Featured News Headlines

BTC Correction Still Bullish? Key Signs Say Yes

Bitcoin [BTC] is currently trading 12.8% below its all-time high, yet the pullback remains within the typical –10% to –18% correction zone seen during past bull cycles. These levels often suggest a period of healthy consolidation rather than a full-scale breakdown.

With BTC holding near $110K, market structure appears intact—potentially setting the stage for a renewed push, barring any external macro shocks.

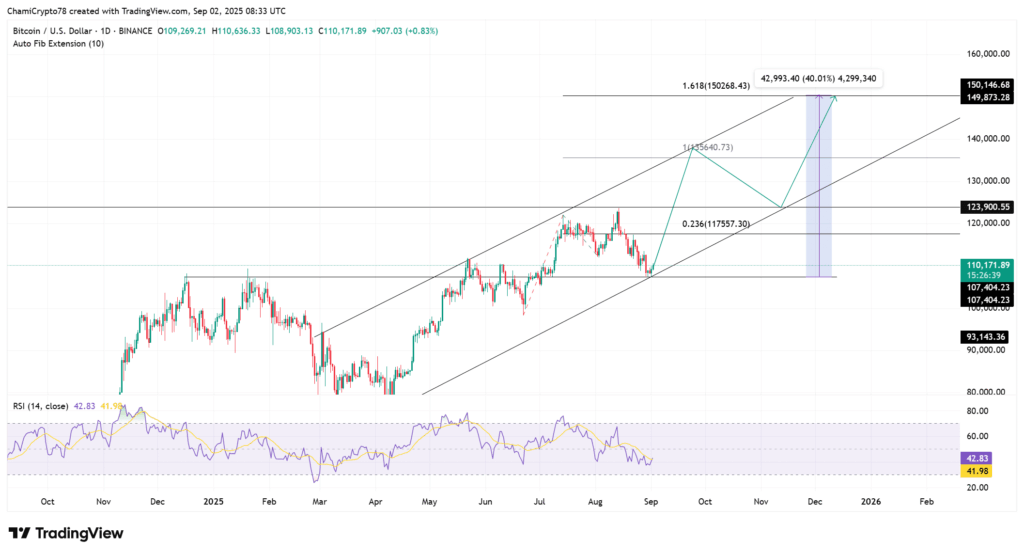

Holding the Ascending Channel

Technical charts show Bitcoin bouncing off the lower trendline of its ascending channel, after revisiting the $107K region. The next logical resistance lies near $123K, while extended targets—based on Fibonacci projections—could reach $150K.

The RSI sits at 42.8, reflecting weak but improving momentum, and leaves room for further upside if buying pressure builds. However, any breakdown below the channel support could expose BTC to downside risks near $93K.

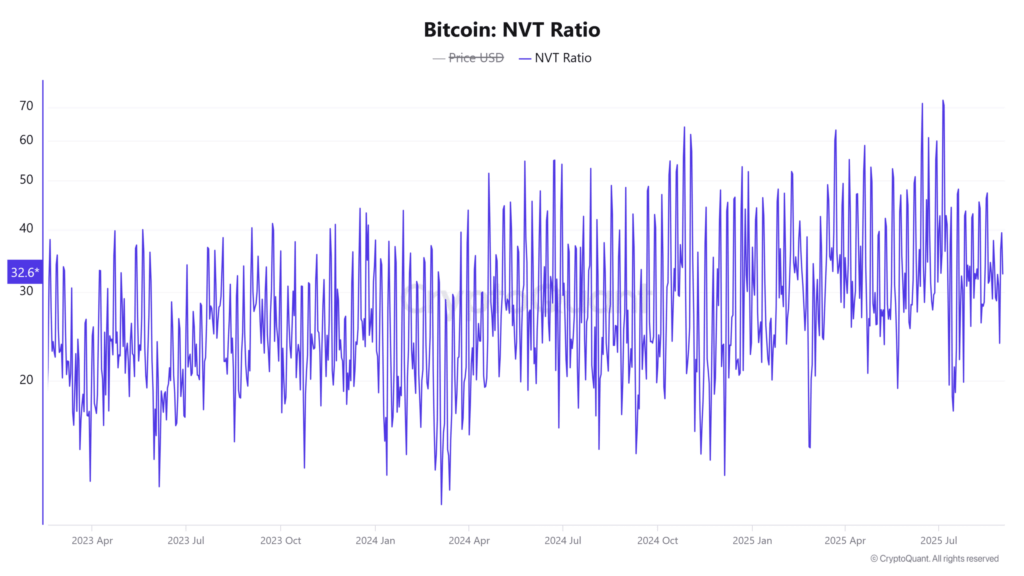

On-Chain Metrics Signal Valuation Support

The Network Value to Transaction (NVT) ratio dropped 17.35% to 32.6, suggesting Bitcoin’s market cap is more aligned with its on-chain activity. Historically, falling NVT values tend to reflect stronger price foundations and less risk of overvaluation—unless transaction volume begins to fade.

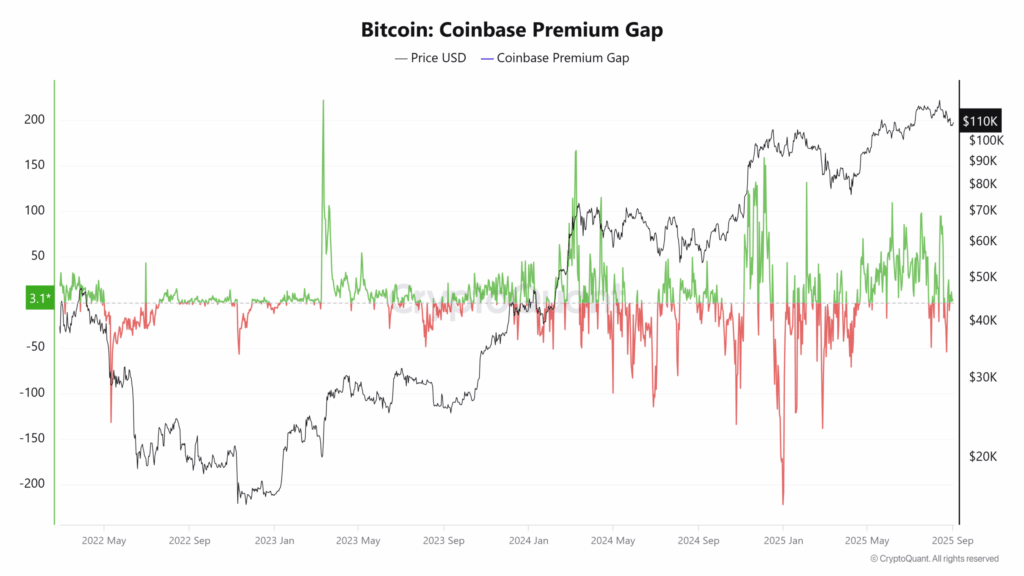

U.S. Demand and Short Liquidations Fuel Momentum

The Coinbase Premium Gap jumped 128% to 2.56, indicating heightened buying activity on U.S. exchanges—often seen as a proxy for institutional interest. Meanwhile, $13.37 million in short liquidations versus only $379K in longs suggests bears were caught off guard, potentially fueling a short-term rally.

Comments are closed.