Bitcoin Whales Accumulate Aggressively: What Big Holders Know That Others Don’t

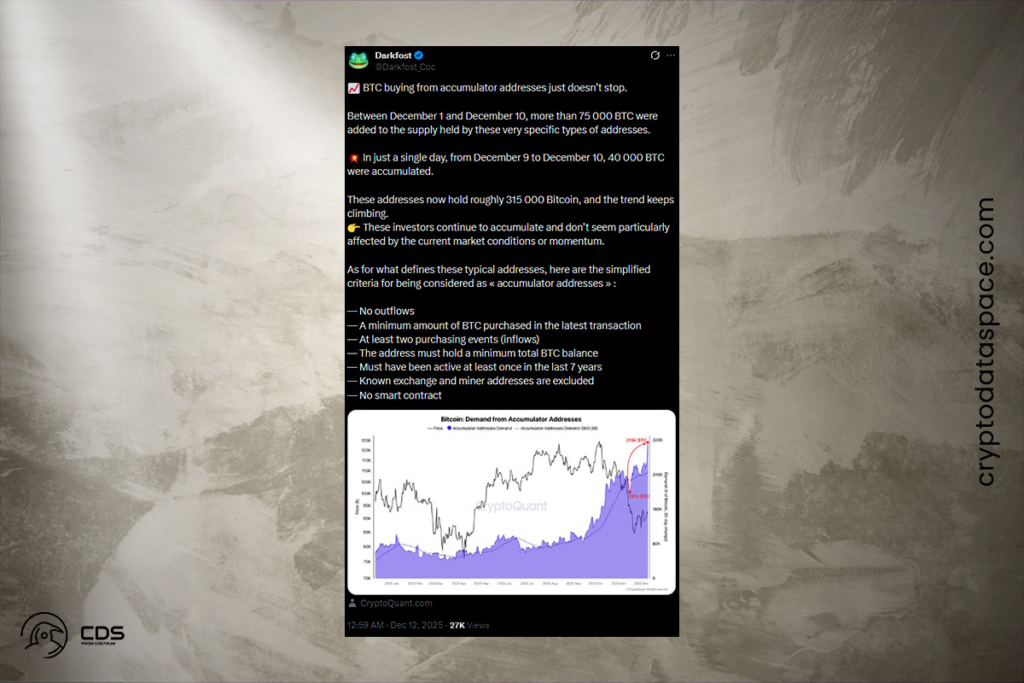

Despite growing unrealized losses and limited liquidity across the industry, bullish Bitcoin wallets are still purchasing the digital asset. In a tweet on Thursday, CryptoQuant researcher DarkFrost stated that large holders bought 75,000 Bitcoin between December 1 and December 10, including 40,000 Bitcoin in a single day. These wallets are defined by strict on-chain criteria as meeting a high buy threshold and having no history of sales. They are not connected to exchanges, miners, or smart contracts, and they also display various inflows. Even though the ongoing accumulation is encouraging, there is a lot of market tension going on at the same time.

Short-term holder losses continue piling up; they’re 20-30% underwater. Historically, this tends to be bullish when long-term holders are accumulating because it shows wealth transfer happening.

Derek Lim, head of research at Caladan

Crypto Rally on Hold as Fed Aid Fails to Deliver Needed Liquidity

In light of the current liquidity crisis, the question arises as to whether the Federal Reserve‘s new $40 billion monthly program to buy Treasury bills and its rate decrease can trigger a durable uptrend. The response was cautiously encouraging, but not a resounding yes, according to the experts.

The $40 billion monthly T-bill program provides technical support,

Lim

He underlined, though, that the Fed’s goal was only to save the banking system from collapsing. It was not intended to generate the additional liquidity necessary for cryptocurrency to gain significant traction. He went on to say that another significant aspect is the liquidity bottleneck that occurs during the holidays. He claims that the Fed’s cautious approach, year-end tax-loss harvesting, and low order books all prevent a dramatic illiquid run-up at the moment.

Bitcoin Stays Resilient Despite Short-Term Market Pressure

Analysts say market structure is positive as long-term holders absorb supply despite these challenges. This dynamic lessens selling pressure and typically leads to larger recovery periods when liquidity improves. The Fed’s moderate easing and dwindling holiday order books may keep volatility high in the immediate term, so traders should be careful. Whether liquidity normalizes and whale accumulation can sustain an upward trend will be watched in January. Bitcoin lies between strong long-term support and tight short-term conditions. This makes it vulnerable but potentially opportunistic.

For more up-to-date crypto news, you can follow Crypto Data Space.