Miners Sell Over 4,200 BTC in 12 Days

Bitcoin (BTC) bounced back to reclaim the $112,000 level on Thursday, recovering from a six-week low hit just two days earlier. Despite this rebound, traders remain cautious as Bitcoin miners have been selling coins at the fastest pace seen in nine months.

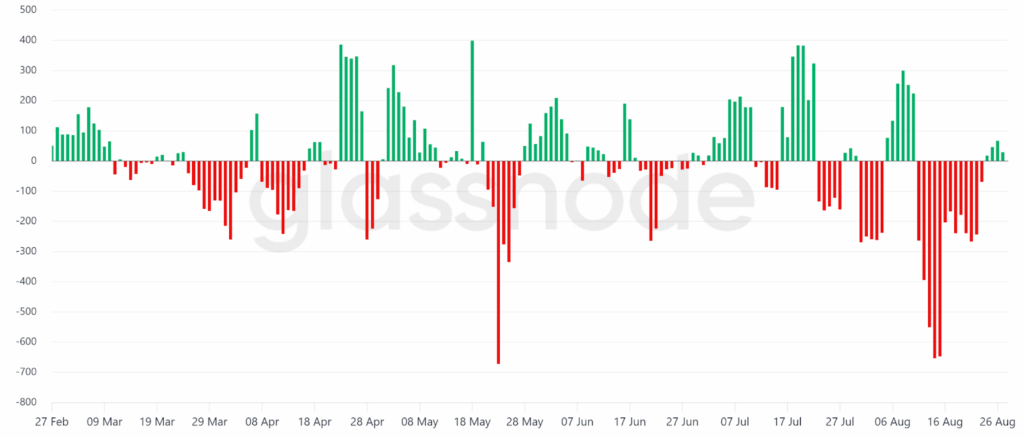

Data shows steady outflows from miner wallets between August 11 and August 23, with no clear signs of renewed accumulation since. During this 12-day period, miners sold approximately 4,207 BTC, worth around $485 million. This contrasts with a previous accumulation phase from April to July when miners added 6,675 BTC to their reserves. Miner balances now stand at 63,736 BTC, valued at over $7.1 billion.

Profitability Decline Fuels Selling Pressure

While these sales are small compared to institutional holdings, they often spark market speculation and uncertainty. Bitcoin’s price has risen about 18% over the past nine months, but miner profitability has dropped by 10%, weighed down by increasing mining difficulty and softer demand for on-chain transactions.

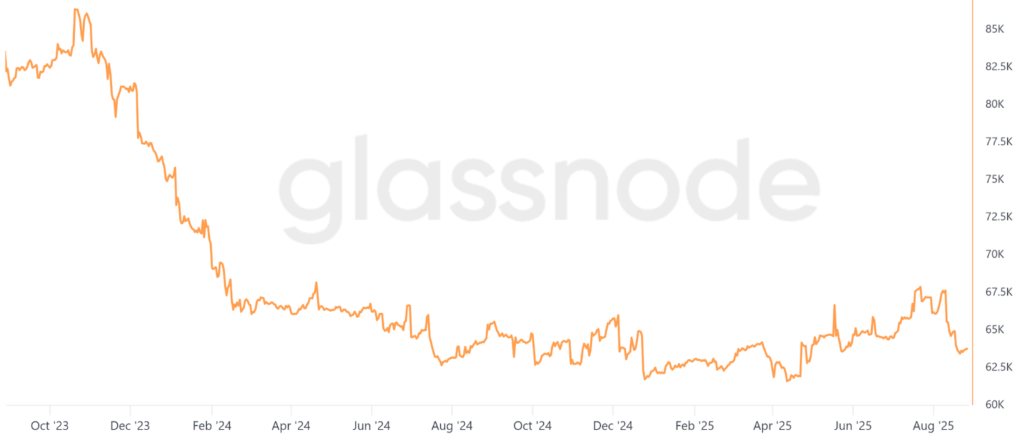

The Bitcoin hash price index currently sits at 54 PH/s, down from 59 PH/s a month ago, reflecting tighter profit margins. However, mining rigs like Bitmain’s S19 XP remain profitable at certain electricity costs.

Strong Fundamentals Despite AI Competition

Some investor concern stems from the growing competition miners face from artificial intelligence infrastructure investments. Notably, mining firms like TeraWulf and others are pivoting towards AI data centers, signaling a diversification trend in the sector.

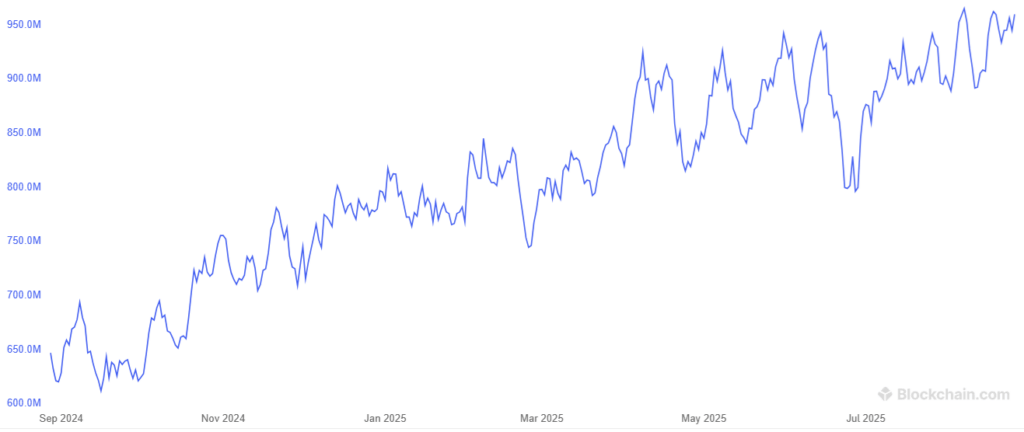

Despite these shifts, Bitcoin’s network fundamentals remain robust. The network’s hashrate is approaching an all-time high at 960 million TH/s, up 7% in the last three months, countering fears of miner stress or deteriorating sector profitability.

At present, there’s no clear evidence miners are forced to liquidate, and ongoing corporate accumulation could offset current outflows.

Comments are closed.