Featured News Headlines

BTC Price Eyes $120K After Holding $110K Support

Bitcoin [BTC] has once again taken center stage after reclaiming the $110K mark — a key psychological level that traders were watching closely. After trading below $110,000 for two days, BTC surged to $112,000 before slightly pulling back to $111,832 at press time, representing a 2.21% daily gain despite being down 1.12% on the weekly chart.

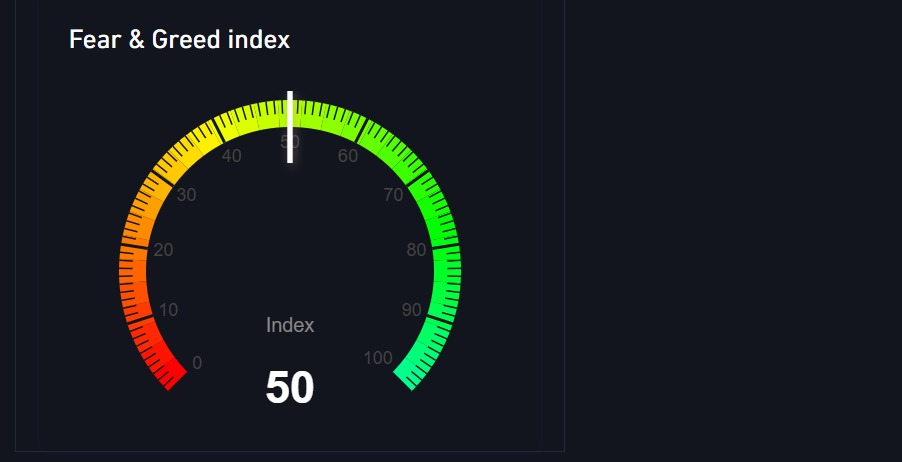

Sentiment Steady as Support Holds

Market sentiment remained stable even amid recent volatility. The Fear and Greed Index hovered at 50, signaling neutral sentiment among participants. While Bitcoin has had a rocky few weeks, traders haven’t turned overly bearish.

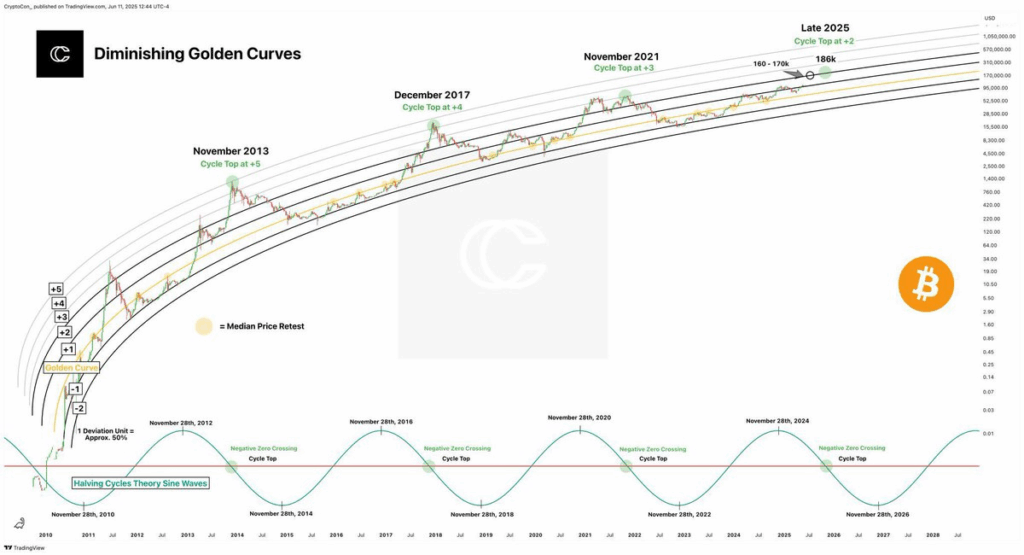

Popular crypto influencer Crypto Rover emphasized that BTC “must hold above $110K–$112K to maintain upward momentum.” Similarly, Trending Bitcoin shared long-term targets between $160K–$170K, reflecting broader optimism if key levels are defended.

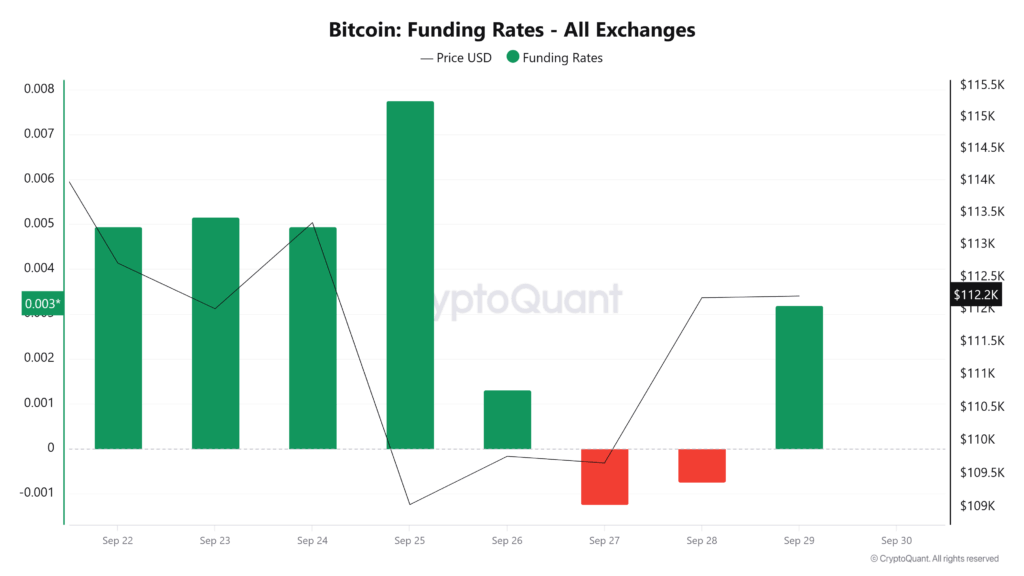

Futures Market Points to a Short Squeeze

Meanwhile, Bitcoin’s Futures data indicated a recovery in trader confidence. Funding Rates turned positive on September 29, following two sessions in the red. At press time, the rate stood at 0.006, suggesting renewed demand for long positions.

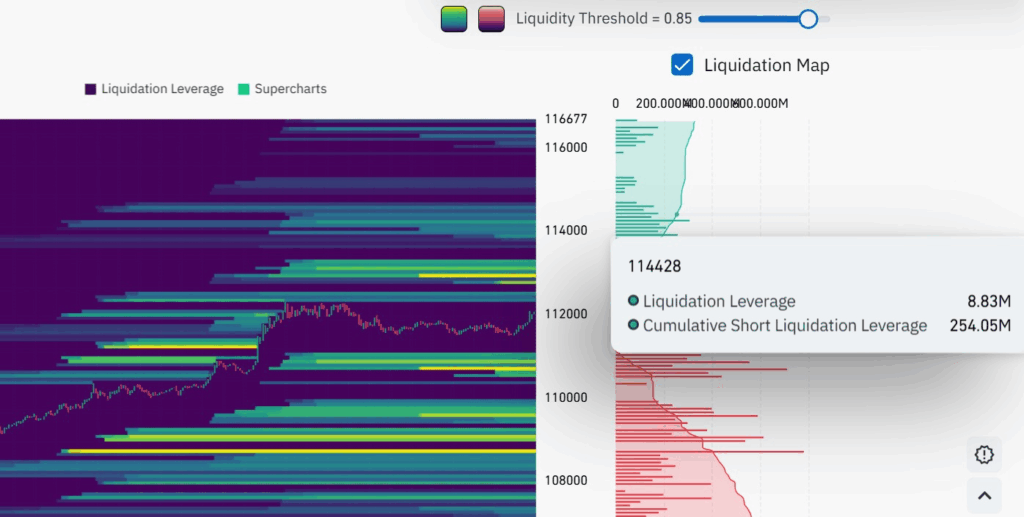

If this momentum continues, a short squeeze could play out. Analysts predict that a retest of $113K might trigger up to $301 million in short liquidations, potentially fueling BTC’s path toward $120K.

CEX Netflows Hint at Bullish Bias

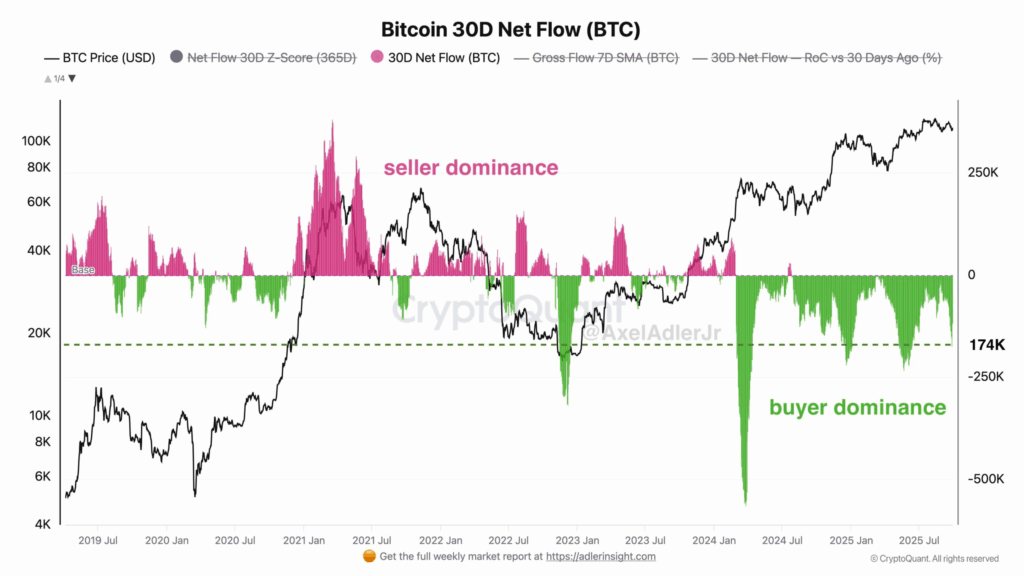

Data from Axel Adler revealed that Bitcoin’s 30-day Netflow on centralized exchanges was still negative at -170K BTC— a sign that more BTC is leaving exchanges than entering, often a bullish indicator.

Historically, sustained negative Netflows reflect reduced sell-side pressure and precede price surges.

Technical Levels to Watch

According to AMBCrypto, bulls are gaining ground in both the Futures and Spot markets, positioning BTC favorably for the near term.

Key resistance levels to watch include the 200-day SMA at $113,691 and the Bollinger Band midline at $114,003. A decisive break above could lead to a test of the upper Bollinger Band at $118,941, with extended targets at $123,852.

If historical Q4 performance holds, Bitcoin could attempt a new all-time high, with $130K as a base case and $140K as a bullish scenario.

Comments are closed.