Featured News Headlines

Bitcoin Scarcity Era Begins: Is This the Start of a New Bull Market?

Since over 93% of all Bitcoin has already been mined, the biggest cryptocurrency in the world is about to enter a new phase of scarcity. Investors and analysts are closely monitoring how this limited supply may affect Bitcoin’s value, network security, and long-term acceptance when the remaining supply runs out. The declining supply, which is caused by institutional accumulation and halving cycles, begs the important question of whether Bitcoin will sustain its growth or become even more valuable.

Only 1.4 Million Bitcoin Left to Mine: What Happens Next?

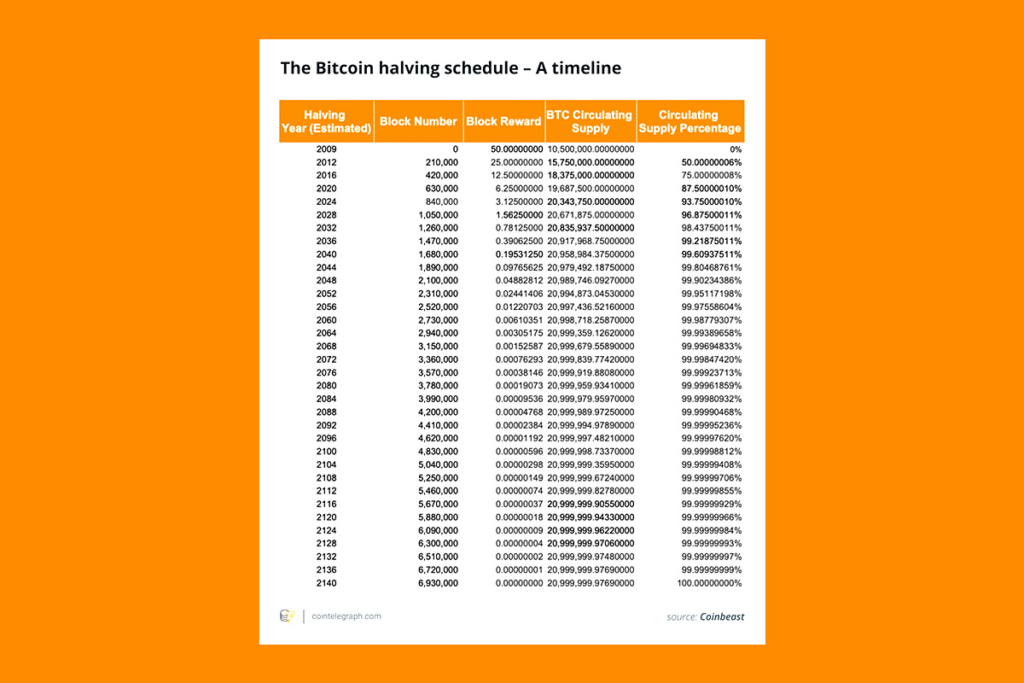

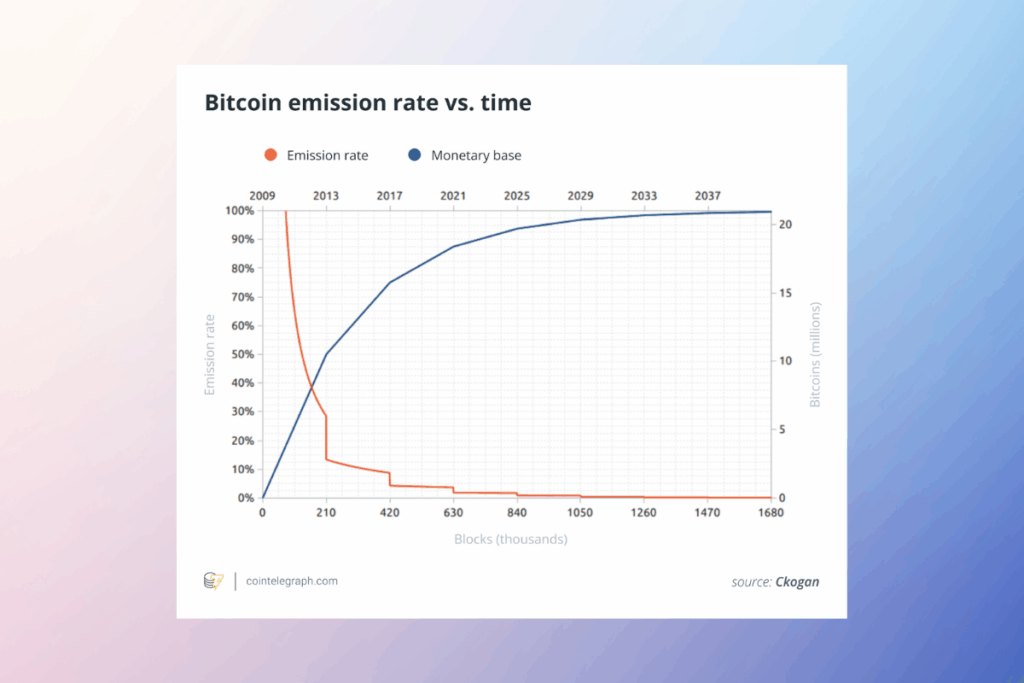

The total supply of Bitcoin is hardcoded at 21 million BTC, a set maximum that cannot be changed short of a protocol modification that breaks consensus. The core of Bitcoin’s value proposition as a deflationary asset is this finite cap, which is enforced at the protocol level. About 19.6 million Bitcoin, or roughly 93.3% of the total quantity, had been mined as of May 2025. After that, there will be an extremely slow mining process for the remaining 1.4 million Bitcoin. The exponential issuance schedule of Bitcoin, which is controlled by an event known as the halving, is the cause of this unequal distribution. The block reward for Bitcoin’s 2009 launch was 50 BTC. That reward is halved every 210,000 blocks, or roughly every four years.

The Race Toward Absolute Scarcity

By 2035, 99% of all Bitcoin will have been mined, according to current estimates. However, because of the nature of geometric incentive decrease, the last fraction, or satoshis, won’t be produced until about 2140. Comparisons between Bitcoin and tangible commodities like gold are based on this artificial scarcity and an unchangeable supply constraint. However, while Bitcoin’s issuance rate is clearly decreasing, the supply of gold is increasing at a rate of about 1.7% per year.

Why Is the Actual Circulating Supply Far Lower Than 21 Million?

Even though more than 93% of Bitcoin’s total supply has been mined, not all of it is still accessible. Due to early adopters who never used their coins again, lost wallets, wrecked hard drives, or forgotten passwords, a sizable fraction is permanently out of circulation.

According to estimates from companies like Chainalysis and Glassnode, between 3.0 million and 3.8 million Bitcoin, or between 14% and 18% of the whole supply, are probably gone forever. This includes well-known dormant addresses, such as the one thought to be that of Satoshi Nakamoto, which is thought to contain more than 1.1 million Bitcoin. This suggests that rather than 21 million, the actual circulating amount of Bitcoin may be closer to 16–17 million. Additionally, as Bitcoin is not recoverable by design, any lost coins remain lost, thereby decreasing the supply.

Mining Difficulty Adjustment: The Key to Bitcoin’s Ongoing Security

A common belief is that the network’s security will deteriorate over time as Bitcoin’s block rewards decrease. In reality, however, the mining sector is significantly more resilient and adaptable than that. Bitcoin’s self-correcting feedback loop controls its mining incentives. Miners leave the network if mining stops making money, which leads to a change in difficulty. The network uses a parameter called nBits to recalibrate mining difficulty every 2,016 blocks, or roughly every two weeks. Regardless of the number of miners competing, the objective is to maintain block timings at approximately 10 minutes. Ineffective miners thus quit if the price of Bitcoin falls or if the payout is insufficient in comparison to running expenses. This makes it harder to fall, which reduces the cost for those who stay. A system that continuously rebalances itself to match available incentives with network involvement is the end result.

Debunking Bitcoin Myths: Why Don’t Higher Prices Mean Infinite Energy Use?

A prevalent misunderstanding is that growing Bitcoin values will lead to limitless energy use. In actuality, mining is limited by economics rather than only by price. Miners are forced to pursue the least expensive, cleanest energy available when block rewards decrease because they are forced to make smaller profits.

The Cambridge Centre for Alternative Finance estimates that between 52 and 59 percent of Bitcoin mining is currently powered by low-emission or renewable energy sources. This movement is being supported by regulations, with some countries punishing fossil fuel operations or providing incentives for clean-powered mining. Furthermore, the notion that rising BTC values will inevitably result in increasing energy use ignores the manner in which Bitcoin self-regulates. Increased difficulty from more miners limits energy expansion by compressing margins.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.