Featured News Headlines

Bitcoin Derivatives Surge as Traders Bet on Major Year-End Move

Bitcoin Volatility Incoming? Crypto derivatives markets are showing clear signs of acceleration as Bitcoin (BTC) traders position for heightened volatility toward the end of the year. According to Glassnode, activity in perpetual futures has intensified, reflecting growing anticipation of a significant market move.

Perpetual Open Interest Climbs as BTC Tests $90,000

Glassnode reported that Bitcoin perpetual open interest (OI) rose from 304,000 BTC to 310,000 BTC as Bitcoin briefly touched $90,000 on Monday. This increase suggests that traders are adding leveraged positions rather than stepping back, even as price momentum stalls near a key psychological level.

At the same time, the funding rate — a key mechanism that keeps perpetual futures aligned with spot prices — increased from 0.04% to 0.09%. According to Glassnode, this combination points to a renewed buildup in leveraged long positioning, with traders betting on a potential year-end breakout.

Rising Funding Rates Signal Bullish — but Risky — Sentiment

An increasing funding rate typically indicates that perpetual futures are trading above spot prices, meaning traders are willing to pay a premium to hold long positions. This often reflects bullish sentiment, but it can also be a warning sign.

Extremely elevated funding rates may signal market overheating, where excessive leverage leaves prices vulnerable to sharp corrections. Despite the optimism, Bitcoin struggled to sustain momentum above $90,000 and was trading near $88,200 at the time of writing.

$23 Billion Bitcoin Options Expiry Adds Fuel to Volatility

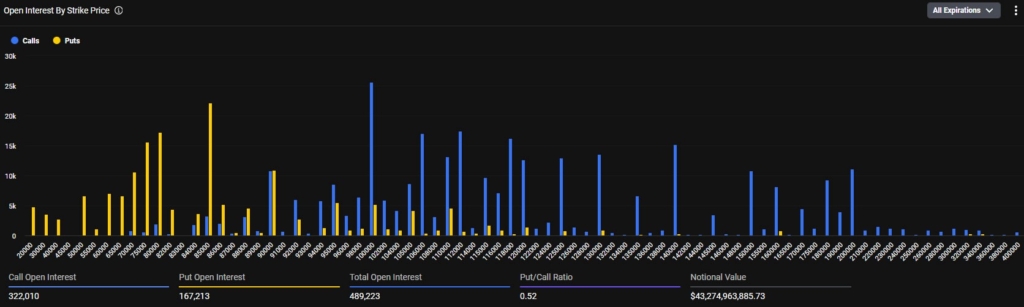

Adding to the tension is a massive end-of-year Bitcoin options expiry scheduled for Friday, Dec. 26. More than $23 billion in notional value is set to expire, making it one of the largest options events on record.

Data from Deribit shows call options clustered around $100,000 and $120,000, while put options are concentrated near $85,000. The put/call ratio stands at 0.37, signaling a heavy skew toward bullish bets. Meanwhile, max pain — the level where most contracts expire worthless — sits at $96,000, according to Coinglass.

If Bitcoin fails to move higher, a large portion of these bullish positions could expire worthless, highlighting how optimistic year-end expectations may collide with market reality.

Comments are closed.