Featured News Headlines

- 1 Bitcoin Poised for Volatility as Key U.S. Economic Events Hit in Early December

- 2 Powell’s Speech and the Official End of Quantitative Tightening

- 3 ADP Employment Data: Labor Market in Focus

- 4 Initial Jobless Claims to Gauge Real-Time Labor Conditions

- 5 PCE Inflation: The Fed’s Most Important Data Point of the Week

- 6 A Make-or-Break Week for Bitcoin

Bitcoin Poised for Volatility as Key U.S. Economic Events Hit in Early December

Bitcoin Volatility Ahead – The first week of December 2025 is shaping up to be one of the most consequential periods of the year for Bitcoin and broader risk markets, as traders prepare for a barrage of U.S. economic events that could redefine expectations for monetary policy. With volatility already simmering, investors now face a cluster of catalysts that could set the tone heading into the Federal Reserve’s final policy meeting of 2025.

Powell’s Speech and the Official End of Quantitative Tightening

All eyes turn to Federal Reserve Chair Jerome Powell on Monday, December 1, at 8:00 pm ET. His address not only marks a critical communication ahead of the Fed’s December blackout period—it also coincides with the official end of quantitative tightening (QT).

The conclusion of QT was outlined in the Federal Open Market Committee’s October 29 statement, which noted: “The Committee decided to conclude the reduction of its aggregate securities holdings on December 1.” The halt reflects the Fed’s assessment that the banking system now holds ample reserves, signaling a move toward a more accommodative policy stance and potentially boosting liquidity.

Powell’s comments come at a sensitive moment, amplified by speculation over possible changes in Fed leadership. Reports suggest President Trump has already selected a successor, though no formal announcement has been made. This uncertainty could further stir market turbulence, especially for assets highly responsive to rate expectations—Bitcoin among them.

With 86% odds currently pointing to a December rate cut, traders will parse every line of Powell’s remarks for clues on the direction of U.S. monetary policy.

ADP Employment Data: Labor Market in Focus

On Wednesday at 8:15 am ET, the ADP Employment Change report for November arrives. The prior reading showed just 42,000 new private-sector jobs, raising questions about labor market momentum heading into year-end.

A strong rebound in hiring could complicate the narrative for imminent rate cuts, pressuring risk assets. Conversely, weaker job growth would reinforce expectations for Fed easing, historically a favorable backdrop for Bitcoin. Analysts also note that the so-called AI-driven dynamics in employment trends may play a role in this week’s numbers.

Initial Jobless Claims to Gauge Real-Time Labor Conditions

Weekly initial jobless claims, set for release Thursday, December 4, at 8:30 am ET, offer another critical look at economic strength. Rising claims typically suggest mounting stress in the labor market—an argument for policy loosening. Lower readings, meanwhile, point to resilience and may reduce the urgency for cuts.

Bitcoin has a well-established history of reacting sharply to labor market surprises, given their direct influence on liquidity expectations.

PCE Inflation: The Fed’s Most Important Data Point of the Week

Friday brings the most influential release of the week: the PCE Price Index, the Fed’s preferred measure of inflation. The data, due at 8:30 am ET, will arrive alongside personal income and spending figures.

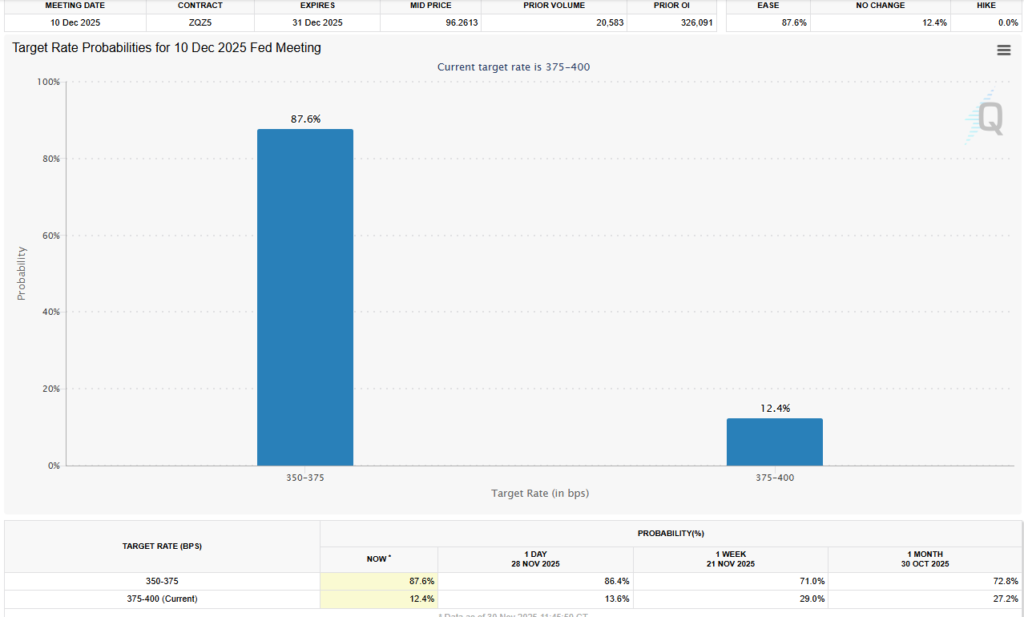

A cooling in either headline or core PCE would bolster the view that inflation is steadily returning to the Fed’s 2% target, likely cementing forecasts for a December 10 rate cut—currently assigned an 87.6% probability by market pricing. Stickier inflation, however, could temper those expectations.

Later that morning, consumer sentiment data (previously at 51.0) will offer further insight into household outlooks and spending intentions.

A Make-or-Break Week for Bitcoin

With four major economic releases packed into a single week—and a pivotal Fed speech—the macro landscape is poised to dominate Bitcoin’s trajectory. As the first week of December begins, the interplay between U.S. jobs data, inflation readings, and shifting policy expectations will likely dictate crypto market momentum more than any sector-specific developments.