Bitcoin Price Recovers Slightly After Falling Below $100K

Bitcoin’s drop to $98.9K marked a 22% decline from its previous peak of $126K. However, bulls quickly defended the $100K support zone, helping the asset recover modestly.

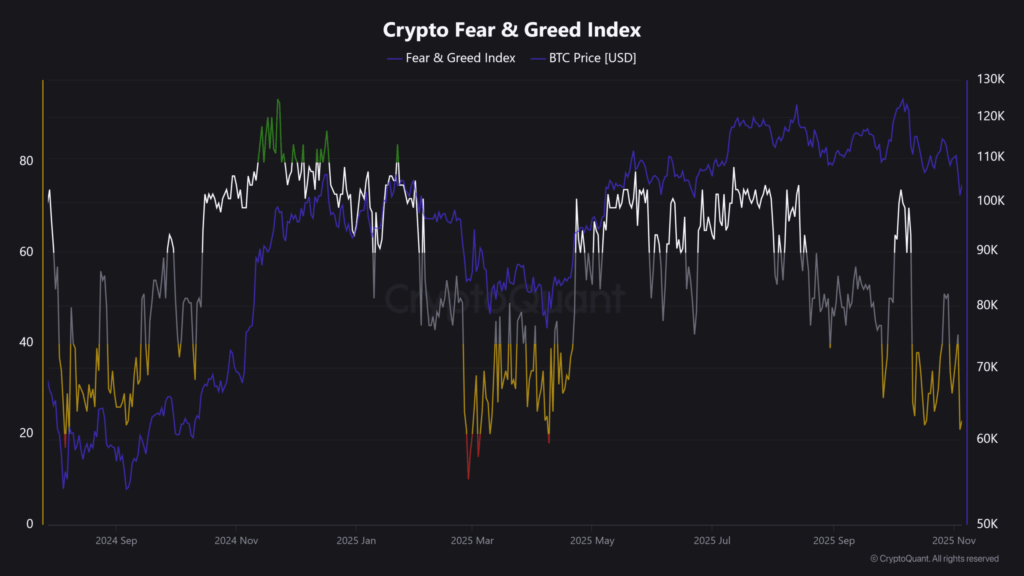

According to the Crypto Fear and Greed Index (CFGI), sentiment improved slightly—moving from an “extreme fear”level of 23 to a “fear” level of 27. While this indicates that caution still dominates the market, the shift suggests early signs of stabilization.

Traders often view such fear-driven phases as potential accumulation zones, though uncertainty remains high. Historically, these conditions have sometimes preceded strong rebounds but also prolonged sideways trends.

Key Indicators Point to Potential Stabilization

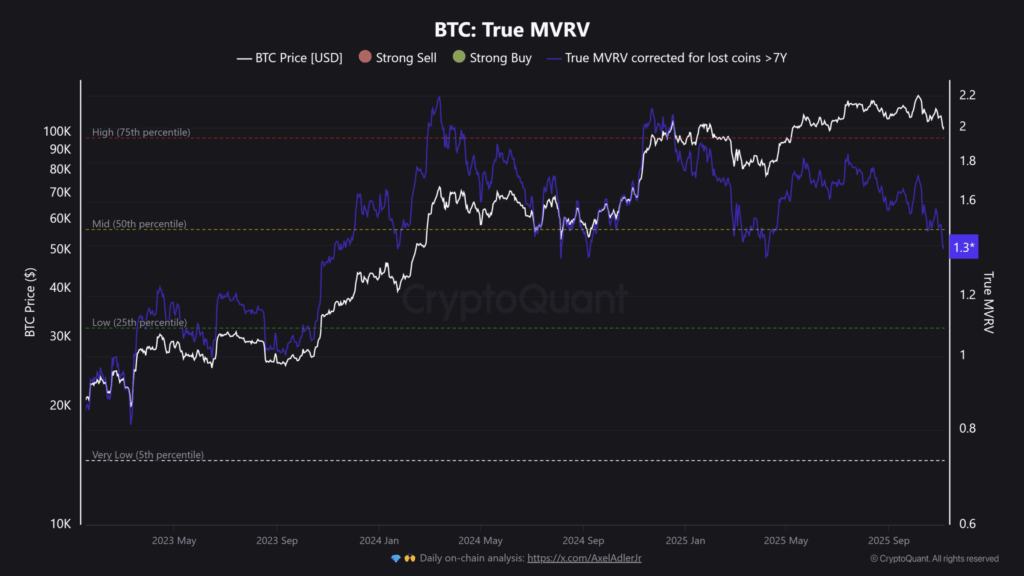

Data from CryptoQuant and other analytics firms highlight several factors that could support a recovery if macroeconomic conditions stabilize. One major metric, the True MVRV (Market Value to Realized Value) ratio, currently sits at 1.38.

In previous cycles, True MVRV levels below 1.5 corresponded with local market bottoms, such as in early 2025 and mid-2024. Conversely, readings above 2 have historically signaled overheated markets and local tops.

“If past trends repeat, Bitcoin could be approaching another rebound zone,” one analyst commented.

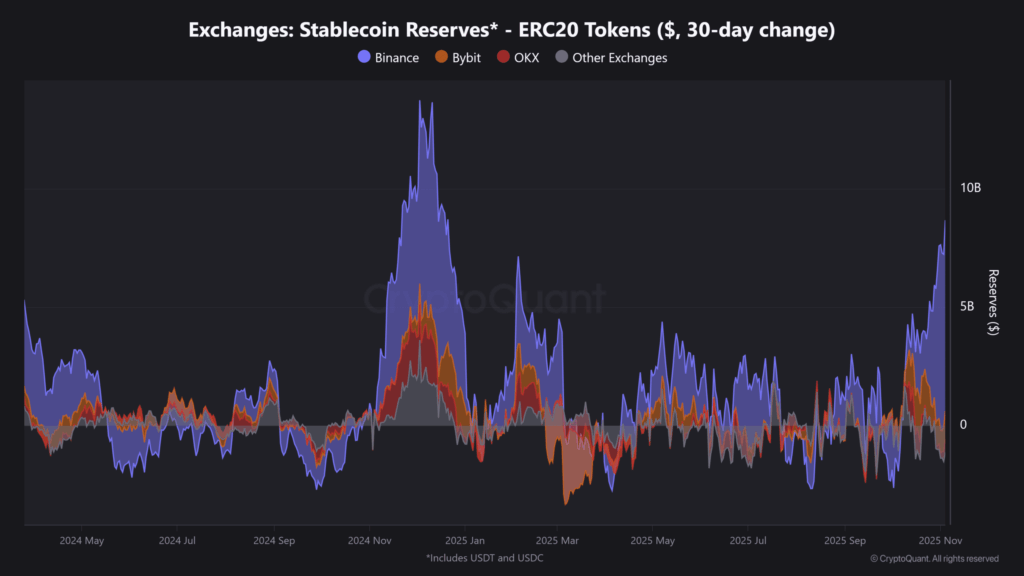

Another positive indicator is the growth in stablecoin reserves. On the Binance exchange, reserves have climbed to a nine-month high of nearly $10 billion, suggesting substantial liquidity waiting on the sidelines. This could provide fresh capital for market inflows once sentiment improves.

Selling Pressure Concentrated on Binance

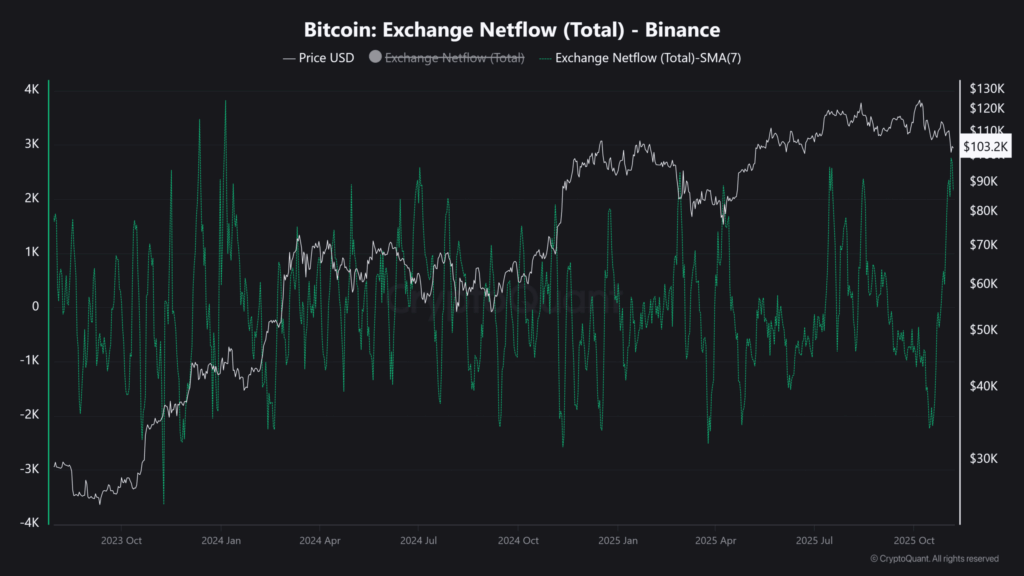

Despite early recovery signs, selling pressure remains elevated, particularly on Binance, which dominates global Bitcoin trading volume. On average, about 3,000 BTC have been transferred daily to the exchange for potential selling.

While this trend reflects ongoing caution, the Exchange Netflow metric shows signs of easing, indicating a gradual slowdown in outflows. A significant drop in this metric could confirm a shift toward renewed accumulation and buying interest.

For now, market participants remain divided—some view current prices as an opportunity, while others warn of possible further downside if macroeconomic headwinds persist.

Comments are closed.