Featured News Headlines

Bitcoin Drops Below $113K as SEC Probe and Tariff Fears Shake Markets

Bitcoin (BTC) dropped below $113,000 for the first time in over two weeks, triggering over $113 million in liquidations of leveraged long positions. The pullback comes just days after reaching an all-time high of $124,176, raising concerns among traders about the sustainability of the current bull run.

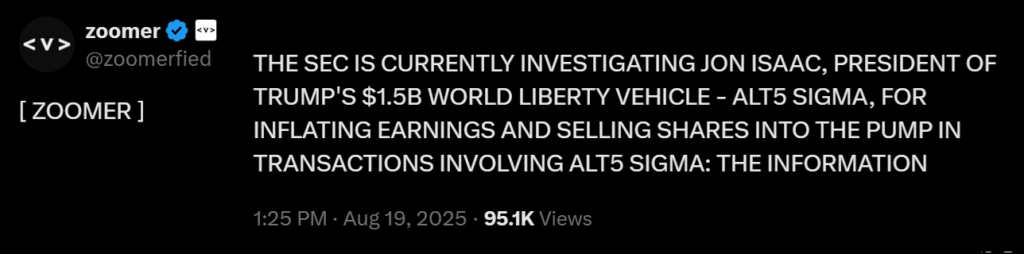

SEC Investigation and AI Disappointment Add Pressure

The correction intensified following reports that the U.S. Securities and Exchange Commission (SEC) is investigating alleged fraud and market manipulation at Alt5 Sigma, a firm recently tied to Trump-linked World Liberty Financial in a $1.5 billion deal. The controversy adds a layer of political and regulatory risk to already jittery markets.

Adding to the uncertainty, a new MIT NANDA study revealed that 95% of corporations failed to achieve meaningful revenue gains from early AI deployments. This contributed to a 1.5% decline in the Nasdaq 100, further weakening investor sentiment.

Tariffs and Economic Concerns Weigh on Risk Assets

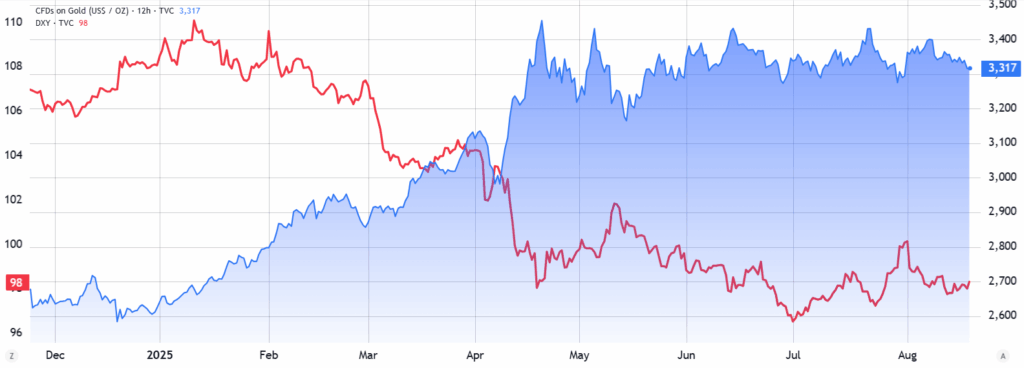

The introduction of 50% tariffs on hundreds of aluminum- and steel-containing products in the U.S. raised fears of supply chain disruptions and inflationary pressure. As confidence in the Federal Reserve’s policy direction declines, investors are increasingly turning to defensive assets like gold. UBS now expects gold to reach $3,700 by September 2026.

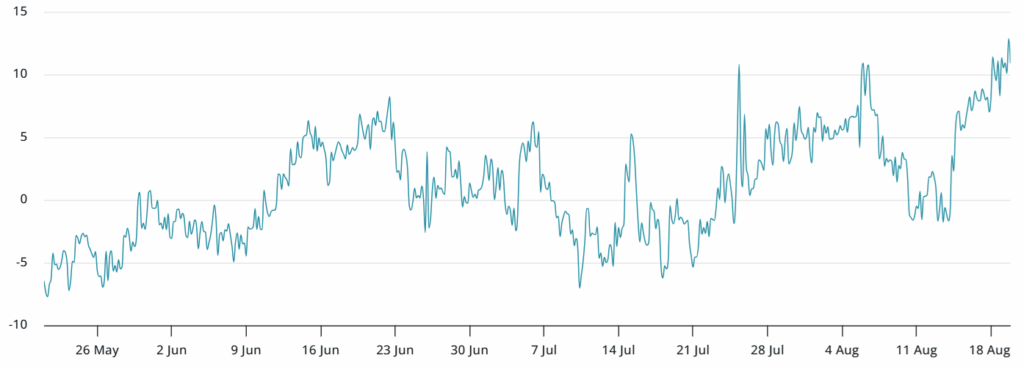

Derivatives Market Signals Fear, but Trend Remains Intact

In crypto markets, fear is visible in the options space. The 30-day BTC options delta skew surged to 12%, its highest level in four months, indicating strong demand for downside protection.

Still, historical patterns show such sentiment spikes can precede major rallies. Despite short-term volatility, Bitcoin’s long-term uptrend remains structurally intact, especially as capital rotates out of equities.

Comments are closed.