Featured News Headlines

Binance CEO on Bitcoin’s Volatility

Richard Teng, CEO of crypto exchange Binance, recently commented on Bitcoin’s market behavior, highlighting that its volatility is comparable to that of most major asset classes. During a media roundtable in Sydney, Teng told Reuters, “What you’re seeing is not only happening to crypto prices.” He emphasized that all asset classes experience cycles and periods of volatility.

Drivers Behind Bitcoin’s Recent Drop

Teng attributed Bitcoin’s recent decline to investor deleveraging and risk aversion, noting that these trends are consistent across traditional financial markets. “At this point in time, there’s a bit of risk (off) and deleveraging happening,” he reportedly said.

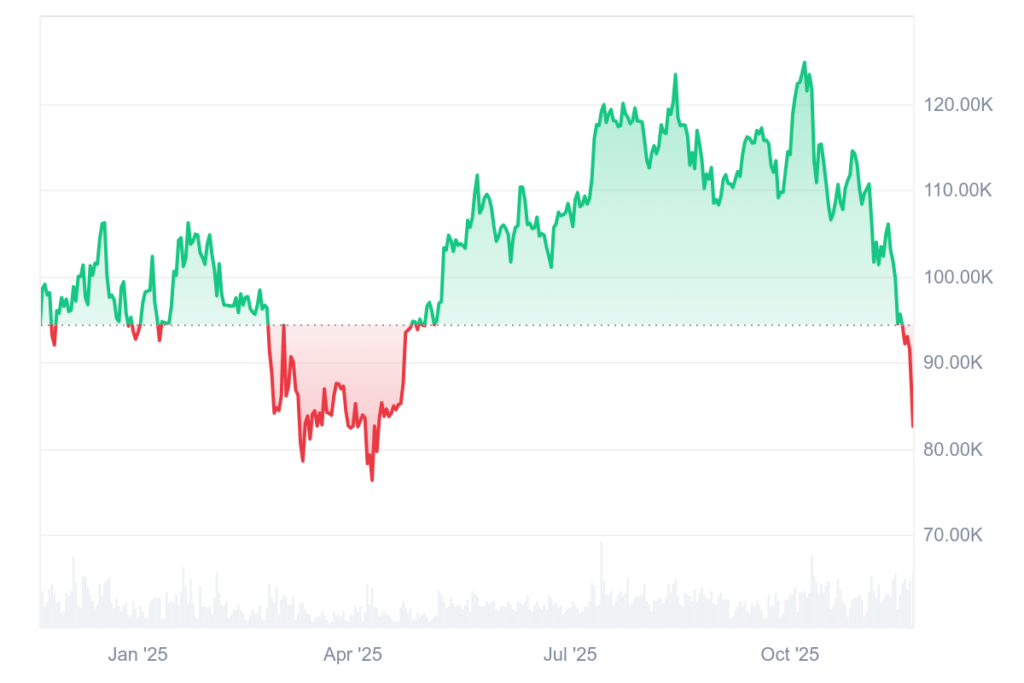

At the time of reporting, CoinMarketCap data indicated Bitcoin trading just above $82,000, a nearly 35% decrease from its October 6 all-time high of over $126,000. The total cryptocurrency market capitalization is approximately $2.84 trillion, down 33.6% from its peak of $4.28 trillion.

Market Perspective: Healthy Consolidation

Despite the decline, Teng pointed out that Bitcoin’s current price remains more than double its value in 2024. He stated, “Over the past 1.5 years, the crypto sector has performed very, very well, so it’s not unexpected that people do take profit.” He added, “Any consolidation is actually healthy for the industry, for the industry to take a breather, find its feet.”

Comparing Bitcoin to Traditional Markets

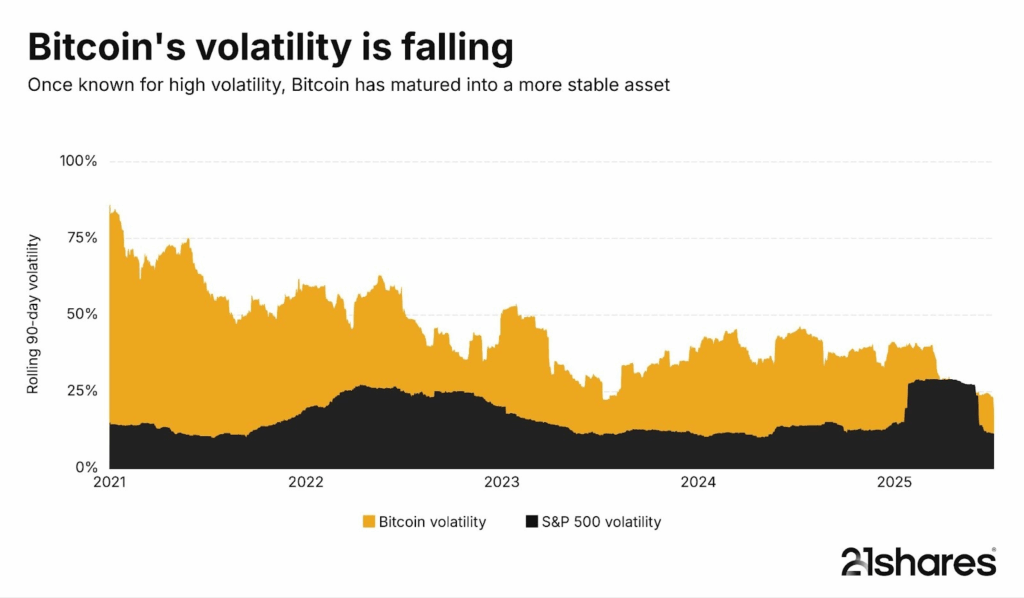

Teng’s observation that Bitcoin’s volatility is not higher than most major asset classes challenges the common perception of crypto as excessively unstable. According to BitBo data, Bitcoin’s 60-day BTC-USD volatility marker in 2025 has ranged from around 1% to peaks of nearly 2.44%.

Historical data supports this trend. 21Shares research shows that Bitcoin’s annualized volatility reached 181% in 2013and fell to as low as 23% in 2025, reflecting its growing adoption and liquidity. During periods of market turbulence this year, the S&P 500’s annualized volatility briefly surpassed Bitcoin’s, though this spike has since normalized.

Bitcoin vs. High-Volatility Stocks

Currently, Bitcoin’s annualized volatility stands well above 50%, compared to the S&P 500’s just over 15%. In the tech sector, certain stocks demonstrate even higher volatility. Tesla’s annualized volatility is over 65%, AMD’s exceeds 73%, and Super Micro Computer also sits at 73%. Palantir, a government intelligence software provider, experiences 63% volatility. However, these examples remain outliers in traditional finance.

Comments are closed.