Featured News Headlines

Bitcoin Volatility Spike Pushes Sharpe Ratio to Zero

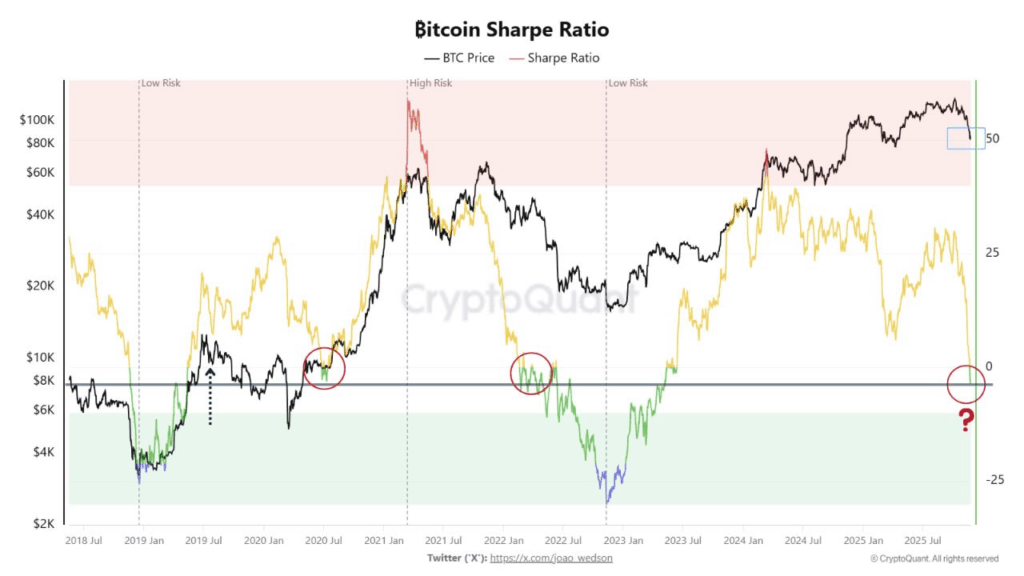

A key technical indicator for Bitcoin has fallen to levels typically associated with major market bottoms. The Sharpe ratio, which measures risk-adjusted returns, has dropped to nearly zero for the first time since 2022. CryptoQuant analyst I. Moreno noted this signals “maximum uncertainty and the early stages of risk repricing” in the market.

What Does a Zero Sharpe Ratio Mean?

The Sharpe ratio compares an asset’s returns against its volatility. When the metric approaches zero, Bitcoin has delivered weak performance relative to its price swings. This creates a potentially favorable entry point for long-term investors.

Moreno explained that Bitcoin has entered territory last seen in 2019, 2020, and 2022. During those periods, the ratio remained at depressed levels before new multi-month uptrends emerged. However, the analyst cautioned that “this does not guarantee a bottom, but it does indicate that the quality of future returns is starting to improve.”

The improvement depends on market stabilization and normalized volatility. When conditions settle, historically low Sharpe readings have preceded sustainable rallies.

Smart Money Indicator or False Signal?

Low Sharpe ratio periods have historically attracted institutional capital. The risk-reward balance improves significantly compared to buying during euphoric peaks when the ratio spikes. In early 2024, the indicator surged toward 50 as Bitcoin breached $73,000 for the first time.

That marked the opposite scenario—high returns with lower relative risk, often a sign of market overheating. The current near-zero reading suggests the market has reset. Whether institutional investors will step in remains uncertain, but the technical setup mirrors previous accumulation zones.

Record Bitcoin Movement Shakes the Chain

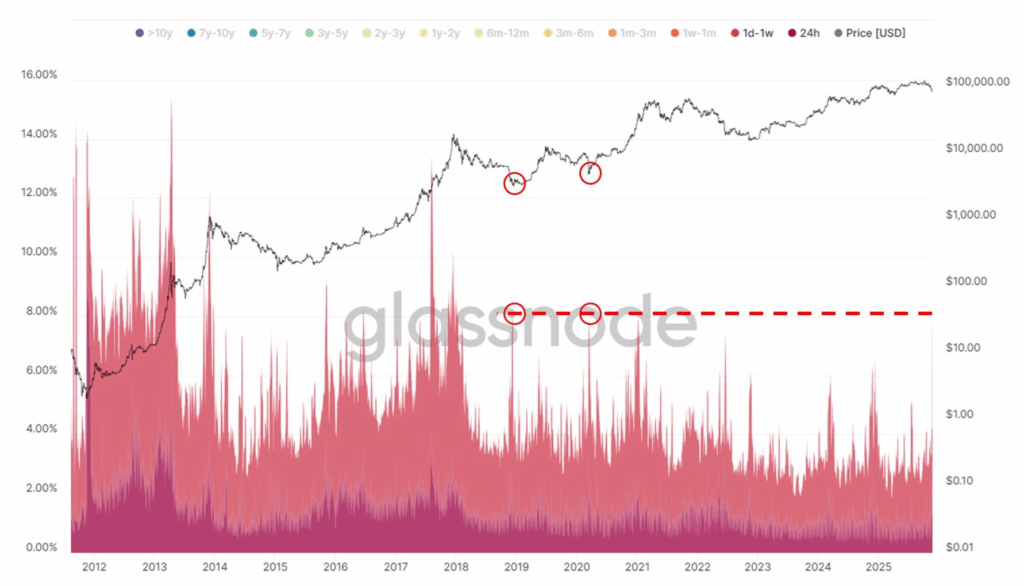

Onchain data reveals unprecedented activity last week. More than 8% of all Bitcoin changed hands, according to Glassnode metrics. This magnitude of movement has only occurred twice in seven years—during bear markets in December 2018 and March 2020.

Joe Burnett, director of Bitcoin Strategy at Semler Scientific, described the event as “one of the most significant onchain events in Bitcoin’s history.” The massive transfer volume coincided with sharp price volatility that caught many traders off guard.

[…] reversing and taking the price with it, Sharpe usually descends further into negative territory. About two months prior to the conclusion of the […]