Featured News Headlines

BTC Shows Signs of Fading Selling Pressure

Bitcoin (BTC) has fallen more than 35% from its all-time high of around $126,200 reached two months ago. Technical and on-chain indicators suggest the cryptocurrency may be establishing a local bottom. Momentum, miner capitulation, and liquidity metrics indicate that selling pressure could be waning.

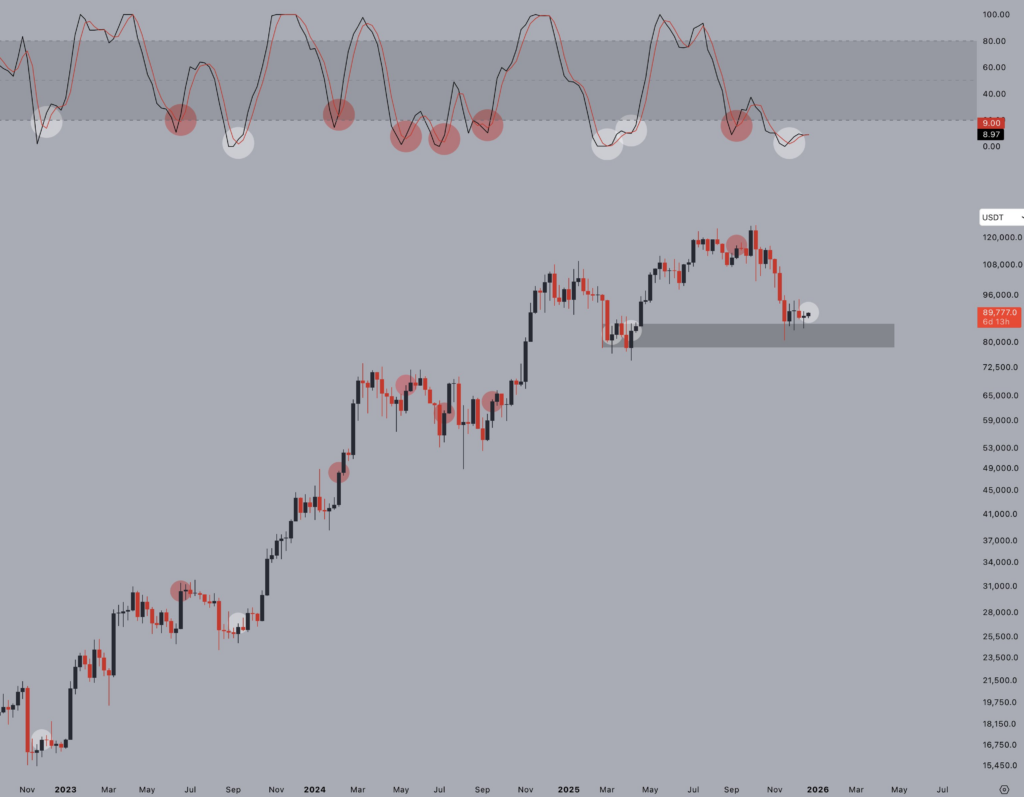

As trader Jesse highlighted, Bitcoin’s weekly Stochastic RSI has turned up from oversold levels, a pattern historically seen near key market inflection points. Similar bullish signals occurred in early 2019, March 2020 during the COVID crash, and late 2022 around the FTX-driven bottom. In each case, momentum shifted before the price followed.

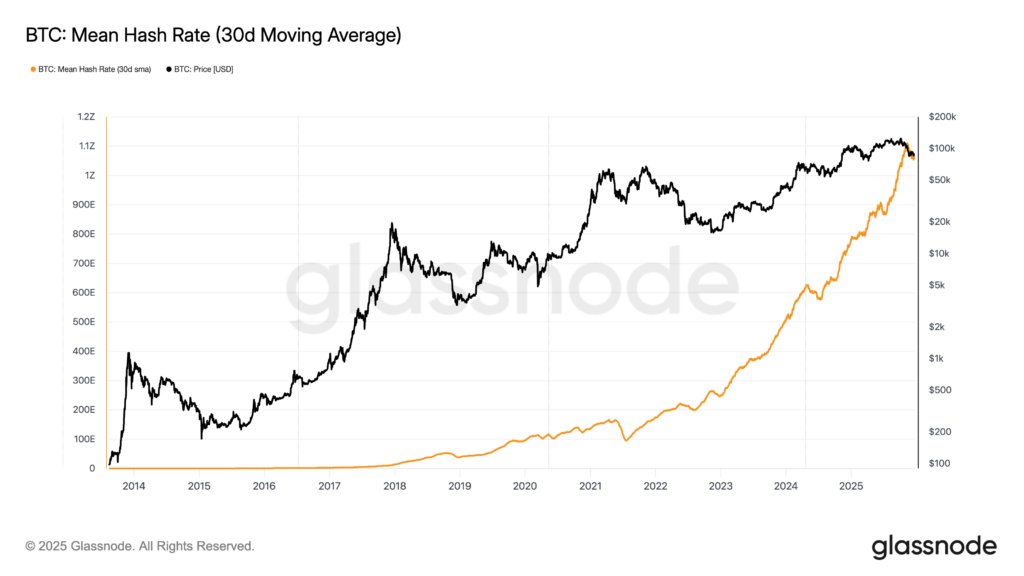

Miner Capitulation Signals Possible Bottom

Bitcoin’s hashrate dropped 4% in the month leading up to December 15. Analysts Matt Sigel and Patrick Bush from VanEck consider this a “bullish contrarian signal” tied to miner capitulation. Historically, sustained hash rate declines have preceded stronger Bitcoin returns, with BTC showing positive 90-day performance 65% of the time after 30-day hashrate drops. Rising prices may further improve miner profitability, potentially bringing sidelined capacity back online.

Macro Liquidity Indicators Point to Recovery

Macro-level liquidity conditions also hint at a potential rally. Analyst Miad Kasravi’s backtesting of 105 indicators found that the National Financial Conditions Index (NFCI) often leads Bitcoin rallies by four to six weeks. Similar signals preceded sharp BTC rallies in late 2022 and mid-2024. Each 0.10-point NFCI decline historically corresponds with roughly 15%–20% upside in Bitcoin, with deeper readings marking longer uptrend phases.

A potential catalyst could be the Federal Reserve’s plan to rotate mortgage-backed securities into Treasury bills, which Kasravi compared to the 2019 “not-QE” liquidity injection that preceded a 40% BTC rally.

Mixed Market Sentiment

Despite these signals, some analysts remain cautious, predicting further downside with Bitcoin price targets ranging from $70,000 to $25,000. The combination of technical momentum, miner activity, and improving liquidity suggests the market may be approaching a local bottom, though short-term volatility remains a key factor.

Comments are closed.