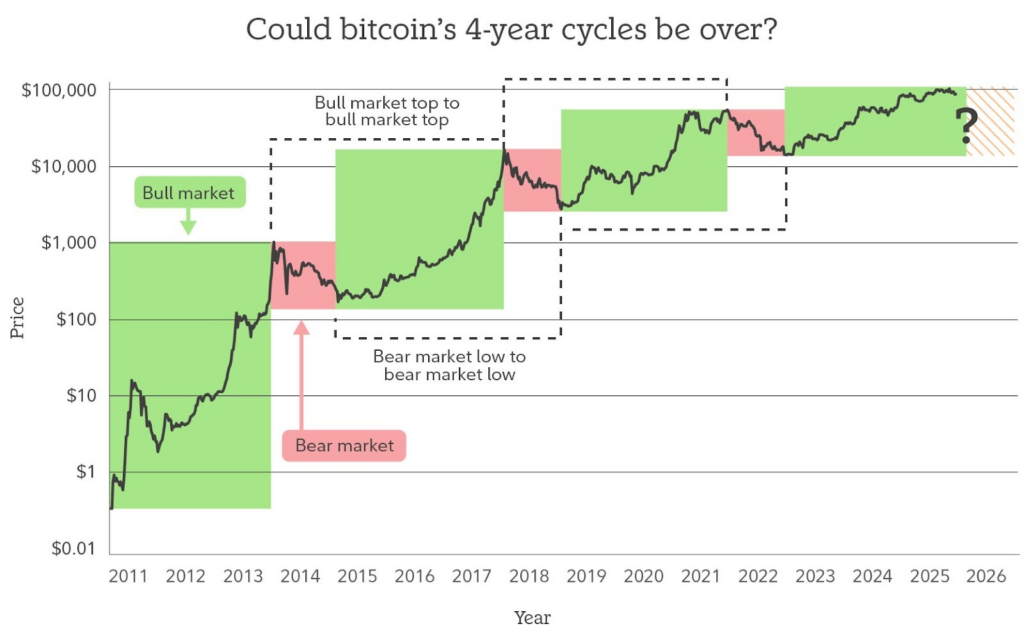

The long-debated four-year crypto cycle — historically tied to Bitcoin halving events — is once again under scrutiny. Analysts are divided on whether this familiar pattern has finally broken or is simply evolving under new market conditions.

Traditionally, Bitcoin’s halving, which cuts miner rewards in half, reduced new supply and triggered a predictable sequence: accumulation, a post-halving bull run peaking roughly 18 months later, followed by a sharp correction and an extended bear market. However, many believe today’s market dynamics are fundamentally different.

Why Some Analysts Say the Cycle Is Broken

A growing wave of institutional participation is at the center of this argument. Spot Bitcoin ETFs, easing US regulations, rising global liquidity, and even changes in Federal Reserve leadership are reshaping how capital flows into crypto markets.

Nick Ruck, Director of LVRG Research, told Cointelegraph that the halving cycle began to weaken in 2025, explaining that sustained institutional demand via ETFs and corporate treasuries has “lessened the expected post-peak crash and reduced volatility compared to prior cycles.”

“While the bull market may face near-term consolidation amid macroeconomic pressures, we anticipate it will extend into 2026 with support from ongoing structural inflows and evolving market dynamics.”

Grayscale echoed this view earlier in December, forecasting a new Bitcoin all-time high in the first half of 2026, driven by macro demand, currency debasement concerns, and a more supportive US regulatory environment.

Standard Chartered’s Geoffrey Kendrick also dismissed the cycle theory as “no longer valid,” revising the bank’s outlook to see Bitcoin reaching $150,000 by the end of 2026. Several industry leaders, including Cathie Wood, Arthur Hayes, Ki Young Ju, and Raoul Pal, share similar views.

The Case for the Cycle Still Existing

Not everyone agrees. Some analysts argue that Bitcoin has already entered a bear market and the four-year cycle remains intact. Markus Thielen, CEO of 10x Research, stated that Bitcoin priced in economic slowdown as early as October 2025.

Meanwhile, analyst Rekt Capital suggested that even if the cycle appears “broken,” it may simply be “leveling up.” PlanB added that much of the selling pressure comes from long-term holders shaped by past cycles and expectations.

As analyst Alex Wacy summarized:

“Cycles don’t always end. Sometimes they stretch.”

Whether broken or evolving, the debate highlights how expectations — not just price — continue to shape crypto market behavior.

Comments are closed.